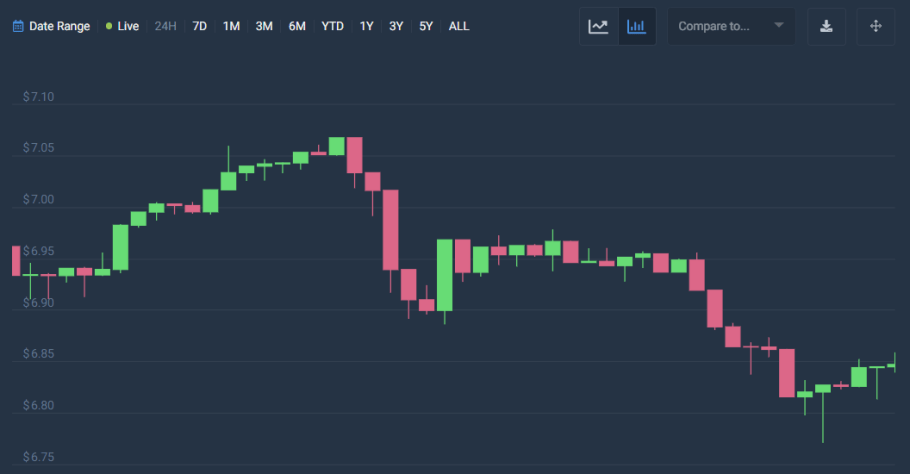

ChainLink price analysis for February 1, 2023, reveals the market following a downward movement, showing decreasing momentum, signifying negativity for the LINK market. The price of ChainLink has remained bearish over the past few hours. On January 31, 2023, the price reached $6.9 from $7.2. However, the market further decreased in value soon after and lost some value. Moreover, ChainLink has decreased and reached $6.8, just moving onto the $7 mark.

Chainlink’s price today is $6.85, with a 24-hour trading volume of $567.91M, a market cap of $3.48B, and a market dominance of 0.33%. The LINK price decreased by 1.28% in the last 24 hours.

Chainlink reached its highest price on May 10, 2021, when it was trading at its all-time high of $52.89, while Chainlink’s lowest price was recorded on Sep 23, 2017, when it was trading at its all-time low of $0.126297. The lowest price since its ATH was $5.36 (cycle low). The highest LINK price since the last cycle low was $9.45 (cycle high). The Chainlink price prediction sentiment is currently bearish, while the Fear & Greed Index shows 56 (Greed).

Chainlink’s current circulating supply is 508.00M LINK out of the max supply of 1.00B LINK. The current yearly supply inflation rate is 8.78% meaning 40.99M LINK were created in the last year. Regarding market cap, Chainlink is currently ranked #4 in the DeFi Coins sector and #7 in the Ethereum (ERC20) Tokens sector.

LINK/USD 1-day price analysis: Latest developments

ChainLink price analysis reveals the market’s volatility following a declining movement. This means that the price of ChainLink is becoming neither less prone to the movement towards either extreme, showing dormant dynamics. The opening price is $6.85, while the high price appears to be $6.86. Conversely, the low price is present at $6.84, with a close price remaining at $6.84. ChainLink market is undergoing a change of -0.05%.

The LINK/USD price appears to be moving under the price of the Moving Average, signifying a bearish movement. The market’s trend seems to be dominated by bears. Moreover, the LINK/USD price appears to be moving downward, illustrating a decreasing market. The market appears to be showing bearish potential; bears are expected to bring the price down to $6.5 by the end of this week.

ChainLink price analysis reveals that the Relative Strength Index (RSI) is 52 showing a stable cryptocurrency market. This means that cryptocurrency is in the central-neutral region. Furthermore, the RSI appears to move downward, indicating a decreasing movement. The dominance of selling activities causes the RSI score to decrease.

ChainLink price analysis for 7-days

ChainLink price analysis reveals the market’s volatility following a decreasing movement, which means that the price of ChainLink is becoming less prone to experience variable change on either extreme. The Opening price appears to be $6.95, while the high price is present at $6.96. Conversely, the low price is present at $6.84, with a change of -1.56% and a close price of $6.84.

The LINK/USD price appears to be moving over the price of the Moving Average, signifying a bullish movement. However, the market’s trend seems to have shown bearish tendencies in the last few hours. Moreover, the market has decided on a negative movement, which will decrease its value and strengthen the bearish control of the market.

Chainlink price analysis shows the Relative Strength Index (RSI) to be 46, signifying a stable cryptocurrency. This means that the LINK cryptocurrency falls in the lower-neutral region. Furthermore, the RSI path seems to have shifted to a downward movement. The decline in the RSI score also means dominant selling activities.

ChainLink Price Analysis Conclusion

Chainlink price analysis reveals that the cryptocurrency follows a declining trend with much room for activity on the negative extreme. Moreover, the market’s current condition appears to be following a declining approach, as it shows the potential to move further downwards.