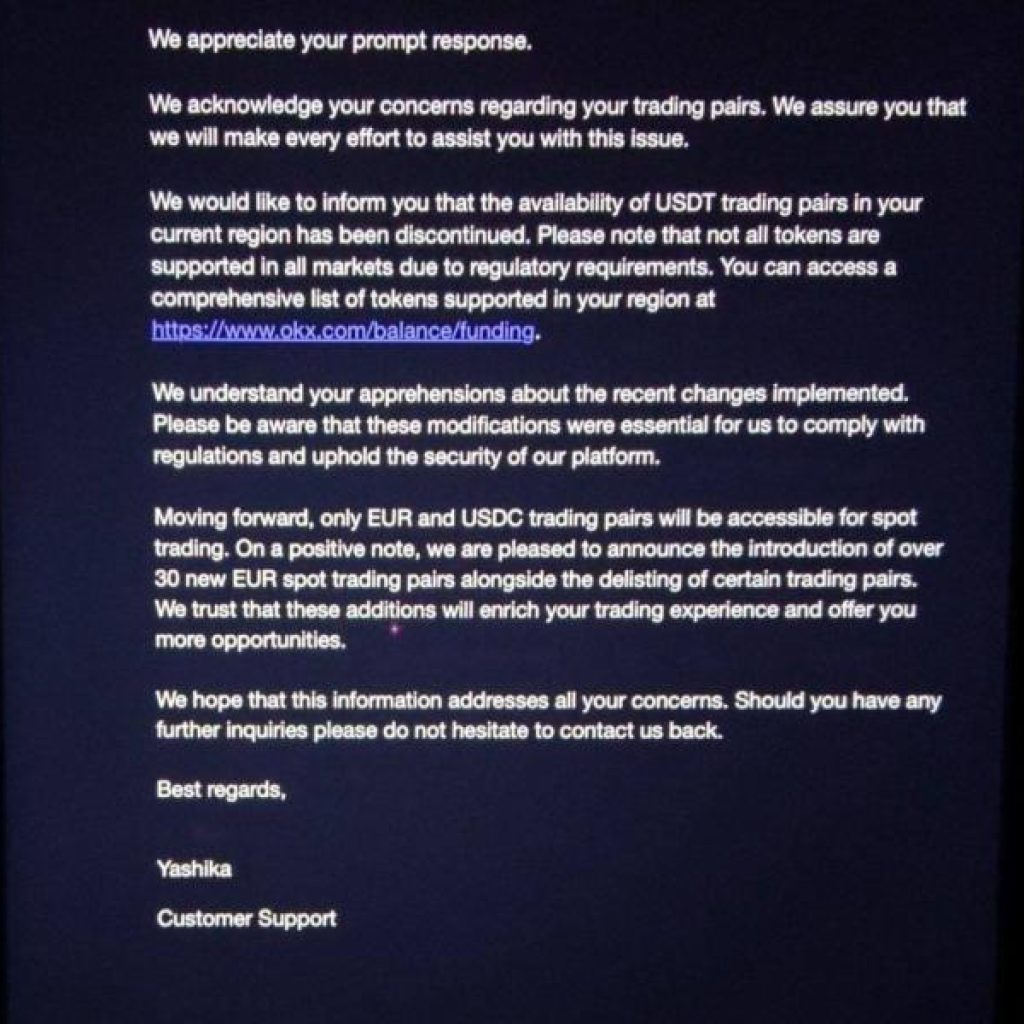

Trading volumes on CEXs have somewhat subsided after topping $9 trillion in March.

According to the latest report by CCData, in May 2024, the cryptocurrency market saw a significant decline in both spot and derivatives trading volumes.

The combined trading volume on centralized exchanges fell by 20.1% to $5.27 trillion during the month. This decline marks the second consecutive month of reduced trading activity, driven by the rangebound price of Bitcoin (BTC) following the network’s April halving.

Spot trading volumes on centralized exchanges dropped 21.6% to $1.57 trillion. The derivatives market also experienced a decline, with volumes decreasing by 19.4% to $3.69 trillion. Despite this downturn, the derivatives market’s dominance increased to the highest level since December 2023, as traders responded to the United States Securities and Exchange Commission’s unexpected approval of spot Ether (ETH) exchange-traded funds (ETFs). This led to a record high in open interest for Ether derivative instruments, which rose by 50.3% to $14.0 billion.