Cardano price analysis continues to show bearish signs, as the token plummeted back to $0.301 over the past 24 hours. ADA has been in the current price zone since November 21, and has failed to provide a meaningful breakout. However, with persistent downtrend and market stagnation, ADA bulls will hope that a significant rally could be formed once the larger crypto market returns to favourable conditions. Over the past 24 hours, Cardano price remained largely static around the $0.30 mark, having decreased over 15 percent from $0.42 price level of a month ago.

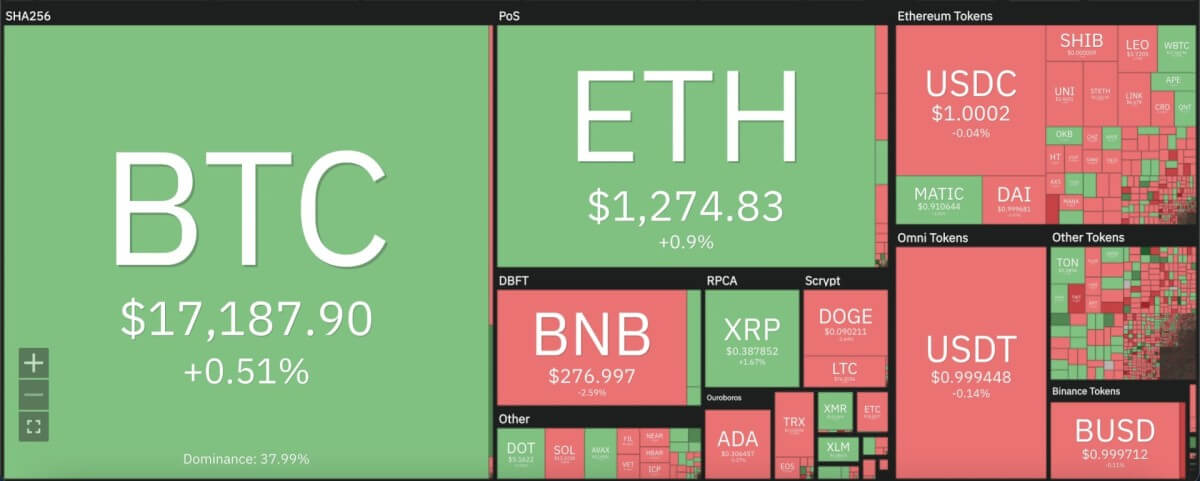

The larger cryptocurrency market showed mixed outcomes across the board over the past 24 hours, as Bitcoin strengthened above the $17,000 mark with a minor uptrend, whereas Ethereum moved closer to the $1,300 mark. Among leading Altcoins, Ripple increased 2 percent to move up to $0.38, while Dogecoin dropped 3 percent to move down to $0.09. Meanwhile, Polkadot consolidated at $5.16, and Solana lost 1 percent to move as low as $13.32.

Cardano price analysis: RSI falls into oversold zone on daily chart

On the 24-hour candlestick chart for Cardano price analysis, price can be seen continuing along an extended horizontal pattern around the $0.30 support zone. The 30-day moving average for ADA has lowered past the 200-day moving average, suggesting that a breakout is long overdue. Price has also fallen below the crucial 9 and 21-day moving averages, along with the 50-day exponential moving average (EMA) at $0.311. Over the past 24 hours, ADA trading volume rose 48 percent, suggesting increased market activity and potential buyer interest.

The 24-hour relative strength index (RSI) has fallen down into the undervalued zone in the 30s, having moved down to 38 over the past 24 hours. The moving average convergence divergence (MACD) curve can be seen close by the neutral zone and could either go for a bullish or bearish divergence, depending on price action over the next 24-48 hours.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.