During U.S. trading hours on Tuesday, Bitcoin (BTC) appreciated as investors pondered the latest banking unrest and appeared to regain interest in cryptocurrencies and other valuable assets. During the hour following the publication of the Job Openings and Labor Turnover Survey (JOLTS) data on Tuesday, BTC and ether (ETH) prices rose by approximately 2%.

BTC rises sharply following the JOLTS data

According to CoinMarketCap data, the largest crypto by market capitalization was recently trading at around $28,775, up roughly 2.6% over the previous 24 hours. BTC’s price hovered around $28,000 for the majority of the previous day before spiking early Tuesday after shares of two regional banks, PacWest Bancorp (PACW) of Los Angeles and Western Alliance Bank (WAL) of Phoenix, fell 27% and 15%, respectively.

The most recent Job Openings and Labor Turnover Survey (JOLTS) data was weaker than anticipated. The report revealed that the number of job openings in the United States fell to 9.6 million in March, which was less than anticipated (9.775) and the lowest level since April 2021.

Crypto market experts recently viewed weaker job statistics as a positive for asset prices since the Federal Reserve would continue to raise interest rates until it is satisfied that inflation has subsided. Furthermore, increases in interest rates are negative for asset prices (including cryptocurrency). Finally, for inflation to fall, labor markets must cool. In other words, “bad” employment data is “good” for markets, at least in the short term.

Reasons for the favorable crypto prices surge

This week’s failure of four U.S. institutions, including the First Republic, has harmed the economy but appeared to boost cryptocurrency prices. The employment data indicated that the economy was weakening and that inflationary pressures may decrease, which could be a further boon for digital assets.

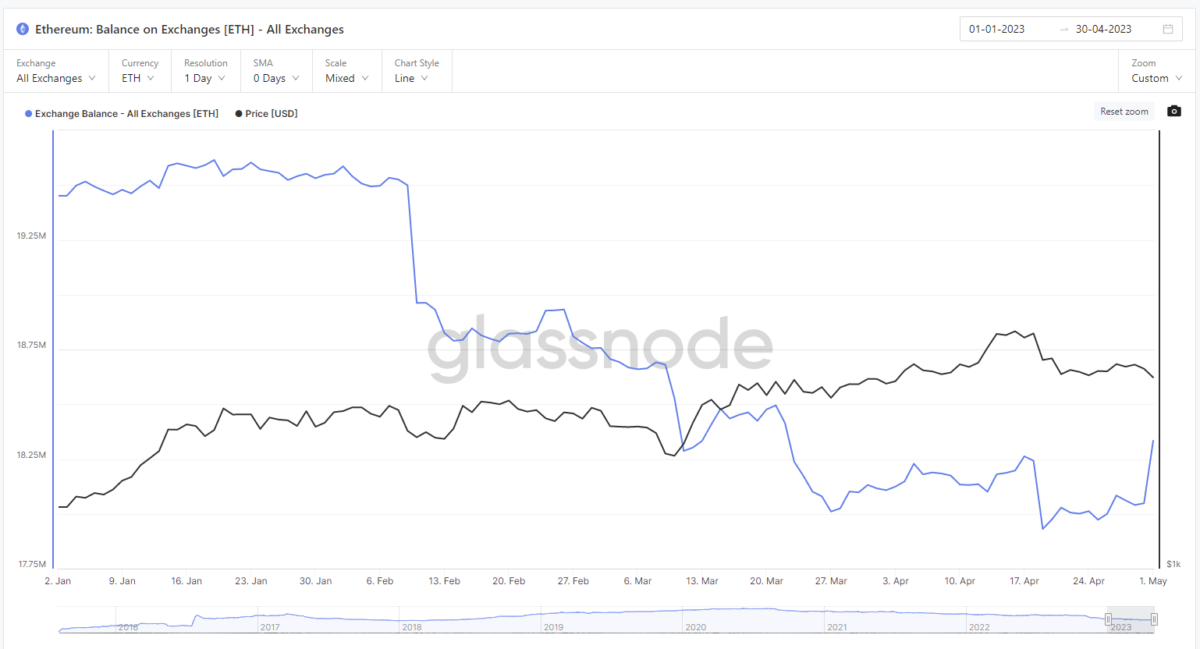

Ether (ETH), the second-largest cryptocurrency by market capitalization, increased by 2.5% to a price of approximately $1,877. The aggregate crypto market performance for the day was greater than 2%.

64% of 37 investors surveyed by CoinShares in April believe the Federal Reserve has made a policy error, while 22% responded “not yet,” indicating that it is “quite possible the Fed will make a mistake in the near future,” according to CoinShares. The lack of investors’ trust in the FED has pushed more people to BTC and other digital assets.

The study also discovered that, despite a flurry of regulatory activities throughout the first quarter of the year, the weighting of digital assets in portfolios has increased to roughly 1.6%, up from 0.7% in October.

Meanwhile, according to the survey, funding managers believe that BTC and ETH offer the most compelling growth prospects, with less appetite for altcoins.

In general, it is impossible to attach price rises and drops to macroeconomic reports with 100% accuracy. However, the timing of Tuesday’s price and volume spikes strongly suggests that BTC was responding to the jobs report. Following the initial move higher, prices moderated throughout the rest of the day.

Crypto markets may also be moving ahead of Wednesday’s more widely recognized U.S. central bank interest rate decision, but the projected 25 basis point increase is likely already priced in.

The fact that other risk assets, primarily equities, did not react similarly to the employment report is an unusual occurrence. The S&P 500, Nasdaq Composite, and Dow Jones Industrial Average (DJIA) all decreased after the data release.

This year, correlations between cryptocurrencies and stocks have diminished, with the correlation between BTC and the S&P 500 falling from 0.80 to 0.27.