Chainlink price analysis demonstrates that the price has been moving down today as the bears have repeatedly tried to seize the lead. Currently, trading below the $5.92 support level, the price appears susceptible to further declines if the level is unable to hold. The technical indicators for LINK are likewise bearish, showing that selling is more inclined than buyers in the near future. As the market declines below $5.92 today, chainlink price analysis shows a declining trend. The resistance for the LINK/USD pair is currently at $6.04 a break above this level could lead to a bullish run. The 24 -hour trading volume for Chainlink has also seen a decline, as it is currently $145,396,282, with a market capitalization of $3,009,394,522.

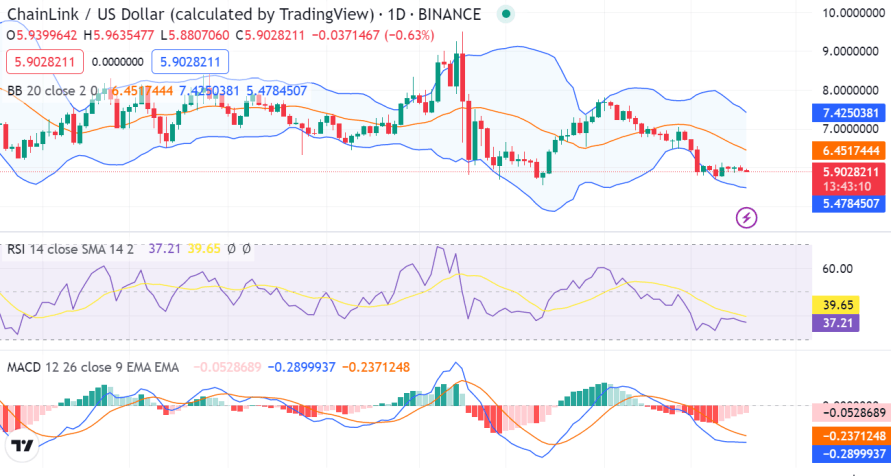

Chainlink price analysis 1-day price chart

The daily chart Chainlink price analysis reveals that the price has been on a downward trend for the past 24 hours as prices are at an intraday low of $5.92.However, an opening movement is being followed by market instability. This suggests that Chainlink’s price is showing more signs of decreasing and is becoming more subject to swings in either direction. The current market price and the initial level of support are used as the upper and lower limits of Bollinger’s band, respectively, which are set at $7.4250 and $5.4784 respectively.

The relative strength index (RSI) for a 1-day chart is trading at 39.65, which indicates that selling pressure is outweighing buying demand at the moment and that the current momentum is relatively weak. The moving average convergence and divergence (MACD) line (blue) is below the signal line (red), which shows that the downward momentum for LINK/USD is continuing in the near future.

Chainlink price analysis: Price drops to $5.92 due to bearish momentum.

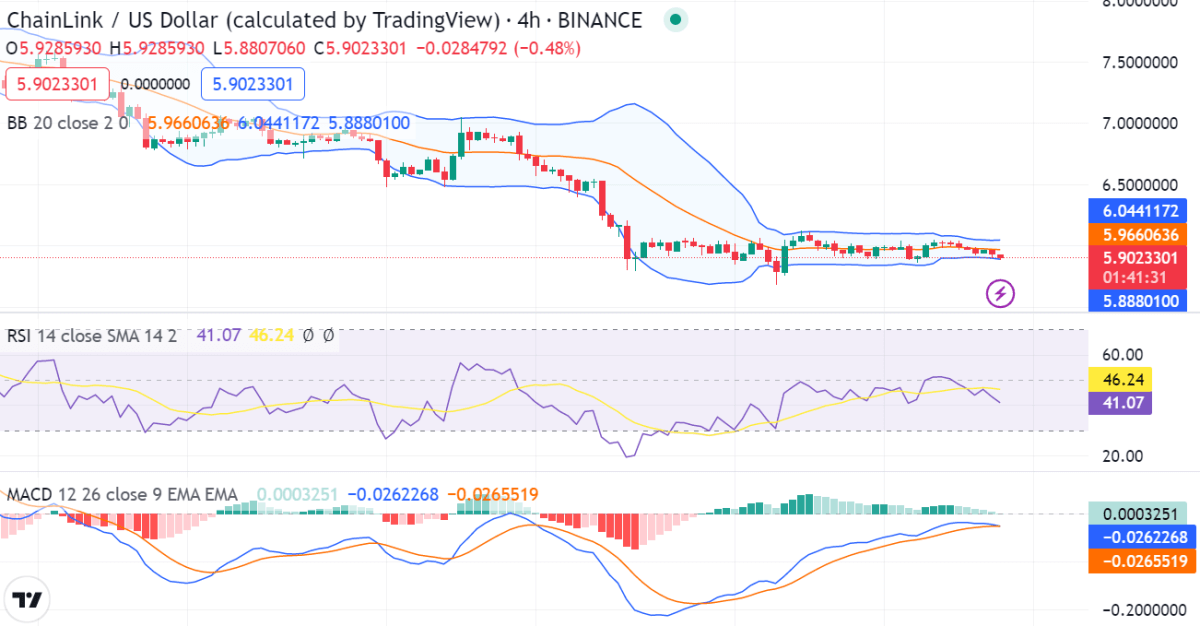

The 4-hour Chainlink price analysis shows the bears have fully taken over the market. Moreover, after being on a downward trend for the previous four hours, the price levels are now swiftly declining. Since no positive support has yet been seen, the price, which is currently at the $5.92 level, is forecast to decline much further from this level. With regard to market volatility, tiny price fluctuations show that the general trend is unfavorable.

The Bollinger Band average shows a $5.9660 range, indicating low volatility in the market. The upper limit of the Bollinger bands has also decreased, up to $6.0441, while the lower band is at $5.8880. The MACD indicator on the 4-hour LINK/USD chart is also following the bearish trend, as the MACD histogram and the signal line are both below the zero line. The RSI indicator is also in bearish territory at 46.24, indicating that LINK/USD may continue to decrease in value.

Chainlink price conclusion

In conclusion, Chainlink’s price analysis indicates that it reached $5.92 in the last 4 hours, and the price appears to be declining today. It appears that another market crash has occurred because of the price’s sharp decline in recent hours. Although the bullish could return and help the market become more upbeat, for the time being, the negative momentum remains in control.