ChainLink price analysis for March 27, 2023, indicates a significant decline in the market, with negative momentum. The price of LINK has been consistently bearish in the past few hours, dropping from $7.3 to $7 on March 26, 2023. However, the market started to increase and the price of ChainLink gained most of its lost value to reach $7.1, just barely reaching the $7 threshold.

Chainlink is currently trading at $7.13 with a 24-hour trading volume of $450.73M, a market capitalization of $3.69B, and a market dominance of 0.32%. The LINK price has decreased by -1.72% in the last 24 hours. Chainlink’s highest price was reached on May 10, 2021, at an all-time high of $52.89, while its lowest price was recorded on Sep 23, 2017, at an all-time low of $0.126297. The lowest price since its all-time high was $5.36, and the highest LINK price since the last cycle low was $9.45.

Currently, the Chainlink price prediction sentiment is bearish, while the Fear & Greed Index is showing 64 (Greed). Chainlink’s current circulating supply is 517.10M LINK out of a maximum supply of 1.00B LINK. The current yearly supply inflation rate is 10.73%, which means that 50.09M LINK were created in the last year. In terms of market capitalization, Chainlink is currently ranked #4 in the DeFi Coins sector and ranked #7 in the Ethereum (ERC20) Tokens sector.

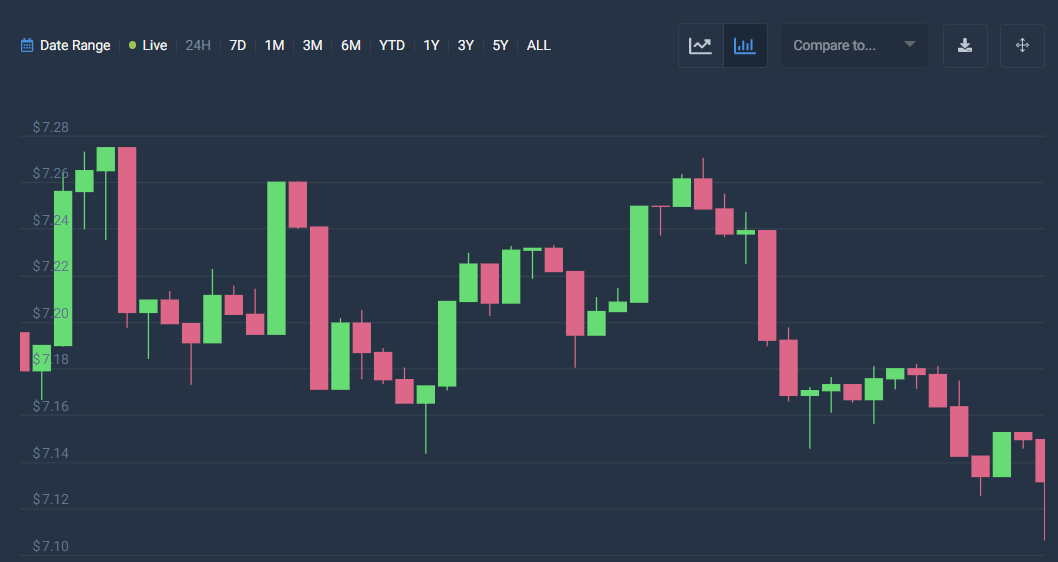

LINK/USD 1-day price analysis: Latest developments

ChainLink price analysis shows a volatile market, with an upward trend. This implies that the price of ChainLink is showing susceptible dynamics toward change. The opening price of ChainLink is recorded at $7.15, with the highest price also being $7.15. However, the lowest price recorded is $7.11, and the close price remains at $7.14. Currently, the ChainLink market is experiencing a decline of 0.18%.

The price of LINK/USD is currently below the Moving Average, indicating a bearish trend in the market. The market seems to be dominated by bears; moreover, the price of LINK/USD is declining, indicating a downward trend. The market is displaying a bearish outlook with significant potential for further decline.

ChainLink price analysis reveals that the Relative Strength Index (RSI) is 51 showing a stable cryptocurrency market. ChainLink is currently experiencing a phase of devaluation where its value is decreasing. The RSI score is decreasing due to the dominance of selling activities, which is further contributing to the downward movement in the market.

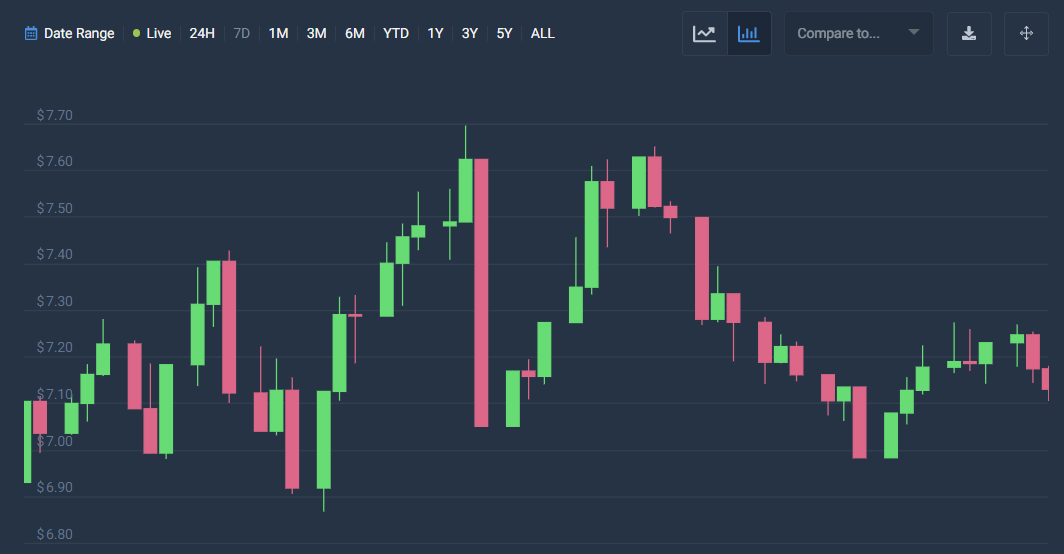

ChainLink price analysis for 7-days

Upon conducting a ChainLink price analysis, it can be observed that the market is currently experiencing volatility after a period of decline. This indicates that the price of ChainLink is becoming less susceptible to extreme changes in either direction. The opening price is recorded at $7.18, with the highest price being $7.18. On the other hand, the lowest price is present at $7.11, depicting a change of -0.57%, while the close price is recorded at $7.14.

Based on the current market analysis, the LINK/USD price is moving under the Moving Average price, indicating a bearish trend in the market. The trend in the market has shown bearish tendencies over the past few hours, further supporting this observation. Additionally, there has been a negative movement in the market, resulting in a decrease in the value of ChainLink and strengthening the bearish control in the market.

Chainlink price analysis shows the Relative Strength Index (RSI) to be 48, signifying a stable cryptocurrency. The current analysis suggests that the LINK cryptocurrency is currently positioned in the central neutral region of the market. Additionally, the Relative Strength Index (RSI) trend indicates a shift toward a downward movement, which is often indicative of a bearish market. The decrease in the RSI score is further evidence of dominant selling activities within the market.

ChainLink Price Analysis Conclusion

Based on the analysis of Chainlink’s price, it can be inferred that the cryptocurrency is currently following a bearish trend, indicating a significant potential for negative market activity. Furthermore, the prevailing market conditions exhibit a downward trajectory, suggesting the possibility of further price depreciation in the future.