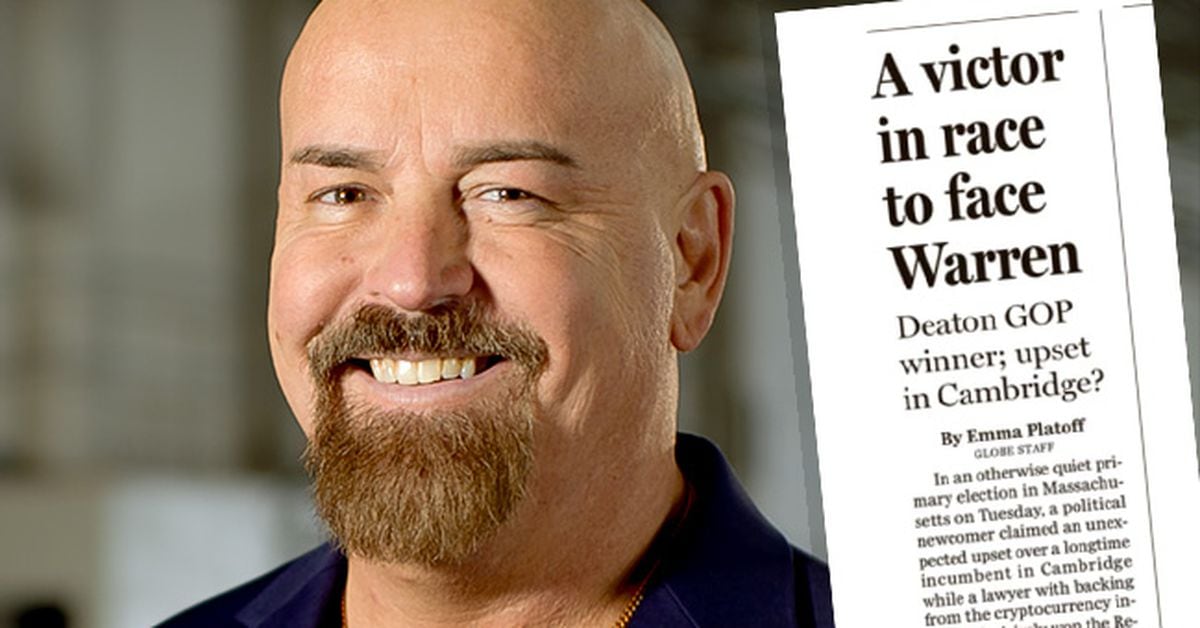

Coinbase defended itself against allegations made on September 14 regarding the lack of transparency in its ETF custody and cbBTC offerings. According to Bitcoin OG, Tyler Durden, a scan through the blockchain public ledger revealed that Coinbase was writing IOUs for Blackrock, calling the founder and CEO of Coinbase ‘anti-Bitcoin.’

Durden had made similar claims against Coinbase in May 2024, but the allegations were countered by independent crypto market analyst Dave Weisberger who termed the claims as “bullshit.” Bloomberg’s senior ETF analyst Eric Balchunas said that he understood why such theories existed and why people used the ETFs as scapegoats. He, however, asserted that all Blackrock and ETFs had done was to save the price of Bitcoin from the abyss repeatedly.

Coinbase refutes off-chain BTC transfers to Blackrock

Baldilocks here.

Not sure what this is all about TBH. All ETF mints and burns we process are ultimately settled onchain. Institutional clients have trade financing and OTC options before trades are settled onchain. This is the norm for all our institutional clients. All funds…

— Brian Armstrong (@brian_armstrong) September 14, 2024

Coinbase CEO Brian Armstrong said he was not sure what all the allegations were about, mentioning that all ETF mints and burns processed by the exchange were ultimately settled on-chain. Armstrong asserted that institutional clients had trade financing and OTC options before the trades’ on-chain settlement. He added that this had been the ‘norm’ for all Coinbase institutional clients. It took only one business day to settle all funds on Coinbase’s prime vaults (on-chain).

Armstrong also disclosed that Deloitte audited the crypto exchange annually like every other public company, and the audits were available at request. Although some community members claimed that Coinbase sold ‘paper Bitcoin’ (cbBTC) to Blackrock without 1:1 backing, Armstrong affirmed that this is what it looked like when a bunch of institutional funds were to flow into Bitcoin.

“As for cbBTC yes you’re trusting a centralized custodian to store the underlying BTC – we’ve never claimed otherwise.”

–Brian Armstrong

Crypto educator and analyst, Duo Nine, expressed his doubt after Armstrong implied that investors would have to trust Coinbase on their word. According to the crypto enthusiast, it was not satisfactory for Coinbase to provide any proof of BTC reserves or any proof of backing for their new cbBTC. Duo observed that Coinbase could go the FTX route if they printed too much paper Bitcoin.

Questions over Coinbase’s Bitcoin reserve still remain

Despite Armstrong’s statement asking investors to trust the centralized custodian, some community members believed Coinbase should still allow investors to verify their Bitcoin backing for their cbBTC. According to TRON’s Justin Sun, cbBTC lacked proof of reserve, had no audits, and could freeze anyone’s balance anytime.

Sun asserted that the current ‘trust me’ situation at Coinbase meant that any U.S. government subpoena could seize all of an investor’s Bitcoin. He called it a dark day for Bitcoin, claiming there was no better representation of central bank Bitcoin than this.

While some of the allegations could be construed as competitors battling for market share, crypto enthusiasts pointed out that trust is key in the crypto space, and it is concerning when transparency is missing. Justin Sun’s firm is set to take over BitGo’s WBTC, which will compete with Coinbase’s cbBTC.