Trillions of dollars will flow into Web3 once the details of the Internet of Contracts are worked out.

The value of tokenized real-world assets (RWA) will exceed that of cryptocurrencies on Web3 in the next few years, Chainlink co-founder Sergey Nazarov said in his keynote presentation at TOKEN2049 in Singapore on Sept. 18. That surge of value flowing from traditional finance (TradFi) will drastically alter the nature of the blockchain industry.

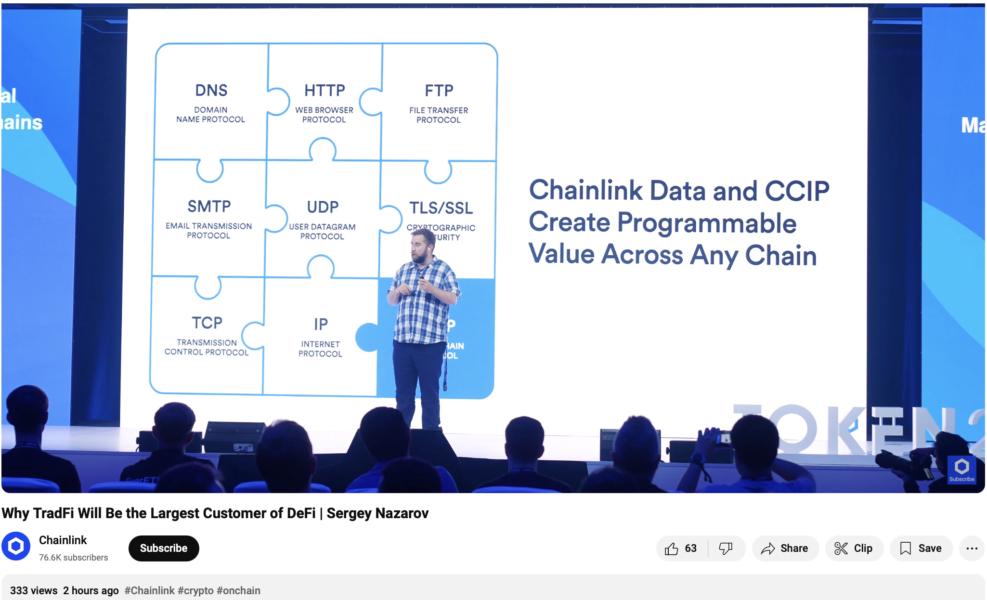

“This is the role I think we should all be preparing for. […] TradFi will be the largest customer of DeFi [decentralized finance],” Nazarov said. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) may have a crucial role to play in an emerging Internet of Contracts that will link central bank digital currency, asset chains, consortium chains and public blockchains, he added.

The Chainlink oracle network “already powers the majority of DeFi,” having enabled $15.49 trillion in transaction value since 2022, Nazarov said. For TradFi to use blockchain technology, it needs access to a variety of types of data, including live data, “to make TradFi smart contracts function properly.”