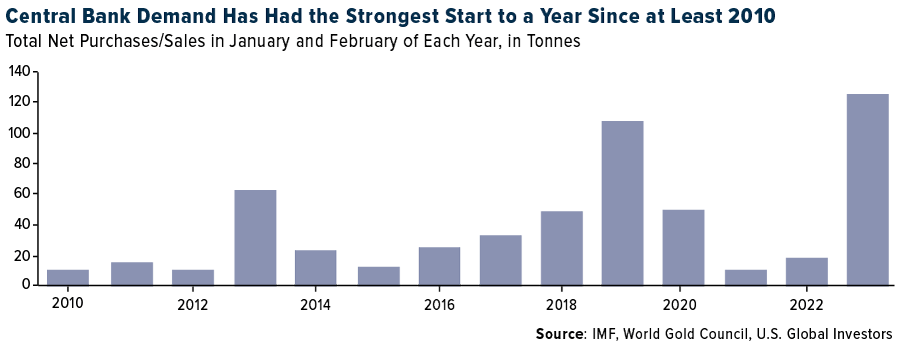

Central banks bought a record 483 tonnes of gold in the first half of 2024, driving the asset to an all-time high.

Central banks across the globe have been stocking up their gold reserves at record levels this year in a pivot to store of value assets.

In a post on X on Sept. 2, macroeconomics outlet, the Kobeissi Letter reported that global net gold purchases by central banks reached 483 tonnes in the first half of 2024, the most on record.

It added that the figure is 5% higher than the previous record of 460 tonnes which was set in the first half of 2023. In Q2 2024, central banks bought 183 tonnes of gold, marking a 6% increase year-over-year.