Fellow Coinwirers,

Thank you for joining us on our Coinwire Crypto Trading Newsletter. We appreciate every subscriber who shows support for our product!

This is the first installment in our crypto trading series on our trading community on Telegram, and we will continue to deliver new entries weekly, along with the latest crypto news. We hope you enjoy and find value in these updates.

In this journal, we will share the insights, experiences, and lessons we’ve gained throughout our time in the trading world. We trust that our reflections will offer valuable guidance for your own trading endeavors.

Trading Period: 14 Oct – 20 Oct

Last week was challenging for both LONG and SHORT positions, with many traders facing significant losses. The key takeaway? Exercise extra caution in highly volatile markets. Typically, we favor swing trading when conditions are more stable, but given the recent market turbulence, we’ve shifted our focus to scalping trades. This approach allows us to lock in profits early while waiting for clearer trends to develop.

Quick Market Overview: The majority of last week’s trading volume was driven by the Meme coin narrative, so naturally, we focused primarily on trading large Meme coins.

Most of the volume last week was driven by the Meme coin narrative, so naturally, I focused on trading Big Meme coins.

Become a Coinwire Trading member & join our OG Private Group for FREE Trading Signals

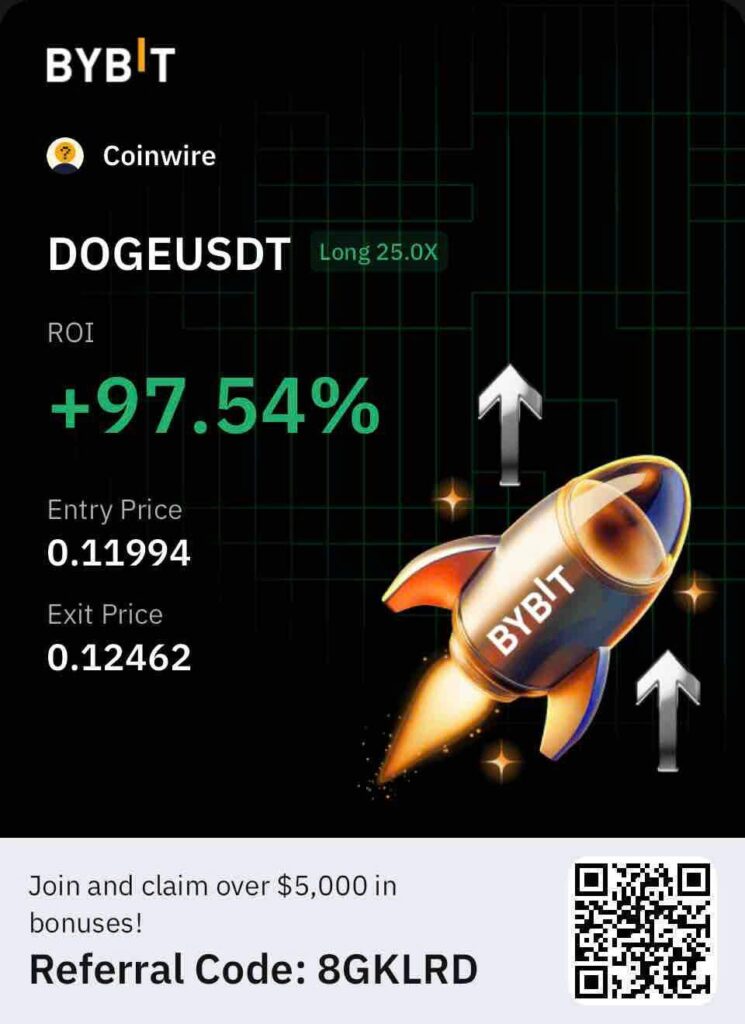

DOGE (DOGE/USDT) – LONG

On October 16, we decided to go LONG on DOGE. After the H4 candle closed, we analyzed the Open Interest (OI) and top volume data—it was clear that buying pressure was building rapidly. Opening up TradingView, we noticed DOGE had established a strong support level, which gave us the confidence to recommend a 25x LONG to the community. And guess what? It paid off significantly. We closed the position with a 97.54% profit.

However, here’s the kicker—we closed the position just a bit too early. A day or two later, DOGE broke through resistance and surged to $0.14! Sometimes, even when you win, there’s still a valuable lesson in patience.

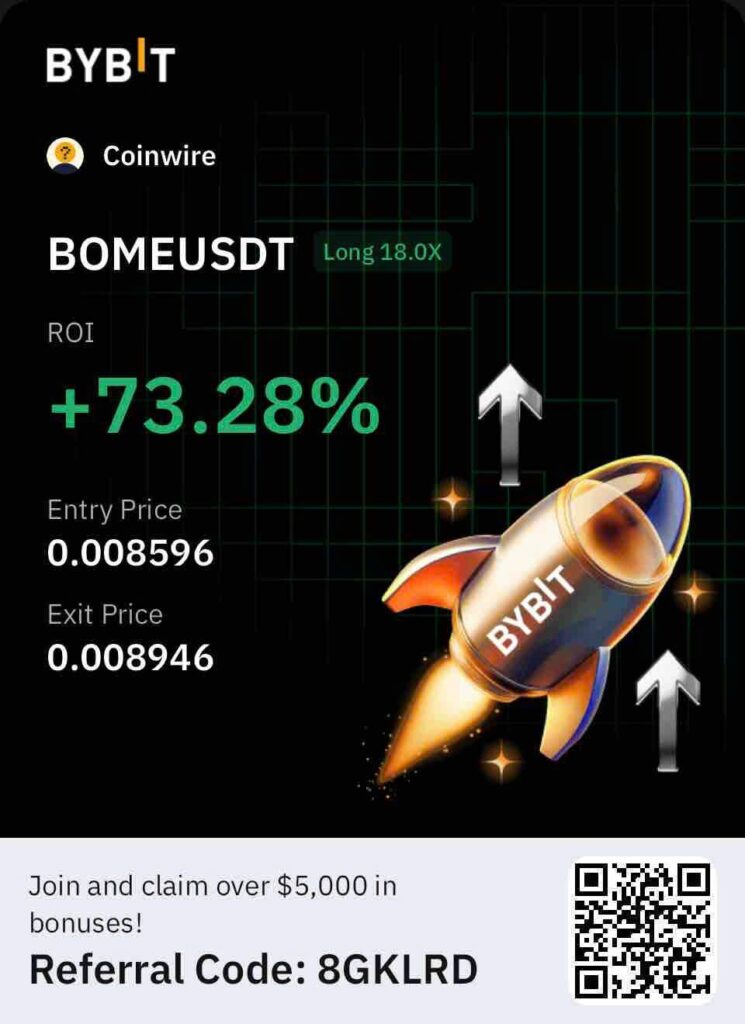

BOME – LONG was another solid trade, with a 73.28% profit locked in.

BANANA (BANANA/USDT) – LONG

Now, let’s talk about our biggest loss last week. We spotted strong buying signals for BANANA, so we decided to go LONG. Unfortunately, the market had other plans and reversed. To make matters worse, our stop-loss triggered at 56.40—only for the price to dip to 56.36 before bouncing back near our entry point. Talk about bad timing! LOL  .

.

Key Lesson

In futures trading, especially in the world of crypto, knowing when to say “enough” is essential. Greed and emotional decision-making can be costly. However, always keep in mind that there will be future opportunities—as long as you manage your funds wisely, you’ll remain in the game.

Stay tuned for more entries in our trading journal. There is much more to share, and who knows, our next update might include a significant breakthrough!

Wishing you all a successful trading week ahead!