Citi partnered with other traditional financial institutions to simulate operations. More development is needed.

Citigroup has teamed up with Ava Labs, other traditional financial institutions and digital asset companies to complete a proof-of-concept for tokenizing private equity funds. Despite outstanding legal and technical issues, Citi is convinced that blockchain technology could transform the private equity industry.

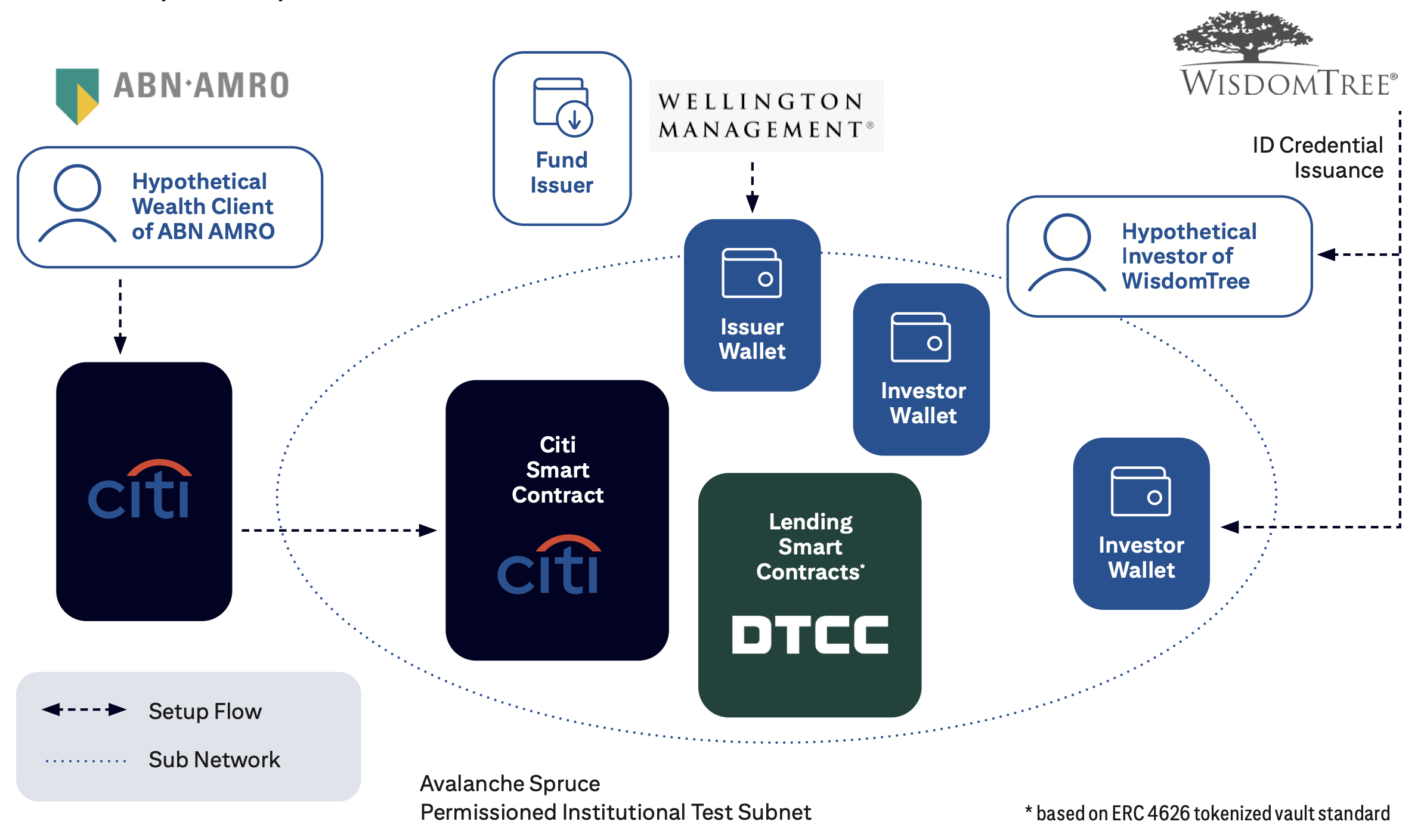

The project used simulated workflows in a Wellington Management-issued private equity fund with ABN AMRO acting as the investor and WisdomTree simulating the platform on the permissioned Avalanche Evergreen Spruce Subnet.

The partners tested smart contracts to enforce distribution rules for a simulated fund. They used a variety of methods to verify identities provided by WisdomTree and partnered with DTCC Digital Assets to use a private fund token as collateral in an automated lending contract. Then the resulting loan was “subject to a haircut and collateralization ratio set based on the pool parameters.” The Citi report on the project stated: