Coinspeaker

CoinShares: Ethereum Overtakes Solana in Total 2024 Inflows Just before ETF Approval

As per the Digital Assets funds flow report from CoinShares, Ethereum witnessed strong inflows last week outpacing Solana’s inflows for 2024 so far. During the last week, the Ethereum investment products recorded inflows of $45 million. With this move, Ethereum’s year-to-date inflows stand at a staggering $103 million. On the other hand, Solana investment products also saw $9.6 million in inflows during the last week with the total inflows standing at $71 million.

These strong inflows into ETH come as the much-awaited spot Ethereum ETF is likely to go live on Tuesday, July 23. Market analysts are expecting a strong surge into Ethereum after the ETF approval, similar to what we saw after the approval of the spot Bitcoin ETFs earlier this year in January.

As of press time, Ethereum (ETH) is trading at $3,500 with a market cap of $420 million and the daily trading volumes skyrocketing by more than 76% to over $17 billion. However, $3,500 has proved to be a major resistance for Ethereum to cross.

As per the on-chain data from IntoTheBlock, a staggering 3.13 million addresses have created a huge sell wall with their average ETH acquisition cost at $3,547. These addresses are currently holding their ETH at a loss, which is adding to the selling pressure and impeding Ethereum’s ability to break through this crucial resistance point.

Ethereum Faces Critical Resistance at $3,500

Since July 16th, Ethereum (ETH) has been struggling to surpass the $3,500 resistance level. A major factor contributing to this challenge is the 3.13 million addresses that purchased ETH at an average price of $3,547.

These… pic.twitter.com/iUOuXtToKq

— IntoTheBlock (@intotheblock) July 22, 2024

Thus, it will be interesting to see if the spot Ethereum ETF approval creates enough bullish action to beach the sell wall, and set Ethereum on the path to further rally.

Bitcoin Products Clock $1.27B in Inflows

The Bitcoin investment products recorded $1.27 billion worth of inflows during the past week. Thanks to the heavy inflows into the spot Bitcoin ETFs in the US last week. Also, the short-Bitcoin ETPs saw further outflows of $1.9 million last week.

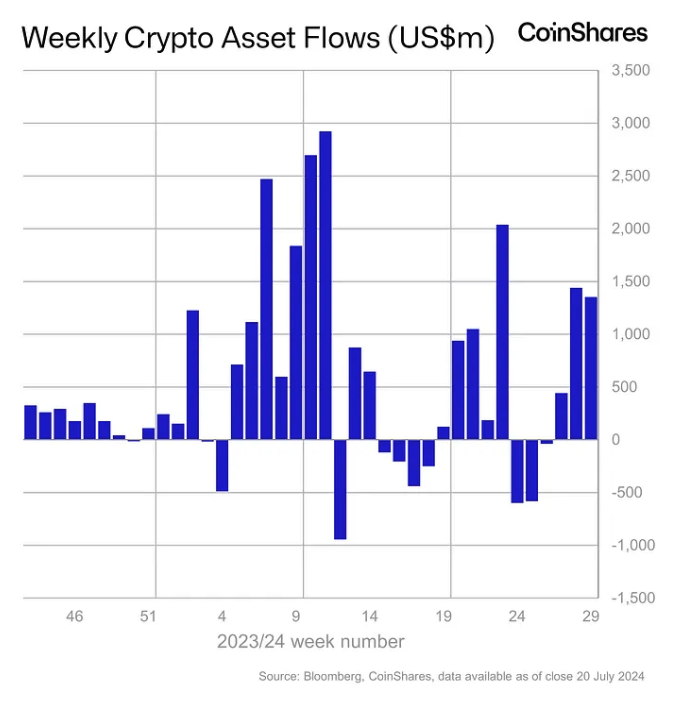

Digital asset investment products experienced substantial buying last week, with inflows totaling $1.35 billion. This brings the three-week run of inflows to $3.2 billion. Exchange-traded product (ETP) trading volumes also saw a notable increase, rising 45% week-on-week to $12.9 billion. However, this still represents a lower-than-usual 22% of the broader crypto market volumes.

Regionally, the inflow picture varied. The US and Switzerland saw significant inflows of $1.3 billion and $66 million, respectively. In contrast, Brazil and Hong Kong experienced minor outflows, totaling $5.2 million and $1.9 million, respectively.

CoinShares: Ethereum Overtakes Solana in Total 2024 Inflows Just before ETF Approval