Chainlink Price Predictions 2023-2032

- Chainlink Price Prediction 2023 – up to $11.00

- Chainlink Price Prediction 2026 – up to $34.43

- Chainlink Price Prediction 2029 – up to $108.37

- Chainlink Price Prediction 2032 – up to $329.44

No one could say if — and when — the crypto winter is ending. We can regard some successful strategies as “green shoots” to create hope for the crypto industry. ETH witnessed three consecutive weeks of inflows after 11 straight weeks of sell-off, according to a CoinShares report. Fear not, and let’s explore Chainlink Price Prediction.

How much is LINK worth?

Today’s live Chainlink price is $15.40, with a 24-hour trading volume of $693,981,432. Chainlink is up 3.10% in the last 24 hours. The current CoinMarketCap ranking is #13, with a live market cap of $8,768,933,012. It has a circulating supply of 556,849,970 LINK coins and a max. supply of 1,000,000,000 LINK coins.

Chainlink price analysis: LINK retrace above $15.00 after a bullish movement

- Chainlink price analysis shows an uptrend.

- LINK is trading at $15.40, up by over 3 percent.

- Support and resistance levels are $14.32 and $15.00, respectively.

The Chainlink price analysis on 22nd December reveals that the LINK/USD pair has been bullish for the past 24 hours. The price surged above the $15.00 key level and has been trading positively since then. The price bounced from here and faced resistance in the $15.80 region. The buyers have the lead in the market, and a break above $15.80 could lead to a retest of the key resistance level at $16.00.

Chainlink price analysis daily chart: Bullish momentum progress LINK’s uptrend pattern

The daily chart for Chainlink price analysis displays a brief bullish momentum. The price is trading above the ascending channel and has remained above the 100-day exponential moving average (EMA). The Bollinger band indicator has remained wide, indicating an increase in volatility.

LINK/USD 24-hour chart, By: TradingView

The relative strength index (RSI) is 54.95, heading toward the overbought region. This suggests that buyers could be in control of the market. The moving average convergence divergence (MACD) line is still above the signal line, implying a strong bullish momentum for the LINK/USD pair. The histogram is positive and above zero, indicating buying pressure in the market.

Chainlink price analysis hourly chart: Bearish activity takes a breather as bulls take charge

According to the hourly chart for Chainlink price analysis, the price has been on an uptrend. The bullish momentum is building as the chart forms higher and lower highs. The 20-day EMA shows the immediate resistance level is $16.00.

LINK/USD 4-hour chart, By: TradingView

The Relative Strength Index (RSI) is above 65, indicating buyers do control the market. The MACD line has crossed above the signal line, suggesting further positive momentum for LINK/USD. The histogram forms green bars indicating that bearish activity takes a breather as the bulls take charge. Looking at the Bollinger band, LINK is trading alongside the upper band.

What to expect from Chainlink price analysis

Overall, the Chainlink price analysis indicates that prices will likely continue the uptrend as buyers look to retest higher levels. The technical indicators suggest further bullish momentum for LINK/USD in the near term. LINK must close above the $15.50 level to confirm an uptrend and a further price rise. A strong break above $16.00 could open up the possibility of LINK/USD reaching the $17.00 mark in future trading sessions.

Recent News/Opinions on Chainlink

Sandeep Nailwal Heralds New DeFi Era with Chainlink-Polygon Integration

Polygon’s Integration with Chainlink Ushers in Exciting DeFi Innovations Sandeep Nailwal, the founder of Polygon, recently expressed enthusiasm about Chainlink’s latest integration with Polygon’s zkEVM, terming it a significant milestone for the decentralized finance (DeFi) sector. This integration, which became operational on the EVM-compatible network last Thursday, is a major advancement in DeFi application development.

Nailwal’s remarks came shortly after Polygon announced that Chainlink Data Feeds are now active on its zkEVM network. He emphasized the potential for a diverse range of DeFi applications, thanks to the synergy between Chainlink’s real-time data solutions and Polygon’s robust ecosystem, which includes the zkEVM and Supernets app chains. This fusion is expected to provide developers with the necessary tools to create sophisticated DeFi platforms, decentralized exchanges (DEXs), and other innovative projects.

Chainlink Data Feeds facilitate the integration of smart contracts with real-world data, encompassing variables like asset prices and NFT floor prices. Incorporating these feeds into the Polygon zkEVM platform opens doors to the on-chain movement of trillions of dollars in tokenized real-world assets (RWAs).

Moreover, Nailwal highlighted the Chainlink Cross-Chain Interoperability Protocol (CCIP) as a key driver for this evolution. CCIP’s widespread adoption across various blockchains, including Avalanche, Ethereum, and Optimism, and its integration with numerous DeFi protocols and global financial institutions, position Chainlink as a leader in the burgeoning tokenization market.

This development comes as the DeFi sector begins to recover from a prolonged bear market, with the total value locked (TVL) across different chains and protocols recently surpassing $50 billion.

LINK Token Rises Amid Staking Update, Gains Top Whale Investors’ Attention

Chainlink’s cryptocurrency, LINK, has outperformed the market, including Bitcoin, with a staggering 189% increase since the beginning of 2023. This surge eclipses Bitcoin’s 139% growth, primarily driven by the anticipation of Chainlink’s new v0.2 staking mechanism. This update has sparked significant interest among large-scale investors, commonly known as whales, leading to a notable uptick in LINK token accumulation.

Recent reports indicate that the top 200 LINK wallets have boosted their holdings by an impressive $50 million, bringing their total to a whopping $11.84 billion, which equates to 746.57 million LINK tokens. This increase in whale activity, coupled with a decrease in token balance, is generating bullish sentiments in the cryptocurrency market.

Investors are increasingly viewing LINK as a long-term asset rather than a short-term gain, reducing the likelihood of immediate selling pressure. On-chain data reveals that the LINK supply stood at 102 million tokens, with nearly 20 million already staked following the introduction of the new mechanism.

The rise in LINK’s value is also attributed to the adoption of Chainlink’s Cross-Chain Interoperability Protocol (CCIP) by prominent institutions like Swift and Wemade. Sergey Nazarov, Chainlink co-founder, touts CCIP as a revolutionary solution in both decentralized and traditional finance sectors.

Concluding its November phase on a high note, Chainlink has secured a position among the top ten cryptocurrencies, thanks to its robust performance and growing popularity among major investors. With the ecosystem transitioning to Chainlink Staking v0.2, and a nine-day Priority Migration period followed by early access beginning December 7, 2023, LINK is expected to maintain its bullish trend, especially with General Access opening on December 11, 2023. Despite the inherent volatility, LINK’s blend of bullish and bearish trends positions it above key resistance levels, fostering a sense of optimism for its performance in December 2023.

Anzen Taps Chainlink to Bolster Real-World Asset Lending

Anzen has formally joined Chainlink’s BUILD program to accelerate decentralized lending growth using real-world assets (RWAs). By connecting to Chainlink’s industry-leading Oracle network, Anzen gains enhanced reliability and security capabilities.

The integration with Chainlink provides Anzen access to specialized Oracle frameworks like Automation for triggering smart contract actions based on interest payments, CCIP for cross-chain connectivity, and Proof of Reserve to authenticate off-chain collateral reserves. Anzen can also leverage new Chainlink features in alpha/beta testing.

In return, Anzen will furnish network fees and other incentives to the Chainlink community, delivering value to node operators and users.

Anzen aims to shift RWAs on-chain by constructing a robust RWA-based lending protocol. This will offer yield opportunities to depositors while supplying reliable credit access to institutions. Expanding RWA crypto lending spurs wider economic development.

By partnering with Chainlink BUILD, Anzen can capitalize on the exceptional reliability of Chainlink Price Feeds. This allows the pricing of RWA loans on reliable market data, avoiding manipulation. Automation ensures proper tracking of repayment schedules, avoiding manual efforts.

For Anzen CEO Ben Shyong, Chainlink integration enables them to reach their goal of mainstream RWA lending. With battle-tested oracles securing operations, Anzen’s protocol can provide attractive yields without compromising security.

Chainlink is the industry oracle standard powering leading DeFi applications by supplying tamper-proof, high-quality data. Anzen’s choice validates Chainlink’s dominance for crypto financial services needing robust, transparent inputs.

The collaboration constitutes a long-term alignment on a shared vision of migrating real-world markets safely onto the blockchain using the decentralized infrastructure.

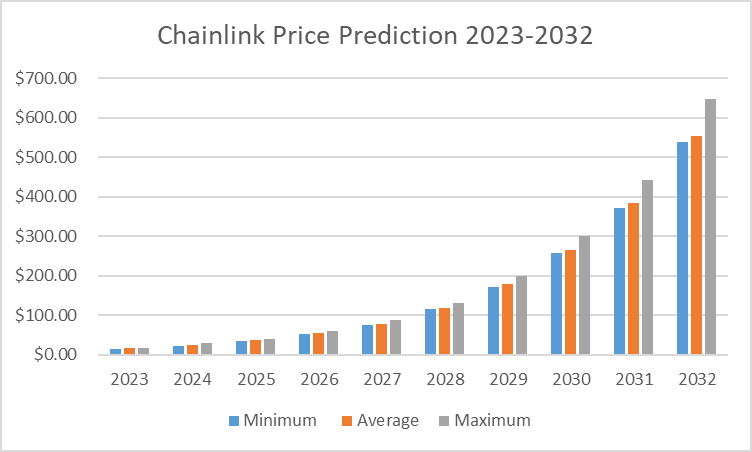

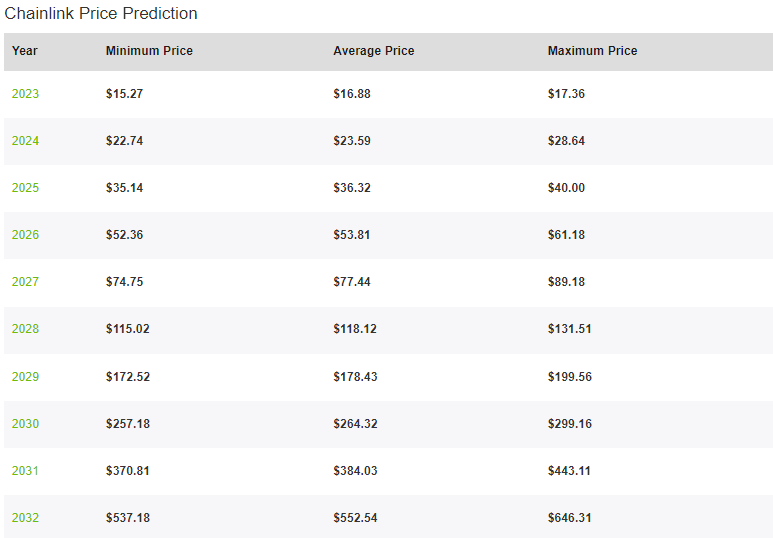

Chainlink Price Prediction 2023-2032

Chainlink Price Prediction 2023

According to our updated Chainlink price prediction for 2023, LINK is expected to see a significant rise, reaching a minimum price value of $15.27, an average price of $16.88, and a maximum trading price of $17.36. This optimistic forecast is underpinned by recent positive developments in the Chainlink ecosystem, such as the partnership with Australian Bank ANZ for tokenized asset transactions.

Chainlink Price Prediction 2024

In 2024, LINK is anticipated to maintain its upward momentum, achieving a minimum price of $22.74, an average forecast price of $23.59, and a maximum trading price of $28.64. The continued growth in the smart contract sector is likely to contribute to this positive trend.

Chainlink Price Prediction 2025

Our forecast for 2025 suggests that LINK could trade at a minimum price of $35.14, an average price of $36.32, and reach a maximum price of $40.00. This reflects the increasing relevance of Chainlink in the decentralized finance (DeFi) space.

Chainlink Price Prediction 2026

For 2026, LINK is predicted to trade at a minimum price of $52.36, an average of $53.81, and a maximum price of $61.18. This aligns with Chainlink’s growing traction in DeFi and expanding partnerships.

Chainlink Price Prediction 2027

Our analysis for 2027 projects a bullish trend for Chainlink, with LINK expected to hit a minimum price of $74.75, an average of $77.44, and a maximum trading price of $89.18. The adoption of smart contract technology and the crucial role of Chainlink’s decentralized Oracle network are key drivers for this forecast.

Chainlink Price Prediction 2028

In 2028, LINK is forecasted to reach a minimum price of $115.02, an average price of $118.12, and a maximum trading price of $131.51. The project’s standing in the DeFi community and its technological innovations are anticipated to fuel this demand.

Chainlink Price Prediction 2029

Continuing its upward trend in 2029, LINK’s minimum price is expected to be $172.52, with an average price of $178.43 and a maximum trading price of $199.56.

Chainlink Price Prediction 2030

The 2030 forecast suggests that LINK could achieve a minimum price of $257.18, an average price of $264.32, and a maximum trading price of $299.16. The growing adoption of blockchain technology is expected to enhance the importance of Chainlink’s oracle services.

Chainlink Price Prediction 2031

For 2031, the price of LINK is anticipated to range from a minimum of $370.81 to an average of $384.03, reaching a maximum trading price of $443.11.

Chainlink Price Prediction 2032

Finally, the 2032 Chainlink price prediction is for LINK to achieve a minimum price of $537.18, an average price of $552.54, and a maximum trading price of $646.31. The potential widespread adoption of blockchain technology in various industries could significantly boost demand for Chainlink’s services.

Chainlink Price Prediction by Technewsleader

Chainlink price prediction by Technewsleader estimates the price of LINK to experience enormous growth. It could attain a yearly turnaround of a minimum of $37.96 and a maximum trading price of $95.36 by 2029. The market analyst states that LINK could attain a maximum price of $170.80 in the next ten years, with a minimum forecast price of $290.26 by the end of 2032.

Chainlink Price Prediction by Coincodex

Coincodex has analyzed various technical indicators and provided a short-term and long-term LINK price forecast. Their Chainlink price prediction estimates LINK Chainlink to rise by 4.25% and reach $ 15.55 by December 17, 2023. According to their technical indicators, the current sentiment is Bearish while the Fear & Greed Index is showing 67 (Greed). Chainlink recorded 15/30 (50%) green days with 5.32% price volatility over the last 30 days. Based on our Chainlink forecast, it’s now a bad time to buy Chainlink.

Chainlink price predictions by Coincodex suggest that the cryptocurrency is anticipated to experience significant fluctuations in the coming years. In 2023, LINK is expected to trade between $7.71 and $21.36, potentially seeing a 179.15% increase. In 2024, the range widens to $7.71 to $45.65, with a potential 496.56% increase. By 2025, Chainlink may reach between $16.18 and $54.12, indicating a 607.21% potential gain. The 2030 prediction suggests a range of $9.92 to $30.15, possibly a 294.07% increase. While the possibility of reaching $100 by October 2032 is mentioned, predictions for $1,000 and $10,000 appear less likely, with the highest estimated price being $333.13 by January 1, 2049. It’s important to note that cryptocurrency prices are highly speculative and subject to change based on various factors.

Chainlink Price Prediction by DigitalCoinprice

Coincodex is another website with a bullish outlook on LINK’s short-term and long-term prospects. The Chainlink price prediction suggests a bullish outlook with expectations of significant growth. By the end of 2025, Chainlink is forecasted to increase by approximately 254.91%, reaching a value of $27.67. However, the current Fear & Greed Index reflects extreme fear in the market. Over the next few years, gradual price rises are anticipated, with 2023 ending around $16.79, followed by $19.67 in 2024. By 2032, the price could reach $149.15, indicating long-term optimism.

Chainlink Price Prediction by Market Experts

Market experts have varying opinions on Chainlink’s price potential in the coming years. The outlook for Chainlink appears to be influenced by several positive and negative factors. On the positive side, Chainlink is actively implementing network upgrades, including the Cross-Chain Interoperability Protocol (CCIP) and Chainlink Economics 2.0, which are expected to enhance blockchain interoperability and the overall value proposition of the Chainlink Network. Additionally, partnerships with institutions like Swift, Amazon Web Services, Associated Press, and Google BigQuery indicate growing institutional adoption and demand for Chainlink’s services.

However, concerns exist, such as the perceived aggressive selling of LINK tokens by the Chainlink team and node operators, which can exert selling pressure and dampen price potential. Nonetheless, Chainlink Economics 2.0 aims to address these issues.

For the near term, the price prediction for Chainlink ranges from lows of $11 to highs of $19, with an average price of $15. Looking further ahead to 2025, experts anticipate potential lows of $20, highs of $28, and an average price of $24.

More Crypto Online notes that there is resistance around $7.88, and if LINK breaks below that level, it could signal a bearish trend with a potential target of $7.23. The analyst mentions an alternative bullish scenario, where LINK might break out of the range if it surpasses $9.50. He emphasizes the importance of monitoring key levels, such as $6.19 and $5.30 for potential breakdowns, and $9.50 for potential upside movements.

Chainlink Overview

Chainlink Price History

Is Chainlink helping empower Web3 innovation? This week, there were 8 integrations of 4 #Chainlink services across 5 different chains: @arbitrum, @avax Fuji testnet, @BNBChain, @Ethereum, and @0xPolygon. Chainlink Functions is now live on Avalanche Fuji testnet, helping bring the world’s APIs to Web3 – May 1 – May 7.

Question of the hour: <a href="http://

“>Dumping LINK? How come despite the constant “adoptions” the $LINK token only continues to bleed against ETH and BTC? Why did you need to dump the token for billions of USD? Just asking.How come despite the constant “adoptions” the $LINK token only continues to bleed against ETH and BTC? Why did you need to dump the token for billions of USD?

— HOI Boy (@mrwwsteppah) May 7, 2023

The Chainlink Spring 2023 Hackathon began last week! 200+ Countries Participating. Don’t miss your chance to join us and explore the intersection of AI and blockchain

More on Chainlink

What is Chainlink?

Chainlink is known as a decentralized oracle network or blockchain abstraction layer. Chainlink uses blockchain technology to securely enable computations on and off chain, supporting what it calls hybrid smart contracts.3 Enterprises using Chainlink can access any major blockchain network, including Ethereum and Solana.

Chainlink Applications

Due to the way the smart contracts of Chainlink were developed, Chainlink has the prospect of fitting into every facet of our lives. Chainlink’s smart contracts were developed to solve the issue with Oracle. The Oracle problem is that blockchains were disconnected from the outside world.

The smart contracts for Ethereum and other crypto assets could only fetch data that was already stored on the blockchain. However, non-deterministic data (data outside the blockchain database) could not be fetched. However, the introduction of Chainlink introduced a middleware solution that could fetch data from outside a blockchain database.

It was done by creating decentralized networks of Oracles, and the fascinating thing here is that the blockchain is not in any way affected.

The ground-breaking development raises the prospect of Chainlink through the roof, and the technology is applicable in the following areas: using satellite imagery in the military for information gathering; triggering insurance payouts; global trade; direct transactions which cut out intermediaries for post-trade processing; paying your workers or getting paid in real-time for services rendered; can be used during elections to vote; can be used for trading on gaming platforms, etc.

Where to buy Chainlink (LINK)?

To use Chainlink’s Oracle system, you need to have Chainlink’s native token, LINK, as a payment means for the service. Chainlink network is built on the Ethereum network and utilizes ERC677, which obtained its efficacy from ERC 20 token standards and enables token transfer to comprise a data payload.

The ERC677 is also utilized for settlement with a Chainlink node operator who supplies and feeds data into the network, paid for by the buyers. The vendors decide the cost of the service after bidding.

Many investors are wondering where to buy the token Chainlink. Apart from earning Chainlink tokens by participating as an oracle or a node operator, they can also be acquired from a cryptocurrency exchange.

Top crypto exchange platforms such as Binance, Coinbase, and Gemini allow individuals to buy LINK using fiat currency via a credit card or debit card, bank transfer, etc. Use a hardware wallet to store LINK tokens securely.

When did Chainlink reach its all-time high?

The popularity and demand for smart contract technology surged in 2021 due to the heightened proliferation of blockchain tech and the Ethereum blockchain’s upgrade. On January 23, LINK’s price reached a new all-time high of $52.

The price of Chainlink continued the positive momentum, and a little later, it was trading at record levels above the $30 price level. On February 14, 2021, LINK peaked at $35.58, setting a new all-time high, but it has since retraced lower.

The coin surged after a small downward trend, reached another all-time high, and traded at $52.43 on May 10. This was the new all-time high set by Chainlink in May.

It couldn’t continue this price growth; shortly afterward, it fell nearly half this price. Chainlink’s price today is just above 25 USD.

What drives LINK price?

Certain prominent elements affect the market value of any cryptocurrency. Such factors include economic news, market sentiments, and government regulations. Apart from these popular asset price influencers, we have identified some more factors responsible for the price actions of LINK.

- Chainlink Future Developments

Chainlink continues to garner significant appeal among developers, and it has completed over 300 integrations with nodes, data providers, DeFi, and blockchain-based projects. To date, every single Chainlink integration has bolstered LINK’s market capitalization, and continued growth is expected.

The more projects linked to Chainlink, the higher the market price of LINK, especially if the projects boom with impressive scalability. In 2021 alone, Chainlink had over 700 partnerships, integrations, and collaborations; in the first quarter of 2022, the project added 140 more.

- Speculations and Interests

The surge in the price of LINK is often tied to rising interest in the coin and significant DeFi developments. It is no hidden secret in the crypto market that when institutional investors turn to an asset, its price goes up.

Similarly, speculations play a significant role in the price of any asset. The value of LINK will respond to rumors in the crypto space, news, and discussion in public columns among miners, investors, and devs.

More importantly, DeFi migration for centralized finance systems will undoubtedly generate massive speculative interest in blockchain projects like Chainlink.

- Oracle Services Functionalities

The output of a smart contract is only as good as its external data sources. Hence, if the data source is malicious, the smart contract outputs inaccurate outcomes.

Ensuring the validity and accuracy of data sources is one colossal concern that Chainlink solves via its Oracle services. The expansion of Chainlink’s functionality could significantly impact LINK’s market value, as seen in 2019 when Google announced a Chainlink integration that led to a giant leap in the coin’s value.

More future integrations and real-world applications will definitely affect LINK’s price.

Where to store LINK

You can use a software wallet (e.g., MetaMask, Trust Wallet) or a hardware wallet (e.g., Ledger, Trezor). When it comes to using a crypto wallet vs. an exchange to store your coin, crypto wallets are generally preferred. However, these options are a bit more cumbersome and do come with their own risks. For example, if you lose your wallet keys, nobody will unlock them for you. But crypto investors still recommend using these wallets because they give you full control over your coins and are less likely to get hacked.

Conclusion

Chainlink theoretically faces off against the entire cryptocurrency market as a cryptocurrency. However, there are only three major rivals to Chainlink as a project: Band Protocol, API3, and WINKlink. As connecting other projects is the primary function of Oracle networks like Chainlink and the three listed above. The most crucial parameter for them is the number of partners they have got, making them compatible with one another and the outside world. Chainlink has ten times more collaborations and integrations than those three combined, putting it far ahead of its rivals. It is unquestionably the best.

The long-term price projections indicate LINK will probably reach new all-time highs as crypto adoptions intensify in the coming years. However, these are our Chainlink price predictions based on deep analysis and the tracking of historical data, so they are not investment advice. Do your own research before taking an investment option.