The halls of Congress are ringing with a new tone of urgency as key members of the United States House Financial Services Committee, along with the Subcommittee on Digital Assets, Financial Technology, and Inclusion, are pushing for an extension of the comment period on a pivotal rule proposed by the Consumer Financial Protection Bureau (CFPB). This move, accentuating the intricate and often murky waters of the cryptocurrency industry, has stirred a significant debate regarding the rule’s potential implications if it were to be set in motion without thorough public scrutiny and understanding.

Congress’ Crypto Conundrum

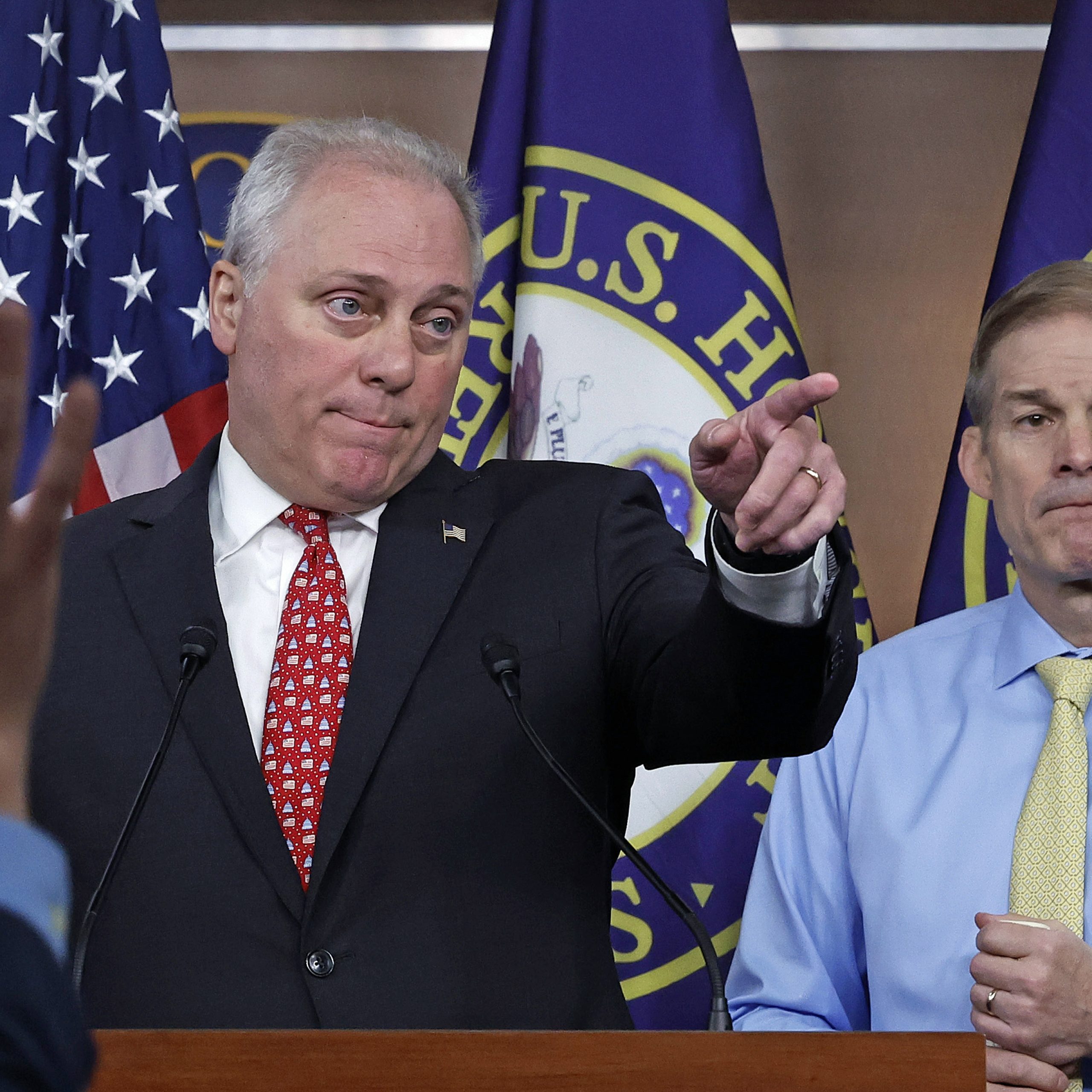

At the heart of the matter lies a November 2023 proposal by the CFPB, aimed at expanding its supervisory reach to include depository institutions, with digital assets falling under the umbrella of “funds.” This extension of authority would, in effect, place wallets in the crosshairs of regulatory oversight. Representatives Patrick McHenry, Mike Flood, and French Hill, in their Jan. 30 correspondence to CFPB Director Rohit Chopra, expressed reservations about how such a rule would apply specifically to various entities within the digital asset ecosystem. Their concerns echo the uncertainty that grips the sector, pondering how this change might inadvertently curb the freedom of crypto exchanges to facilitate peer-to-peer transactions through wallets hosted on their platforms.

The lawmakers’ apprehension is not without merit. Central to their argument is the role of peer-to-peer transactions via ‘self-hosted wallets’ – a cornerstone of the digital asset ecosystem that significantly mitigates third-party risk. The apprehension is that roping in certain digital wallet providers, who don’t necessarily maintain ongoing consumer relationships, might unwittingly introduce an unwelcome layer of regulatory risk.

This sentiment is shared by the Crypto Council for Innovation, which, earlier in January, voiced its deep concerns about the rule’s potential to fragment regulatory practices further. The advocacy group suggested holding off on any extension of the CFPB’s authority over the digital asset space, instead deferring to Congress for a more appropriate regulatory framework.

Legislative Labyrinth and Crypto’s Future

A broader legislative picture adds more complexity to this unfolding drama. December 2023 saw McHenry, chair of the House Financial Services Committee, announce his decision not to seek reelection, casting a shadow over the future of crypto regulation. The balance of power in the U.S. House of Representatives hangs in the balance for the 2024 elections, with all 435 seats in play.

In a rare display of bipartisan effort, Senators Elizabeth Warren, Joe Manchin, Lindsey Graham, and Roger Marshall have co-sponsored a bill targeting crypto crime. The Digital Asset Anti-Money Laundering Act of 2023 seeks to amend the Bank Secrecy Act, bringing a wide array of digital asset providers under the definition of financial institutions. This sweeping bill aims to close gaps in the nation’s Anti-Money Laundering rules and impose regulations akin to those governing traditional banks.

The bill, if passed, would mark a significant shift in the regulatory landscape for cryptocurrency providers in the U.S. The legislation, currently in the hands of the Senate Committee on Banking, Housing, and Urban Affairs, remains a topic of fervent debate, with implications far beyond the financial sector.

Crypto industry insiders, like Grant Fondo, co-chair of Goodwin’s digital currency and blockchain practice, view the bill as a potential overreach, fearing it could stifle innovation in decentralized finance. The bill’s broad scope raises questions about the feasibility of imposing banking regulations on entities fundamentally different in nature, like software companies validating blockchain transactions.

Senator Marshall has positioned the bill as a matter of national security, emphasizing the need to curb illicit activities financed through cryptocurrencies. Meanwhile, Senator Warren highlights the potential use of digital assets by adversarial nations to bypass U.S. sanctions and fund illegal activities, including North Korea’s missile program.

As Congress grapples with these complex issues, the fate of the crypto industry hangs in the balance. With the House reorganizing and the Senate requiring a supermajority for legislation, the path ahead for crypto regulation remains uncertain. The 2024 election season, with its heightened focus on geopolitical matters and the balance of power in Washington, adds another layer of complexity to the equation.