Two popular platforms for tracking cryptocurrencies are CoinMarketCap and CoinGecko. Even though they are similar, each one is distinct due to a few key differences. This article will assist you in comparing CoinMarketCap vs CoinGecko by outlining the features of each tracker, including price, NFT tracking, data analysis, market cap calculation criteria, popularity, along with benefits and drawbacks.

Key Differences

There’s a lot to consider when comparing crypto trackers. You can draw several insights from this article to help compare CoinMarketCap to CoinGecko.

- CoinMarketCap uses the circulating supply method to calculate market capitalization, while CoinGecko uses the total supply method, which is more accurate.

- CoinGecko offers more relevant information, hence creating a better user experience than CoinMarketCap.

- Token data display on Coingecko is easier to understand than it is on CoinMarketCap.

- CoinMarketCap has more flexible pricing for premium tiers than CoinGecko

- Crypto filtering is easier on CoinMarketCap because of the platform’s custom filter feature.

Overview

CoinGecko and CoinMarketCap have distinct differences. Here’s an overview detailing the most outstanding features of each site.

| Feature | CoinMarketCap | CoinGecko |

| Affiliations | Binance | Independent |

| Number of active users | 35 million | 8.3 million |

| Number of listed coins | At least 11,000 | At least 10,000 |

| Market Cap Calculation Criteria | Circulating supply | Total Supply |

| Desktop Compatibility | Compatible with Windows, Linux, and Mac | Compatible with Windows, Linux, and Mac |

| Mobile app | Android and iOS | Android and iOS |

| Pricing | Free plan Premium for $8.32 monthly | Free plan Hobbyist for $29 Startup for $79 Standard for $299 Professional for $699 Enterprise plan has customizable pricing |

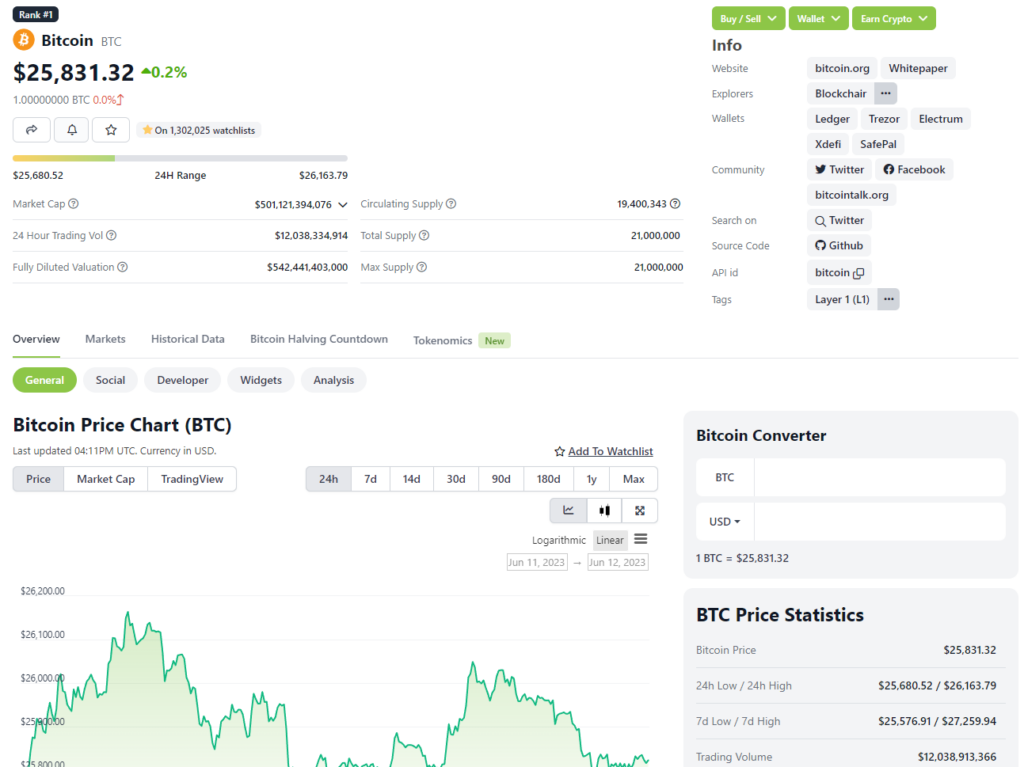

What Is CoinMarketCap?

CoinMarketCap is the most-referenced cryptocurrency tracking website. Since its launch in 2013, this Binance-owned platform has tracked crypto asset performance using key filters like market cap, price, algorithm, and industry.

The website also offers a dependable portfolio tracking system. This means CoinMarketCap clients with investments in several digital assets can enlist their assets and have the site monitor and report each asset’s performance.

To access portfolio tracking, clients must have a CoinMarketCap account. Once signed into the account, users can navigate to the Portfolio button, select the Create portfolio option, choose the coins in their portfolio, add a Buy or Transfer in the transaction, and complete the process.

Pros

- Tracks over 11,000 tokens

- It has impressive filters that are also customizable

- Offers flexible pricing plans.

- It has a broad user base

- Has top-notch security

Cons

- It is often subject to biased reporting

- Does not have sufficient information on NFTs or NFT markets.

- Premium plans may be expensive.

What Is CoinGecko?

CoinGecko is also a top-ranking crypto-tracking website. This platform launched in 2014 under its CEO, TM Lee, and COO, Bobby Ong. With a mission to offer users actionable crypto insights, CoinGecko has always analyzed digital assets by their market cap, price history, and industry, providing accurate crypto data for investors, companies, and analysts.

Like CoinMarketCap, CoinGecko also has one of the leading portfolio tracking services. Platform users can rely on this service to help them track crypto earnings for multiple cryptocurrency strategies, including high-risk, conservative, long-term HODL, and low-cap gems.

To access Coingecko’s portfolio tracker, users only need a Coingecko account. With the account setup complete, customers need to sign in, opt to Create a portfolio and name it. After this, navigate to the coin page of the tokens you want in your portfolio, click the Star icon next to them, and select the portfolio you wish to place them in.

Pros

- Simple, easy-to-use user interface.

- Has more accurate and reliable market cap readings and token performance reports.

- It generates quarterly reports on the state of the crypto market

- The premium price plan is more affordable

- It covers a broader range of assets, like NFTs and ICOs, and gives more market data.

Cons

- Does not have information on crypto lending rates.

- It doesn’t cover general crypto-related business information.

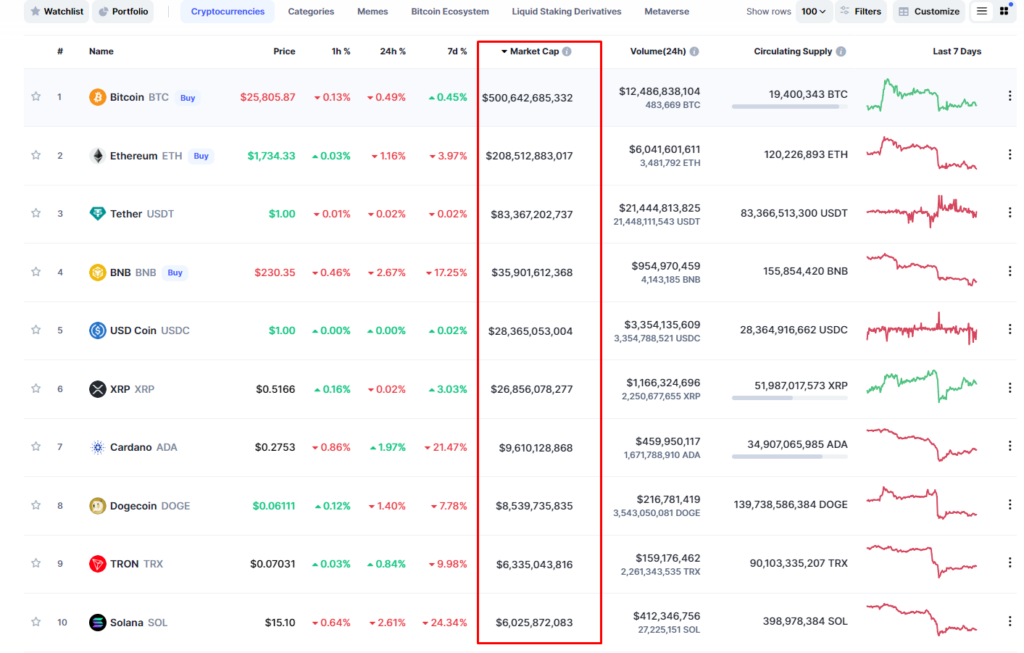

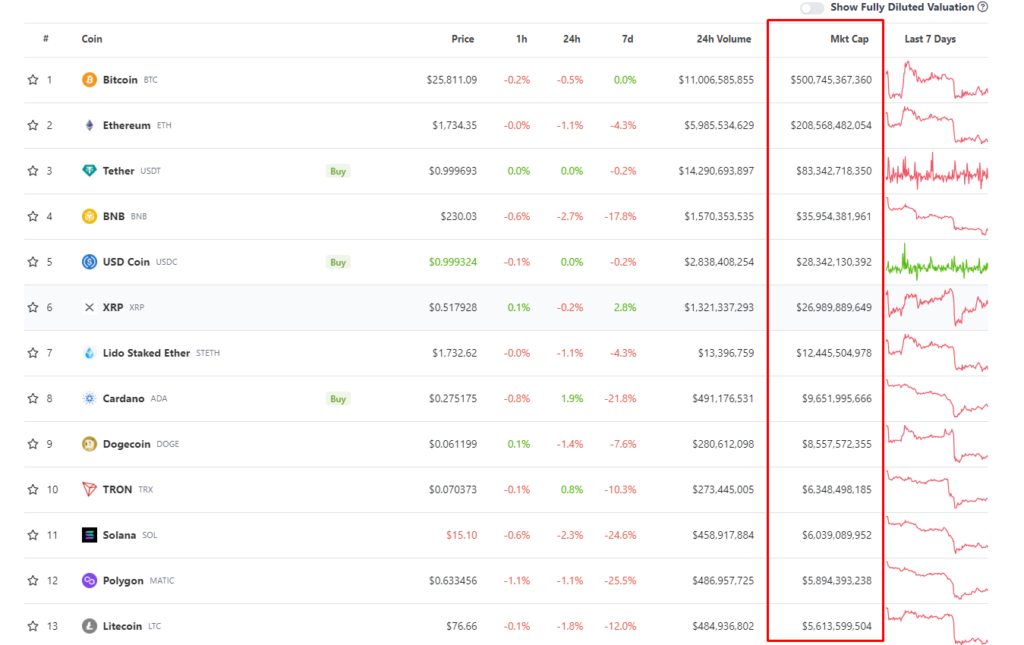

CoinMarketCap vs CoinGecko: Market Cap Calculation Criteria

Another way to compare CoinMarketCap to CoinGecko is to check how each platform generates the market cap for the different assets it lists.

CoinMarketCap uses the circulating supply approach to come up with the market cap. This multiplies a coin’s current market value by the number of tokens that are publicly available for buying and selling.

For example, since Bitcoin was invented, 18 million coins have been mined. However, the network has permanently lost about 4 million of these, placing Bitcoin’s circulating supply at close to 14 million.

CoinGecko applies the total supply method. The market cap derived from this criteria is calculated by calculating the total number of existing coins. Whether these coins are circulating or have been locked up through liquid staking or initial coin offerings, they are still included.

The circulating supply is always significantly lower than the total supply. This may paint a relatively inaccurate picture of the coin’s demand and can be misleading, especially for novice investors or traders. Therefore, CoinGecko is the reigning champ of the market cap calculation criteria.

Winner: CoinGecko

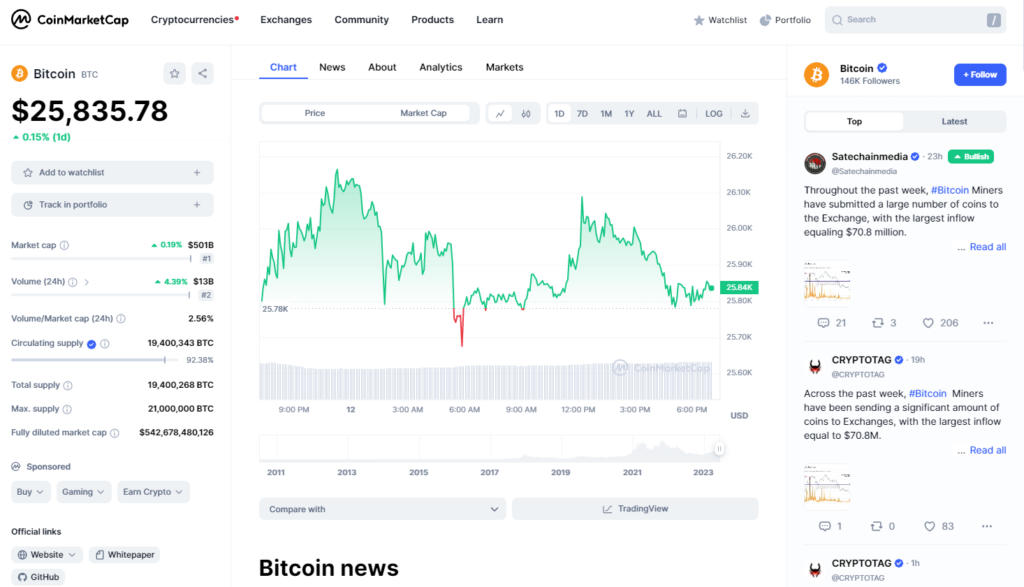

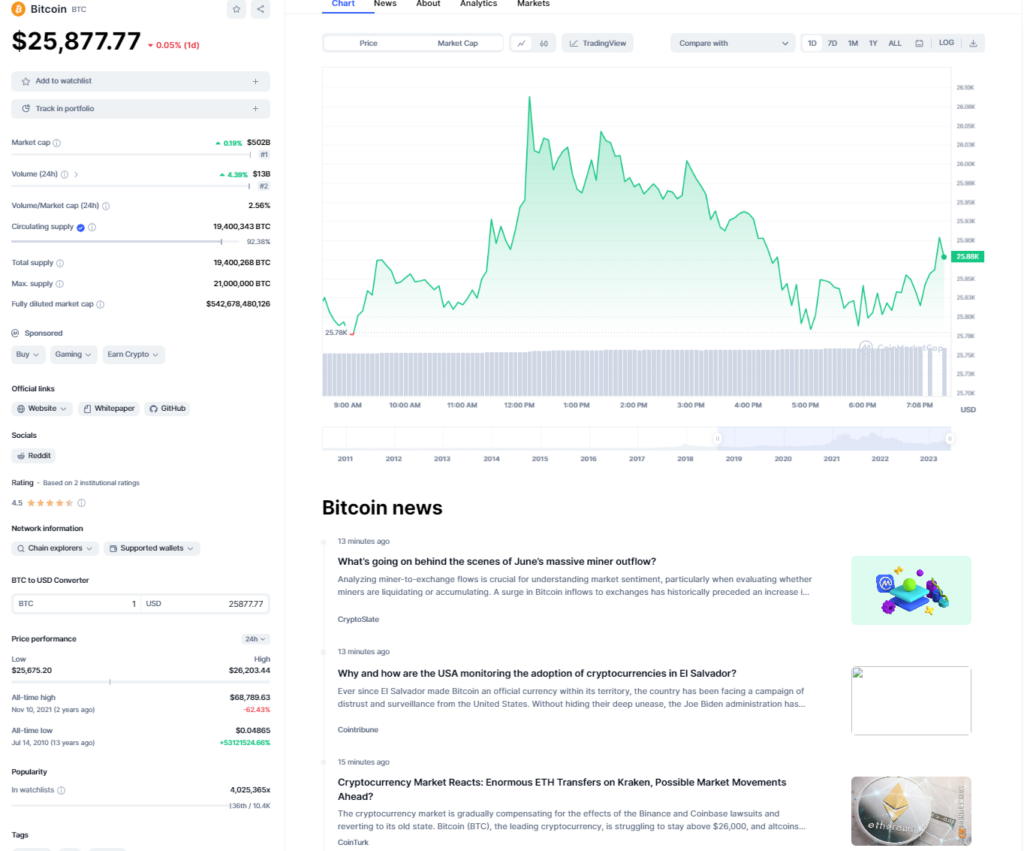

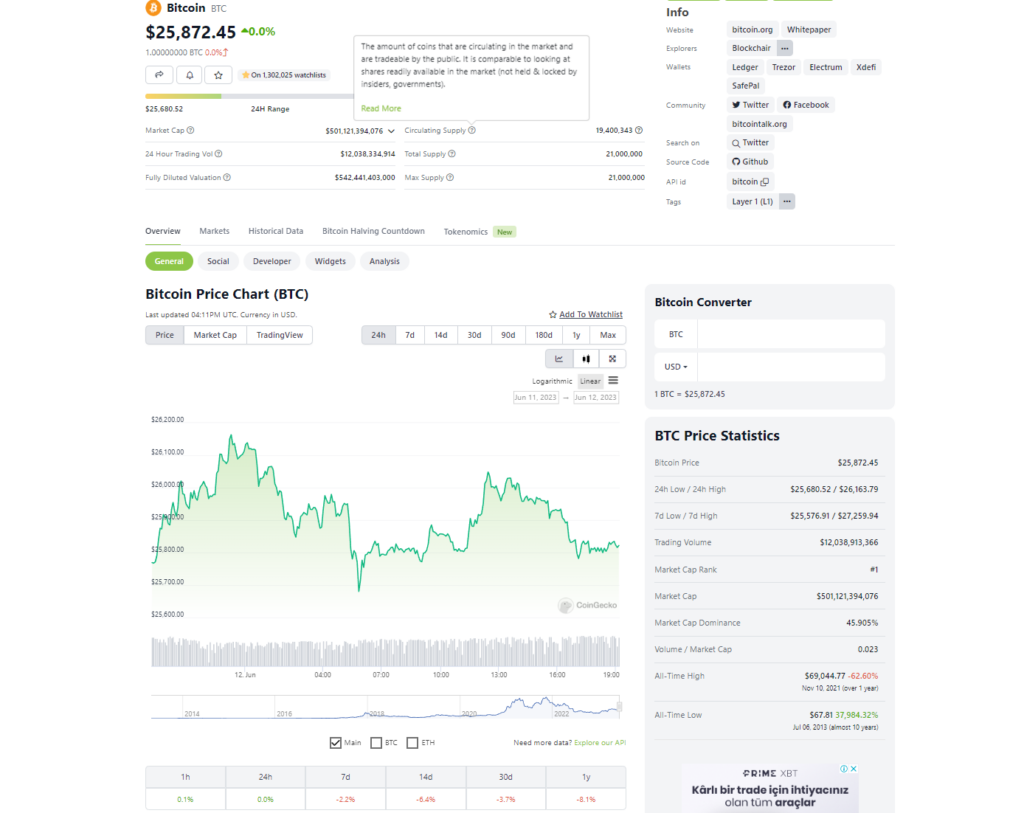

CoinMarketCap vs CoinGecko: User Experience

CoinMarketCap’s user-friendly outlook is impressive. There’s often a summary of the coin or asset, a brief history of the project, commentaries, and relevant links. It also has videos and articles embedded at the top of the website, which can be helpful.

CoinGecko also has remarkable user-friendliness. It summarizes token information and displays relevant links and statistics. CoinGecko has a summary of the asset’s history, use cases, and tabs showing different token aspects, such as markets and commentaries, and has minimal clickbait compared to CoinMarketCap.

Winner: CoinGecko

CoinMarketCap vs CoinGecko: Token Data Presentation

Besides the general information displayed about a token, users also need an easy-to-follow and comprehensive data presentation. Users should be able to effortlessly gauge the price, patterns, and other useful data indicators for the said asset.

CoinMarketCap ranks a digital asset by its market cap. The token dashboard also lets clients view price changes daily or weekly and has a chart showing other performance metrics. Additionally, users can create watchlists that help monitor selected tokens.

On the other hand, CoinGecko provides data on the current price and price fluctuations over an hourly or 24-hour period. There’s also a default weekly chart showing price fluctuations over the past seven days. Besides that, multiple tabs with data such as token history, tokenomics, market view, and trading view show insightful elements that can impact the coin’s performance.

CoinGecko’s data is presented more comprehensively. The display is quite customizable and easier to navigate compared to CoinMarketCap.

Winner: CoinGecko

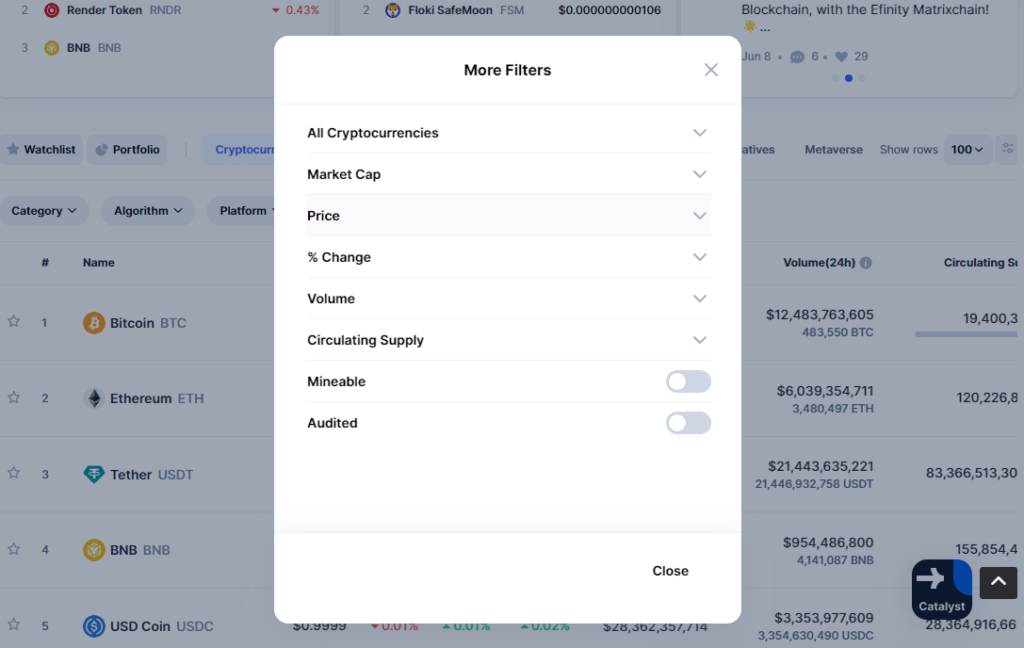

CoinMarketCap vs CoinGecko: Crypto Filters

The ease of sorting out assets based on given criteria is essential for a good cryptocurrency tracker. These filters help users visualize the finer details of a particular asset.

CoinGecko has multiple filters. Below is a summary of each and what it can help you achieve.

- Price filters: You can view tokens by their prices over the last hour, day, week, or month.

- Trust score: This filter shows the liquidity for specific trading pairs. It also indicates API coverage and operation scale.

- Hot-cold wallet: Classifies tokens based on the DeFi wallets that support them.

- Social: This classifies a token’s community presence on platforms like Reddit and Twitter.

- Developers: Filters a token’s development pages, including GitLab and GitHub.

- ICO: This helps investors track Initial Coin Offerings

CoinMarketCap also offers multiple filters. Here’s a summary of them.

- Platform: This filter ranks coins based on the network it is affiliated with.

- Algorithm: Users can select coins based on the consensus mechanism they apply.

- Industry: This sorts assets based on the fields they are used for.

Although CoinMarketCap’s list of filters is short, there’s an option for users to add their own filters. This makes tracking highly customizable.

Winner: Tie

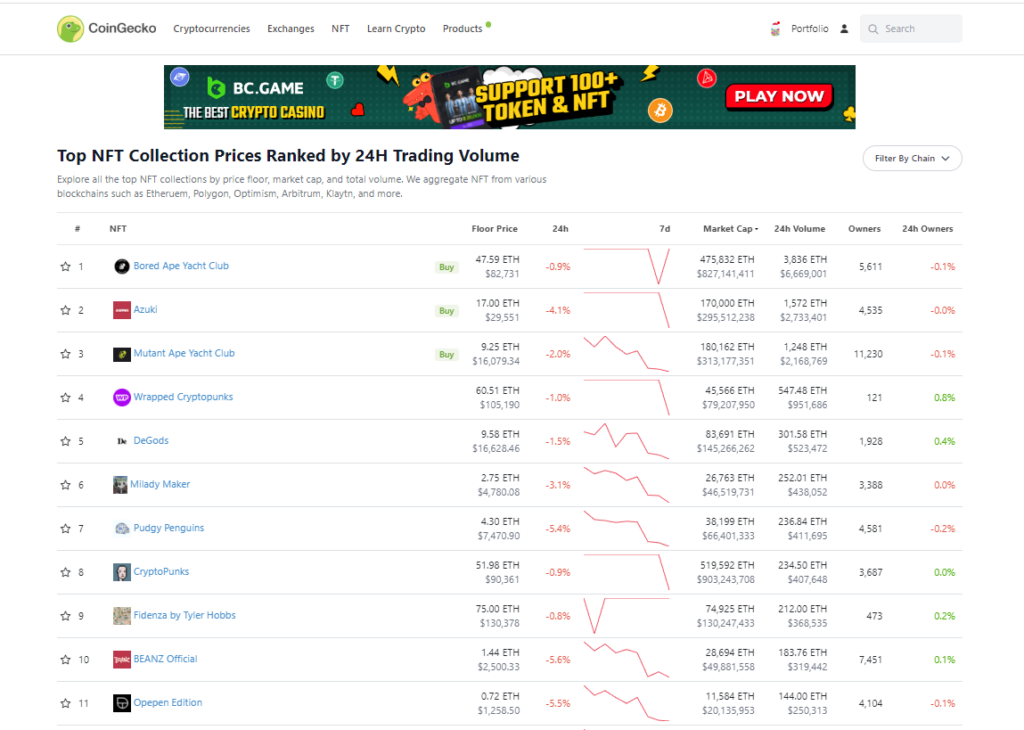

CoinMarketCap vs CoinGecko: NFT Tracking

Non-fungible tokens are lucrative investments. Crypto enthusiasts and investors, therefore, need a tracking platform that helps them keep tabs on these assets.

CoinMarketCap has very little information about NFTs. There’s little else besides having them as one of their filter categories and listing their market cap.

In contrast, CoinGecko has comprehensive NFT coverage. The platform shows metrics on NFT volume transactions, the total number of NFTs, unique NFTs, and NFT events. There’s even an NFT spotlight category that details impressive NFT projects.

Winner: CoinGecko

CoinMarketCap vs CoinGecko: Pricing

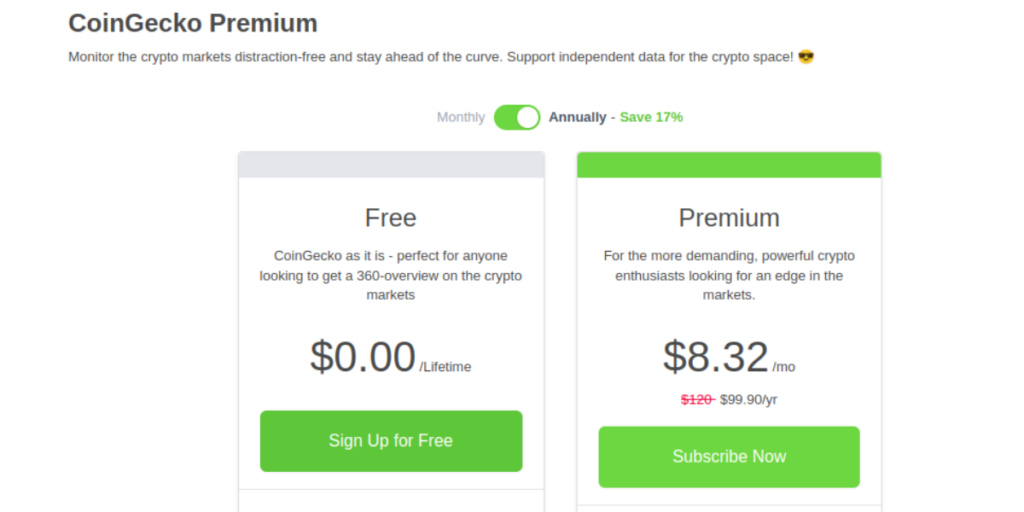

Both CoinMarketCap and CoinGecko have free and paid tiers. Let’s look at each platform’s cost and the benefits of the various pricing categories.

CoinGecko’s free tier offers customers the benefits listed below

- A view of live prices and access to historical data for at least 10,000 coins.

- Daily rewards or candies that one can redeem for wearables and other CoinGecko gifts.

- Portfolio tracking on Android and iOS apps with device syncing.

The premium plan costs $8.32 monthly or $99.90 yearly. Below are the benefits that come with this plan.

- All benefits of the free tier package.

- The platform’s research analysts write bi-weekly market reports and send them via email.

- Weekly roundups summarizing your portfolio.

- More daily rewards.

- CoinGecko book series includes guides on topics such as how to make money from NFTs and how to understand decentralized finance.

- Ad-free experience.

- Private chats with the platform’s research analysts.

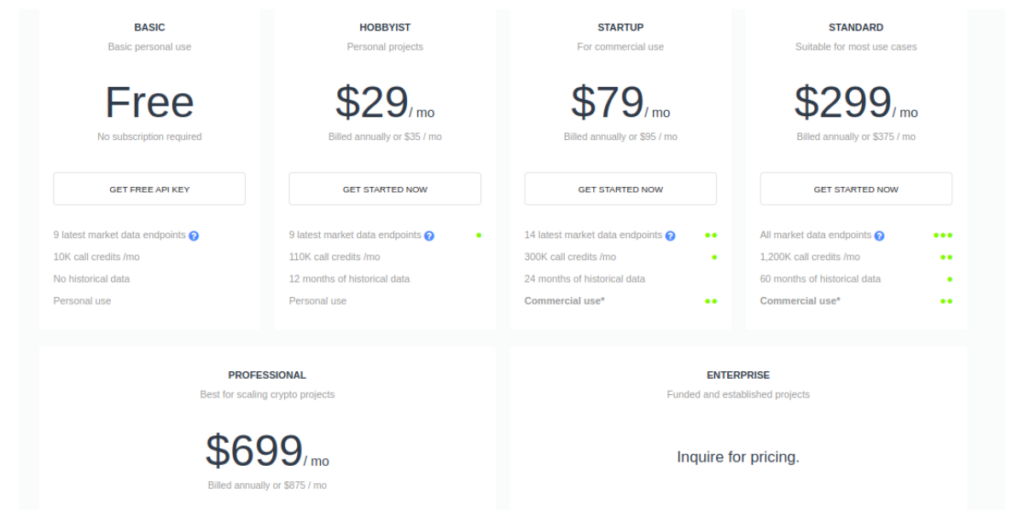

CoinMarketCap also has a free plan with the characteristics listed below.

- Nine latest market data endpoints

- 10,000 call credits monthly

- No historical data

The other CoinMarketCap plans include Hobbyist for $29, Startup for $79, Standard for $299, Professional for $699, and Enterprise, which has customizable pricing. Let’s break down what each plan has to offer.

- Hobbyist: This plan offers nine latest market data endpoints, 110,000 call credits monthly, and 12 months of historical data

- Startup: Users get 14 latest market data endpoints, 300,000 call credits monthly, and 24 months of historical data

- Standard: All market data endpoints 1.2 million call credits monthly and 60 months of historical data

- Professional: All market data endpoints, 3 million call credits monthly, all-time historical data

- Enterprise: All market data endpoints, custom call limits, and historical data from April 2013 to present

Though CoinMarketCap’s premium offers may seem more expensive, they offer more flexibility than CoinGecko tiers.

Winner: CoinMarketCap

CoinMarketCap vs CoinGecko: Security

Although crypto trackers don’t store your assets, they can access personal information. For this reason, you need to analyze the tracker’s security features.

CoinMarketCap does not store personal details. This reduces the risk of a data breach that exposes client information.

Conversely, CoinGecko stores user data. However, this information is strictly encrypted to avoid data spills in the event of hacking attempts.

Winner: CoinMarketCap

CoinMarketCap vs CoinGecko: Customer Support

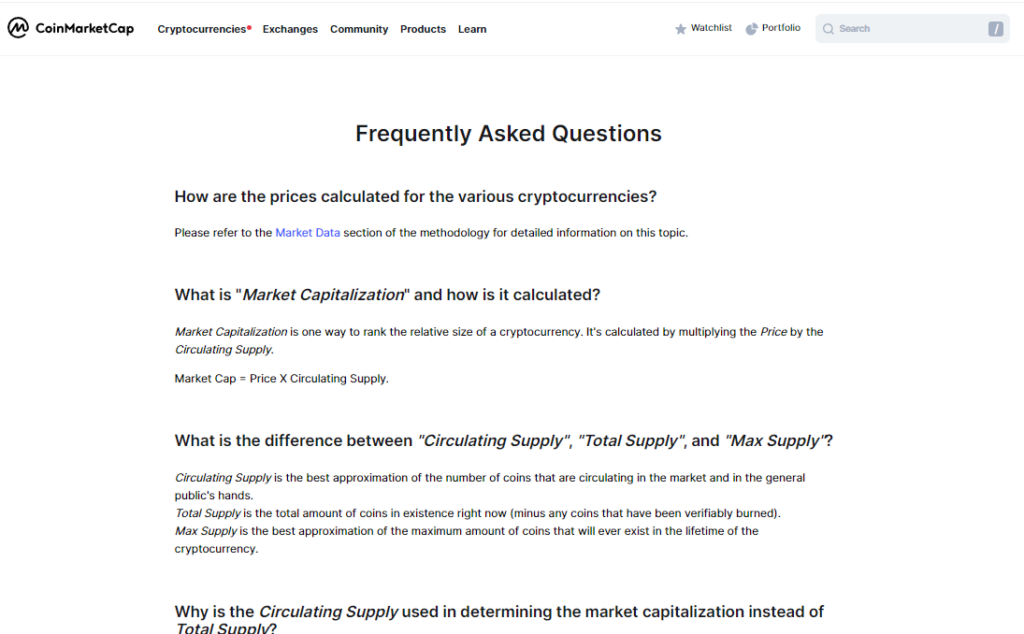

CoinMarketCap has a robust customer support system. It offers comprehensive FAQs, a glossary of crypto terms, and request forms that users can submit when they have questions. There’s also the alternative of contacting customer support.

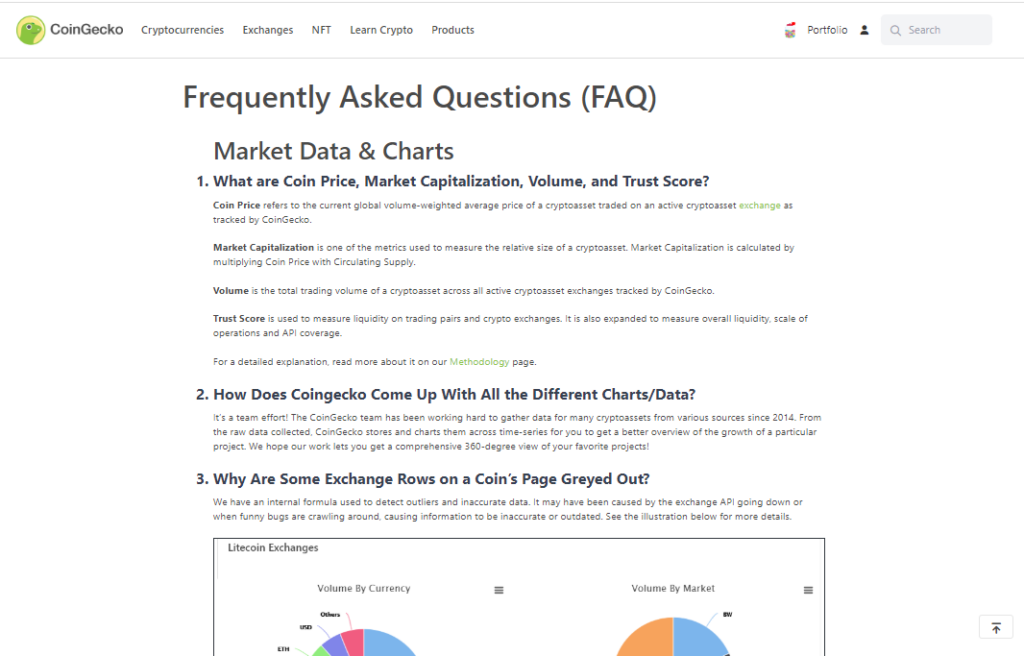

CoinGecko, too, has an FAQ section and a ticket system for clients who want to request direct help. The ticket response time is usually a few days.

Winner: Tie

Should I Use CoinMarketCap or CoinGecko?

CoinMarketCap and CoinGecko are two strong competitors where cryptocurrency portfolio tracking is concerned. However, it’s easy to choose between the two.

If you’re tracking a portfolio for small-scale personal use and you need a platform with accurate market cap readings, well-organized content display, and comprehensive data presentation and insights, CoinGecko is your go-to site.

On the other hand, if you have more of an enterprise-level portfolio and need an easy-to-use platform with impressive crypto monitoring filters, a watchlist, and flexible pricing, CoinMarketCap is what you need.

FAQs

Which is better between CoinMarketCap and CoinGecko?

The choice between CoinMarketCap and CoinGecko depends on the outcomes you expect from a crypto tracker.

With CoinGecko, you will have a platform with accurate market cap readings, well-organized content display, and comprehensive data presentation and insights. The platform is best for personal-level portfolios.

In contrast, CoinMarketCap is best for enterprise-level tracking. The site offers an intuitive user interface with impressive crypto monitoring filters, a watchlist, and flexible pricing.

What is a crypto tracker?

Crypto trackers are digital platforms that provide live and historical updates on the financial performance of digital assets. They indicate the asset’s market capitalization, price, and other data that can help investors monitor performance and make better investment decisions.

Is Coingecko accurate?

However, CoinGecko is generally considered a reputable and reliable cryptocurrency data platform. Its market capitalization readings are more precise than CoinMarketCap because it uses the total supply method. The platform also has other accurate information on crypto asset prices and trading volumes.

However, due to the fast-paced nature of the market, some information may take a while to change on the site, so it’s always a good idea to cross-reference the data you get from CoinGecko.

Is Coinmarketcap legit or not?

CoinMarketCap is a legitimate and well-known platform. The site is widely used in the cryptocurrency community and has been around since 2013.

Elevate your crypto trading career with CoinWire Trading signals. Get Premium daily signal calls, trading insight, updates about the current market, and analytics about hidden crypto gems now.