ChainLink price analysis for October 29, 2022, reveals the market following an upwards movement, showing constant momentum, signifying positivity of the LINK market. The price of ChainLink has remained constant over the past few hours. On October 28, 2022, the price reached $7.1 from $6.8. However, the market increased in value soon after and gained more value by reaching $7.2. Moreover, ChainLink has lost some value and reached $7.1, just moving onto the $7.5 mark.

The current price of ChainLink is $7.1, with a trading volume of $325,731,468. Chainlink has been up 2.66% in the last 24 hours. ChainLink currently ranks at #23 with a live market cap of $3,535,518,891.

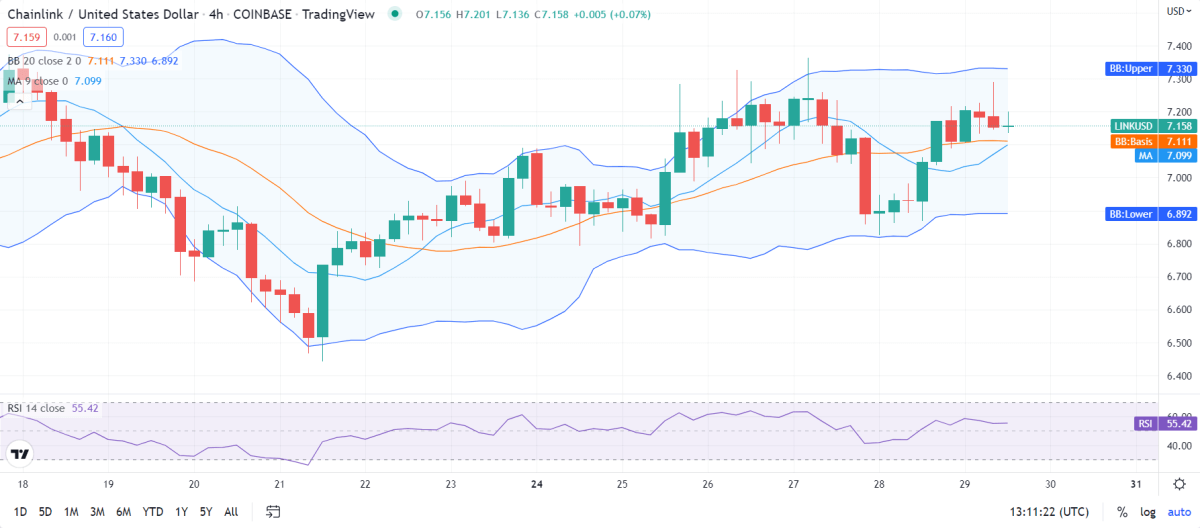

LINK/USD 4-hour price analysis: Latest developments

ChainLink price analysis reveals the market’s volatility following an opening movement. This means that the price of ChainLink is becoming more prone to the movement towards either extreme, showing increasing dynamics. The Bollinger’s band’s upper limit is $7.3, which is the strongest resistance point for LINK. Conversely, the lower limit of Bollinger’s band is $6.8, which is the strongest support point for LINK.

The LINK/USD price appears to be moving over the price of the Moving Average, signifying a bullish movement. The market’s trend seems to be dominated by bulls. However, the LINK/USD price appears to be moving upward, illustrating a further increasing market. The market appears to be showing bullish potential.

ChainLink price analysis reveals that the Relative Strength Index (RSI) is 55, showing a stable cryptocurrency market. This means that cryptocurrency is in the upper-neutral region. Furthermore, the RSI appears to move linearly, indicating a constant market. The equivalence of buying activities and selling activities causes the RSI score to remain dormant.

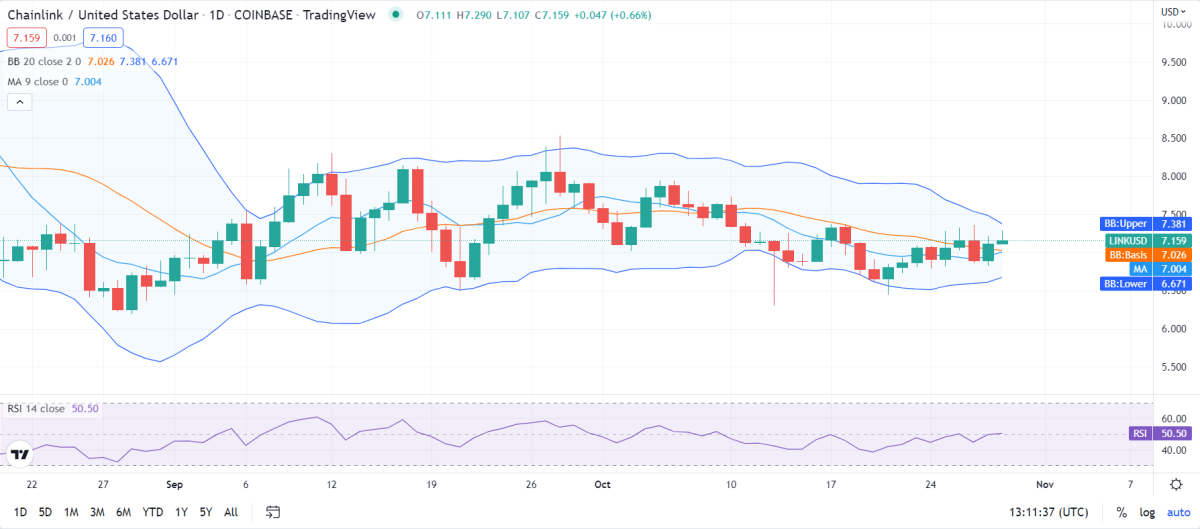

ChainLink price analysis for 1-day

ChainLink price analysis reveals the market’s volatility following a decreasing movement, which means that the price of ChainLink is becoming less prone to experience variable change on either extreme. The Bollinger’s band’s upper limit is $7.3, serving as LINK’s strongest resistance point. Conversely, the lower limit of Bollinger’s band is $6.6, which is the strongest support point for LINK.

The LINK/USD price appears to be moving over the price of the Moving Average, signifying a bullish movement. The market’s trend seems to have shown bearish dynamics in the last few days. However, the market has decided on a positive approach. As a result, the movement path has shifted today, the price started moving upwards, and the market started opening its volatility. This change has played a crucial role in the development of ChainLink. However, the price attempts to move toward the resistance band of the market.

Chainlink price analysis shows the Relative Strength Index (RSI) to be 50, signifying a stable cryptocurrency. This means that the cryptocurrency falls in the central-neutral region. Furthermore, the RSI path seems to have shifted to an upward movement. The increasing RSI score also means dominant buying activities.

ChainLink Price Analysis Conclusion

Chainlink price analysis reveals that the cryptocurrency follows an increasing trend with much room for activity on the positive extreme. Moreover, the market’s current condition appears to be following a massive positive approach, as it shows the potential to move to either bullish extreme. The market shows much potential for development towards the increasing end of the market.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.