Coinspeaker

Chainlink’s Supply on Exchanges Drops to 21.4%: Is LINK About to Rally?

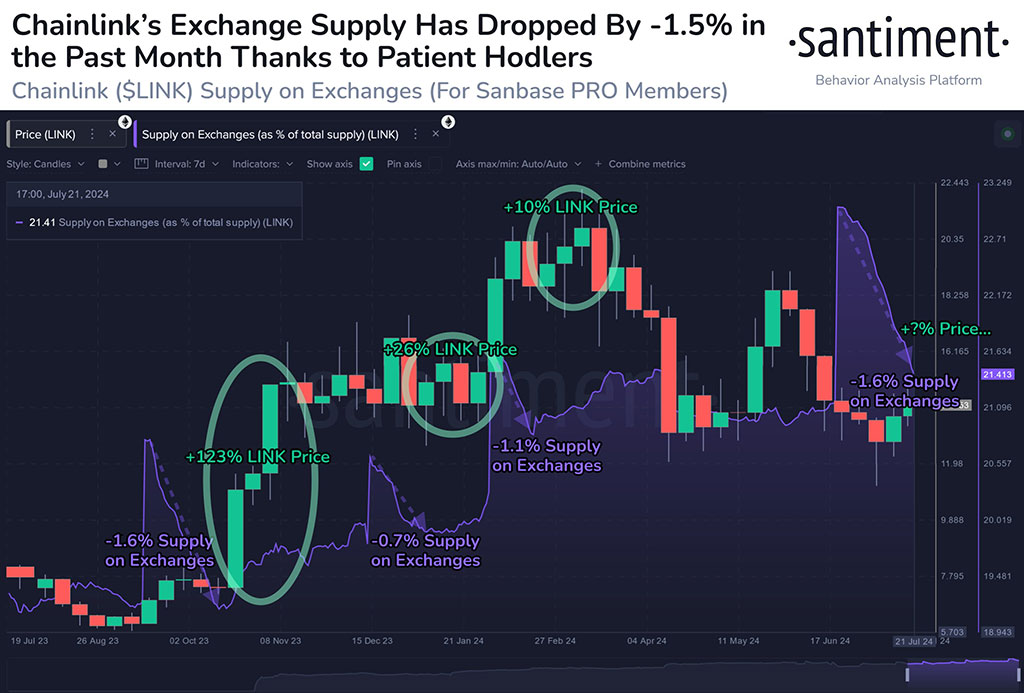

Chainlink’s supply on exchanges on exchange has declined significantly, signaling a potential rally for LINK. According to Santiment, LINK’s supply on exchanges has dropped from 23% to 21.4% in the past 30 days.

Per the on-chain data intelligence provider, the decline in exchanges mirrored the late 2023 pre-rally.

“The last time we saw this level of decline of LINK coins on exchanges, from Sep. 15 to Oct. 14, the 15th ranked market cap coin surged +123% over the next 4 weeks.”

Photo: Santiment

Apart from the last 2023 hike, historical data showed LINK always saw an upswing after a significant drop in supply on exchanges (SoE).

For instance, per the attached Santiment chart, the altcoin rallied 26% after a 0.7% decline in SoE in December 2023. The same pattern was observed in February 2024. It jumped 10% to over $20 after a 1.1% drop in SoE in January.

Will the Trend Repeat and Rally LINK?

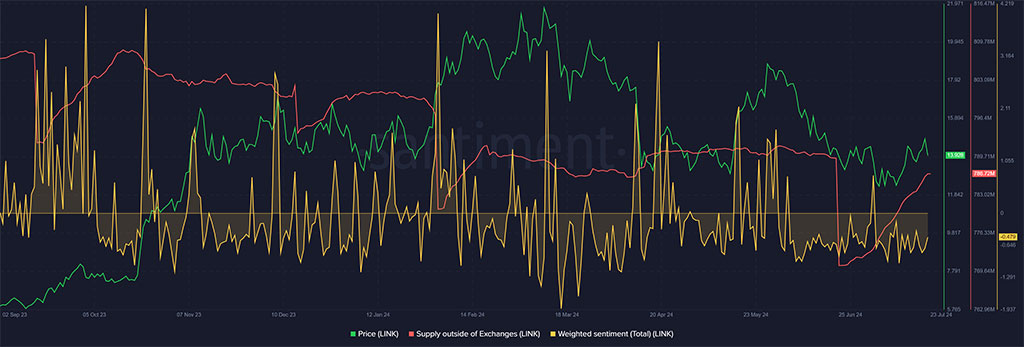

Additionally, past LINK rallies after the decline in SoE were marked by upticks in supply outside of exchanges (red) and a surge in positive weighted sentiment (orange). In short, the past rallies happened after a massive LINK accumulation spree and improved market sentiment.

Photo: Santiment

As of press time, supply outside of exchanges had increased, denoting a surge in LINK’s accumulation spree. However, the overall market sentiment didn’t favor the bulls just yet, as shown by the negative weighted sentiment.

LINK Price Prediction: Is a +20% Gain Likely in the Short Term?

On the price chart, LINK defended the key 2024 demand zone above $12, marked cyan. An improved market sentiment and surge in demand at the level could drive LINK to the immediate bullish target around $16, which coincides with the trendline resistance.

Photo: TradingView

Such an upswing could tip a 22% potential gain for LINK bulls.

But, as of press time, demand remained stagnant, as shown by the RSI (Relative Strength Index) resting at the average level. A drop below the demand zone could delay the above-bullish outlook. As of press time, LINK traded at $14.10 and was up 3% on a monthly adjusted basis.

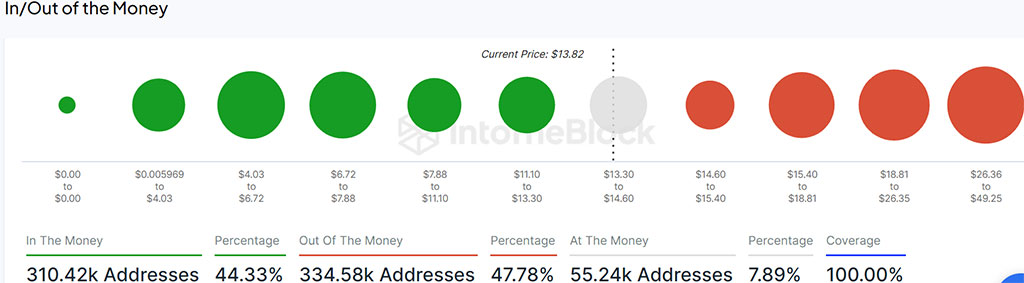

Meanwhile, over 79,000 LINK addresses were at a loss, especially those that bought the altcoin between $15 and $18. The cohort could be attempted to sell off to break even, which could briefly stall the expected LINK recovery.

Photo: IntoTheBlock

So, LINK could eye $16 in the short term and grab a potential 20% gain. However, some holders could be tempted to take profit above $15, which could derail the expected upswing.

Chainlink’s Supply on Exchanges Drops to 21.4%: Is LINK About to Rally?