Billionaire venture capitalist Chamath Palihapitiya says that risk assets like stocks will likely see major turbulence amid the Federal Reserve’s tight monetary policies.

In a new episode of the All-In Podcast, Palihapitiya says that market participants were expecting Fed Chair Jerome Powell to start cutting rates imminently.

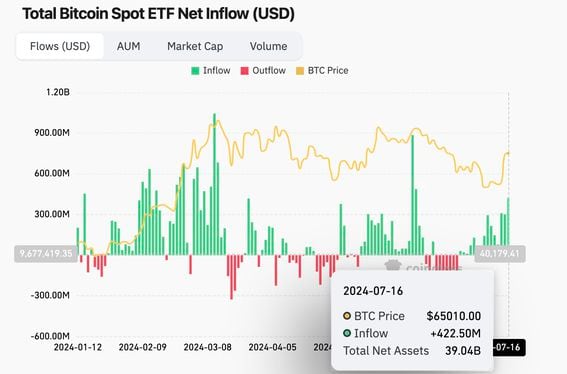

Last week, however, stocks and Bitcoin (BTC) slid after projections from the Federal Reserve showed that the central bank might hike rates to 5.6% this year before trimming it to 5.1% in 2024, about 500 basis points higher than its June projection.

Says Palihapitiya,

“I think what happened this week is actually pretty important because I think the markets were really trying to force Jerome Powell to start the cutting cycle. And now they had to move the date at which they could expect cuts out by a year.

I think that we’re only starting to see the reverberations of that. You’re going to have to reprice a lot of risk assets.”

At time of writing, the Fed funds rate stands at 5.33%.

Palihapitiya also says that corporate America has to rethink its strategies to make sure they have sufficient funds to withstand the Fed’s “higher for longer” monetary policy.

“I told my CEOs, ‘Guys, let’s get enough cash to last through the middle of 2025… I mean get to default alive but if you can’t, please have enough money to the middle of 2025’. I think that that was wrong.

I think now you’ve got to be [prepared until] Q1 of 2026 and maybe even mid-2026.

So now, I have to go back to all these CEOs and redo an entire justification for why they need to cut even more people, cut even more expenses, cut more burn.”

I

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Masterofedit69

The post Chamath Palihapitiya Warns Stocks and Risk Assets Could See Major Repricing Amid Fed’s ‘Higher for Longer’ Policy appeared first on The Daily Hodl.