TL;DR Breakdown

- Cardano price analysis suggests sideways movement at the level

- The closest support level lies at $0.3400 and further below at $0.3350

- ADA faces resistance at the $0.3700 mark

The Cardano price analysis shows that the ADA price action has struggled to break above the $0.3700 and has fallen below the $0.3500 mark as the bearish pressure persists.

The broader cryptocurrency market observed a bullish market sentiment over the last 24 hours as most major cryptocurrencies recorded positive price movements. Major players include SOL and DOT, recording a 32.26 and a 14.06 percent incline, respectively.

Cardano price analysis: ADA falls below the $0.3500 mark

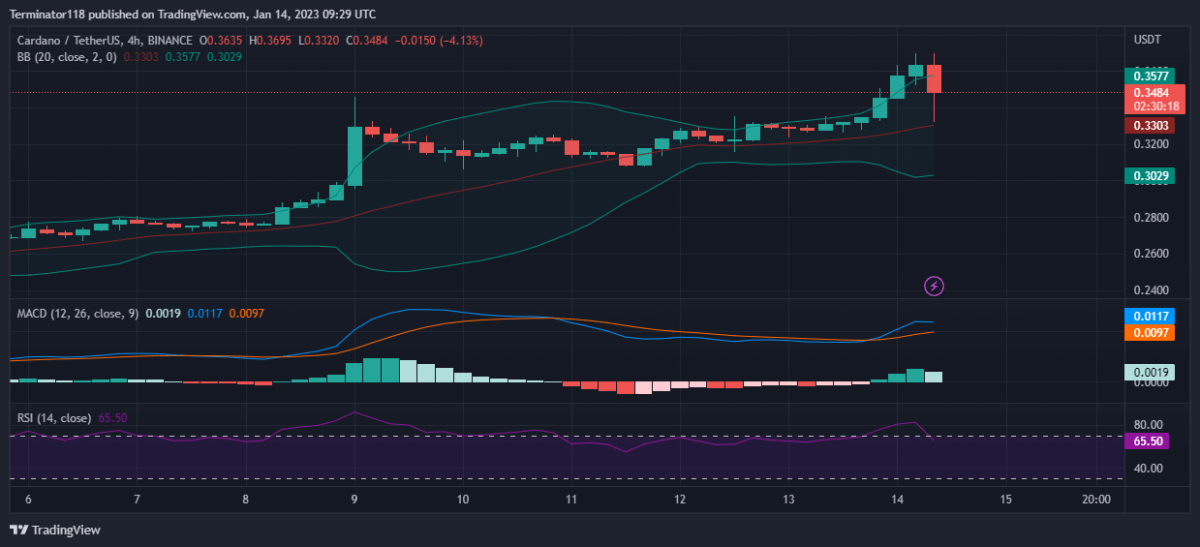

The MACD is currently bullish, as expressed in the green colour of the histogram. However, the indicator shows low bullish momentum as observed in the low height of the histogram. Moreover, the lighter shade of the histogram suggests a declining bullish momentum as the price struggles to climb past $0.3700.

The EMAs are currently trading high above to the mean position as net price movement over the last ten days remains positive. However, the EMAs move close together suggesting low momentum across the timeframe. Moreover, the converging EMAs suggest an increasing bearish pressure for the asset.

The RSI briefly rose to the overbought region but has since gone back into the neutral region as ADA got rejected at the $0.3700 price level. Currently, the index is trading at the 65.50 mark showing steady bullish momentum with a horizontal slope suggesting an equilibrium between both sides of the market.

The Bollinger Bands are wide at press time as the price action observes relatively high volatility across the 4-hour charts. Currently, the price is trading close to the indicator’s upper limit suggesting high volatility across the timeframe. The indicator’s mean line provides support at the $0.3029 mark while the upper limit presents a resistance level at the $0.3577 mark.

Technical analyses for ADA/USDT

Overall, the 4-hour Cardano price analysis issues a buy signal, with 14 of the 26 major technical indicators supporting the bulls. On the other hand, only three of the indicators support the bears showing a low bearish presence in recent hours. At the same time, nine indicators sit on the fence and support neither side of the market.

The 24-hour Cardano price analysis shares this sentiment and also issues a buy signal with 12 indicators suggesting an upwards movement against seven suggesting a downward movement. The analysis shows a struggle for dominance between the bulls and the bears across the daily charts. Meanwhile, the remaining seven indicators remain neutral and do not issue any signals at press time.

What to expect from Cardano price analysis?

The Cardano price analysis shows that the Cardano market is enjoying a strong bullish rally as the price rose from $0.2700 to the current $0.3500 in the last 10 days. Currently, the price is facing strong resistance at the level and the bulls have been rejected at the $0.3700 mark to fall back below the $0.3500 mark.

Traders should expect ADA to slow down at the level as while the technical analyses are bullish, the short-term charts support the bears suggesting a lack of bullish momentum across the 4-hour chart. Currently, the price can be expected to trade in the $0.3400-$0.3500 range while a breakout in either direction would start a rally.