Tether’s robust performance in 2023 shows rising demand for stablecoins and closer ties between crypto firms and the traditional financial system.

Stablecoin-issuer Tether had a strong year in 2023, raking in $6.2 billion in net profits, primarily from passive income from United States Treasury securities backing its USDT stablecoin reserves.

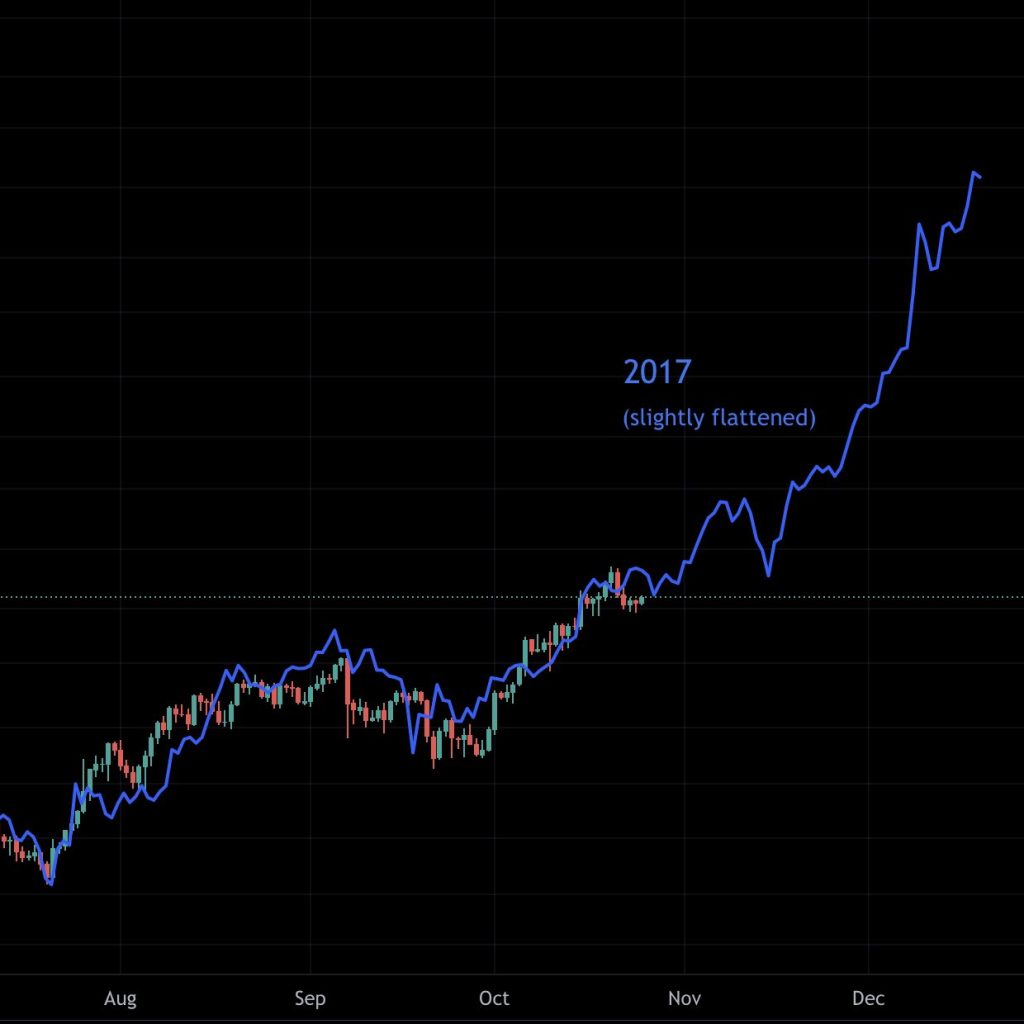

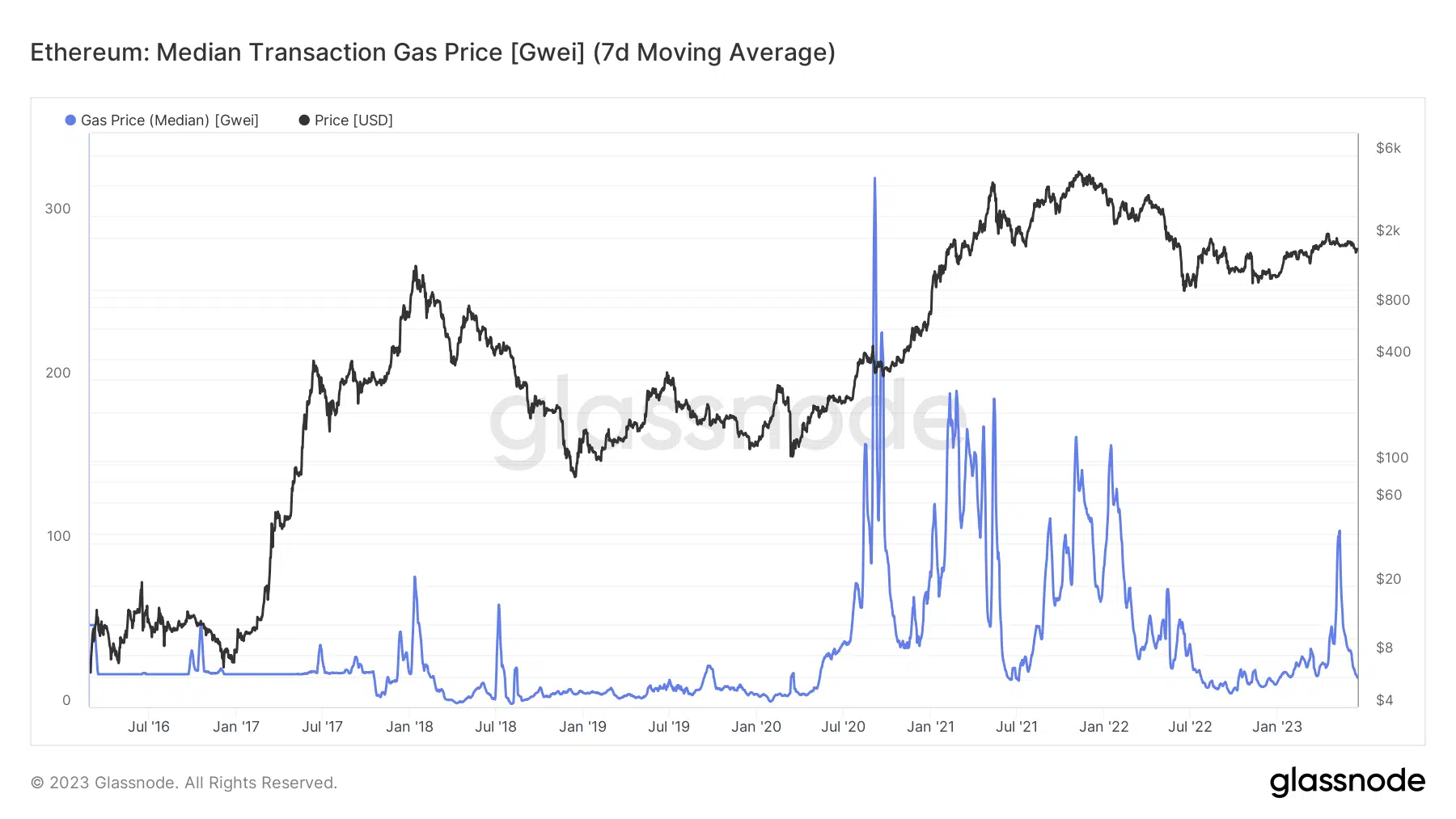

Over the last year, Tether capitalized on the heightened concerns regarding the U.S. banking systems and potential contagion effects on other stablecoins, such as USD Coin (USDC). But the firm was not immune to fear, uncertainty and doubt. In response, Tether increased its exposure to high-level assets to back its stablecoin, primarily short-term U.S. Treasurys, which are considered one of the safest assets worldwide.

As a result, the crypto company could profit from the higher interest rate environment, thus strengthening its financial position while improving its risk profile by providing a safer asset as a backup to its reserves. Considering the uncertain times the crypto industry faced in 2023, it’s a good deal.