In a significant turn of events, the renowned cryptocurrency exchange Coinbase witnessed a remarkable surge of 12.7% in its shares during after-hours trading. Its fourth-quarter earnings report prompted this surge, which surpassed Wall Street’s expectations and showcased a resilient performance amidst a dynamic market landscape.

Coinbase’s fourth-quarter net revenue soared to an impressive $905 million, marking a substantial 45.2% increase from the previous quarter. This substantial revenue growth exceeded consensus estimates, which hovered around $825 million.

Moreover, the firm achieved a notable milestone by swinging to a profit, reporting a net income of $273 million. This marked its first positive income quarter since the fourth quarter of 2021, contrasting sharply with the net loss of $2 million recorded in the preceding quarter.

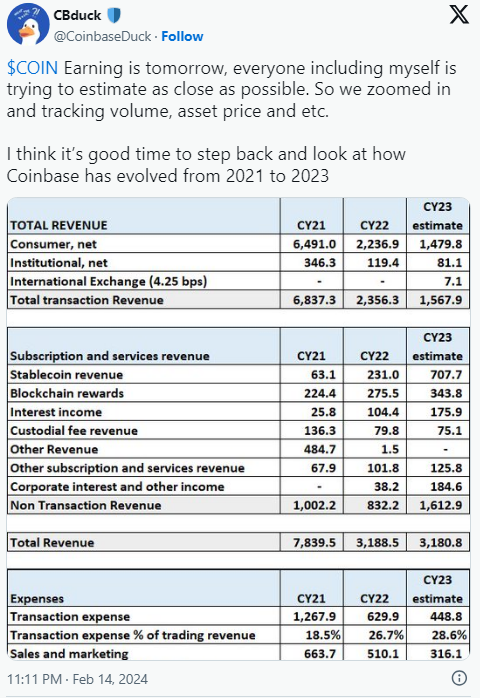

Coinbase key revenue streams

Transaction revenue emerged as a primary driver of Coinbase’s revenue, accounting for $529.3 million in the fourth quarter. Consumer crypto trading contributed significantly to this figure, nearly doubling from the third quarter to $493 million. Institutional transaction revenue also witnessed an impressive surge, doubling to $36.7 million. The exchange processed over $29 billion in consumer trading volume, reflecting a staggering 164% quarter-on-quarter increase.

Additionally, Coinbase generated $375.4 million from subscription and services revenue, with stablecoin and blockchain rewards constituting major components at $171.6 million and $95.1 million, respectively. This diversified revenue stream underscores the exchange’s robust business model, capable of harnessing various avenues for growth.

Market response

The release of Coinbase’s stellar financial results ignited a flurry of investor activity, propelling its share price to $186.7 during after-hours trading, as reported by Google Finance. Before the earnings release, Coinbase stock had surged 41.2% over the last eight trading days, fueled by anticipations of a strong financial performance. This positive sentiment was further buoyed by an increased rating from JPMorgan analysts on February 15, adding to the favorable outlook surrounding the exchange.

Coinbase’s fourth-quarter earnings report is a testament to its resilience and adaptability in navigating the volatile cryptocurrency landscape. With robust revenue growth, a return to profitability, and an expanding array of revenue streams, the exchange continues solidifying its position as a leading player in the digital asset space. As investors digest these promising results and anticipate future developments, Coinbase remains poised to capitalize on emerging opportunities and drive further value for its stakeholders.