Chainlink price analysis shows that the bulls are in control as the price revisits $5.57. This is a good sign for the bulls as it indicates that they are still in control of the market. The buyers have been pushing the price higher recently, and it appears that they may be ready to take it even higher. However, the sellers have been present at $5.58, creating a resistance level that the buyers will need to overcome before LINK can continue its upward momentum.

Chainlink has been in bearish yesterday, but the recent price surge suggests that the bulls are beginning to take control. The trading volume has also increased to $167 million, which is a sign that there is increasing investor interest in the cryptocurrency. The market cap of LINK is currently at $2.83 billion, which makes it the 21st largest cryptocurrency in terms of market capitalization.

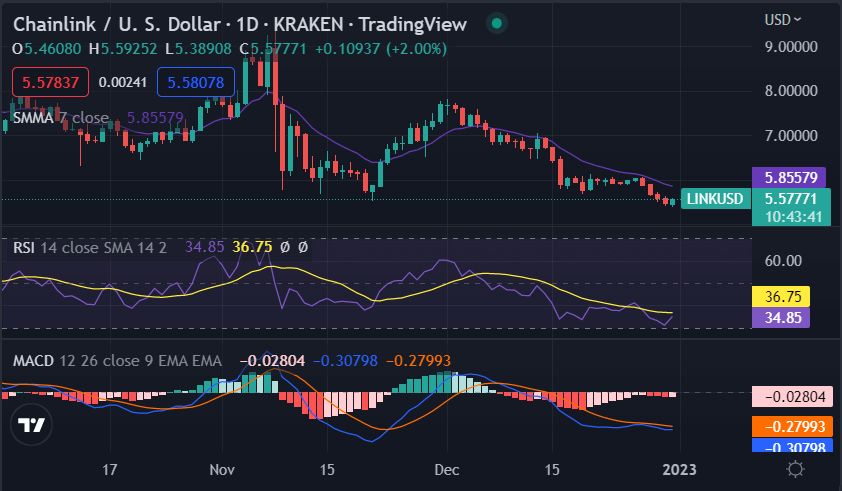

Chainlink price analysis: LINK/USD trades at $5.57 after a bullish run

The 4-hour chart of Chainlink price analysis shows that the pair has formed a symmetrical triangle pattern. This is a bullish reversal pattern and suggests that the price may continue to rise in the short term. Currently, the pair is trading at $5.57, and if it breaks above the resistance level of $5.58, it could rise to the next resistance level of $5.60. On the downside, the pair could find support at $5.41 if it fails to break above the resistance level of $5.58.

The Smooth Moving Average (SMA) suggests that LINK is in a bullish trend as the 50 SMA is above the 200 SMA. The Relative Strength Index (RSI) is also in the bullish zone and is currently at 24.96. This suggests that LINK has some room to move higher before it reaches the overbought zone. The MACD is also in the bullish zone, which suggests that the buyers are still in control.

Chainlink price analysis 1-day price chart: Link faces rejection at $5.58

The daily chart of Chainlink price analysis shows that the pair is trading at $5.57 after recovering from the support level of $5.41 that was formed on the previous day. The market for LINK has formed high lows and higher highs, which is a sign of bullish momentum. The price has also broken above the resistance level of $5.58 but faced rejection at this level, which suggests that the buyers may need to build more momentum before they can push LINK above $5.57.

Overall, the technical indicators suggest that LINK is in a bullish trend and is likely to continue its uptrend in the short term. The MACD red line is above the blue line and is also in the positive zone, suggesting that there could be further upside potential for LINK. The SMA is also in the bullish zone with the 50 SMA above the 200 SMA, suggesting that LINK may continue to rise in the short term. The Relative Strength Index (RSI) score has reached up to index 36.75; the indicator is trading at a steep upwards curve, indicating strong buying activity.

Chainlink price analysis conclusion

Overall, Chainlink’s price analysis suggests that LINK could be headed higher in the coming days as the year ends. The pair has formed a bullish reversal pattern on both charts, and the technical indicators are also in the bullish zone.