Coinspeaker

CoinShares Report: Digital Asset Investment Products Suffer $206M Outflows, Ethereum Dips Further

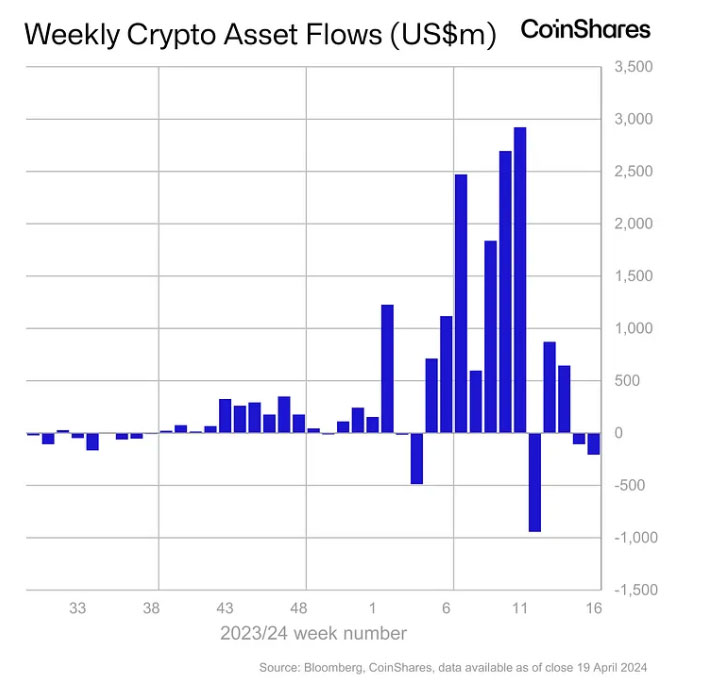

Digital asset investment products faced another week of outflows from investors, with total outflows amounting to $206 million, according to CoinShares weekly report on April 22, 2024. The negative trend followed the previous week‘s $126 million outflow, indicating a potential shift in institutional investor sentiment.

Photo: CoinShares

While investment products saw outflows, trading volumes for Exchange-Traded Traded Products (ETPs) went down slightly to $18 billion. However, it’s crucial to understand that this figure constitutes a smaller portion of total Bitcoin volumes compared to recent trends.

Bitcoin trade activities are steadily increasing, and at the moment, the volume of exchanges traded products (ETPs) accounts for just 28% of the total, down from 55% a month prior. This shift could indicate that investors are preferring to buy Bitcoin directly rather than through ETP vehicles.

FED Policy Drive ETP Outflows

The report suggests the outflows might be related to investor concerns about Federal Reserve policies (FED). The expectation that the FED will sustain elevated interest rates for an extended duration could dampen enthusiasm for ETPs, which are frequently viewed as a reduced-risk option compared to directly possessing digital assets.

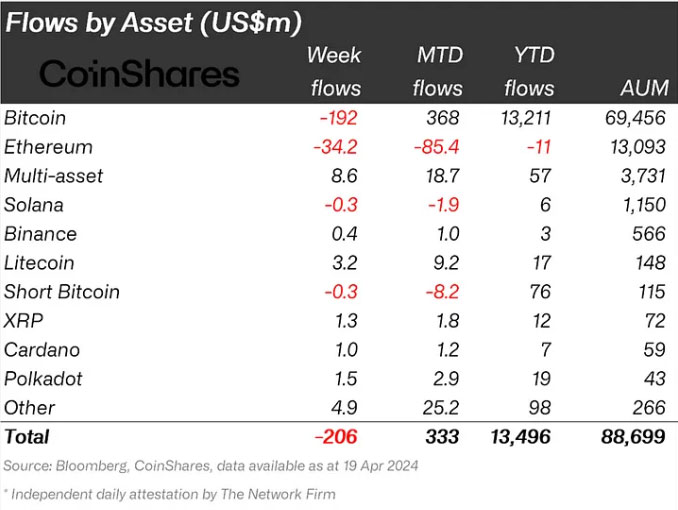

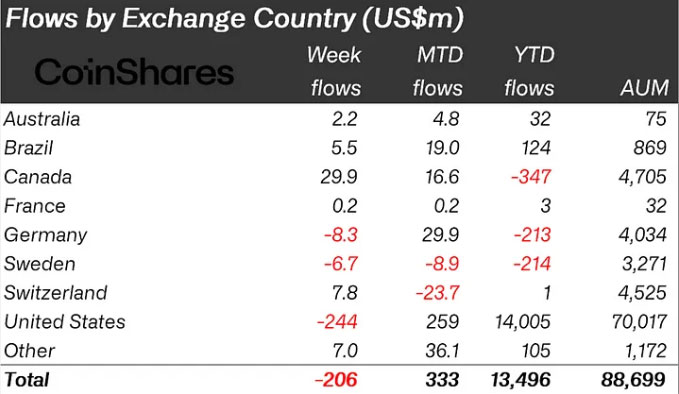

The negative sentiment seem focused in the US, with $244 million leaving US-based exchange-traded funds (ETFs). Interestingly, the outflows targeted established ETFs, while newly launched ones kept attracting inflows, though at a slower rate than prior weeks. The trend shows investors may favor newer exchange-traded product offerings.

While most nations experienced a decline, Canada and Switzerland stood out with significant investments of $30 million and $8 million, respectively, into digital assets. However, Germany witnessed a modest withdrawal of $8 million from this sector.

Ethereum’s 6th Consecutive Outflow Week

Ethereum continued its trend of outflows, recording its sixth consecutive week with a $34 million outflow. However, multi-asset investment products exhibited enhanced sentiment, drawing $9 million in inflows last week. Moreover, Litecoin and Chainlink attracted inflows of $3.2 million and $1.7 million, respectively.

On the other hand, Bitcoin itself witnessed $192 million in outflows, but short positions – essentially bets that the price will fall – failed to capitalize significantly. Short-bitcoin positions saw a mere $0.3 million in outflows, indicating a lack of strong conviction for a price decline among investors.

The trend of investor caution extends to blockchain equities as well. These equities witnessed their eleventh consecutive week of outflows, totaling $9 million. This ongoing trend suggests concerns about the potential outcomes of the fourth Bitcoin halving on mining companies’ profitability.

CoinShares Report: Digital Asset Investment Products Suffer $206M Outflows, Ethereum Dips Further