Cryptocurrency needs a whistleblower program to diminish the likelihood of FTX-style manipulation or fraud during the bull market ahead.

It’s no secret that the Securities and Exchange Commission and cryptocurrency enthusiasts aren’t exactly the best of friends. But there’s one thing crypto can take from the SEC — its whistleblower program.

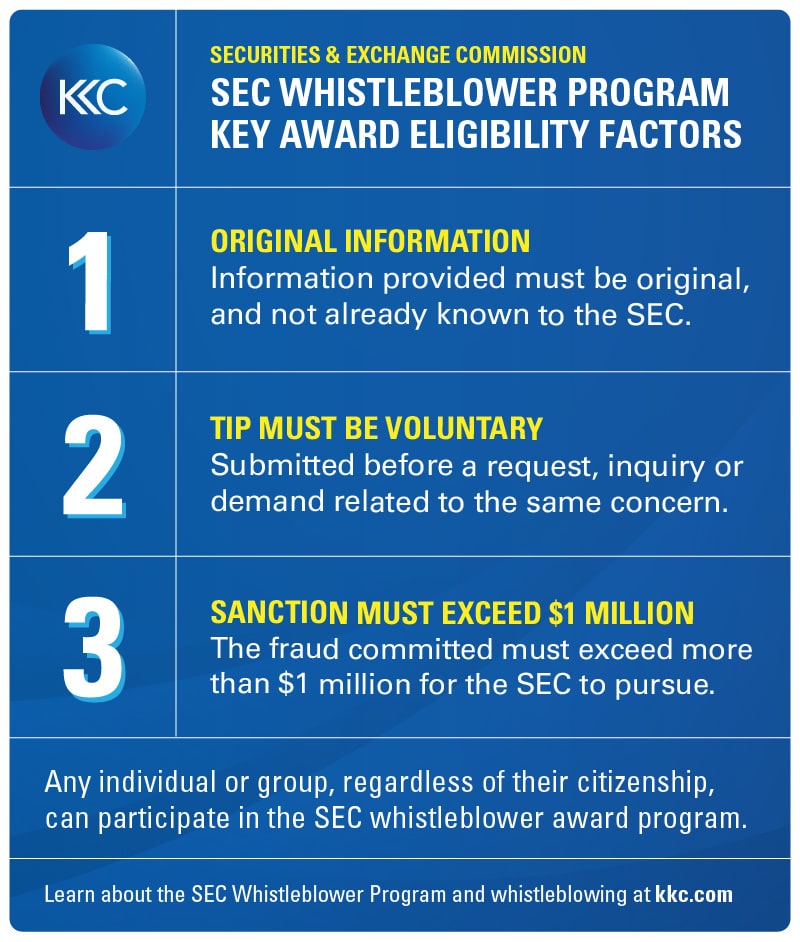

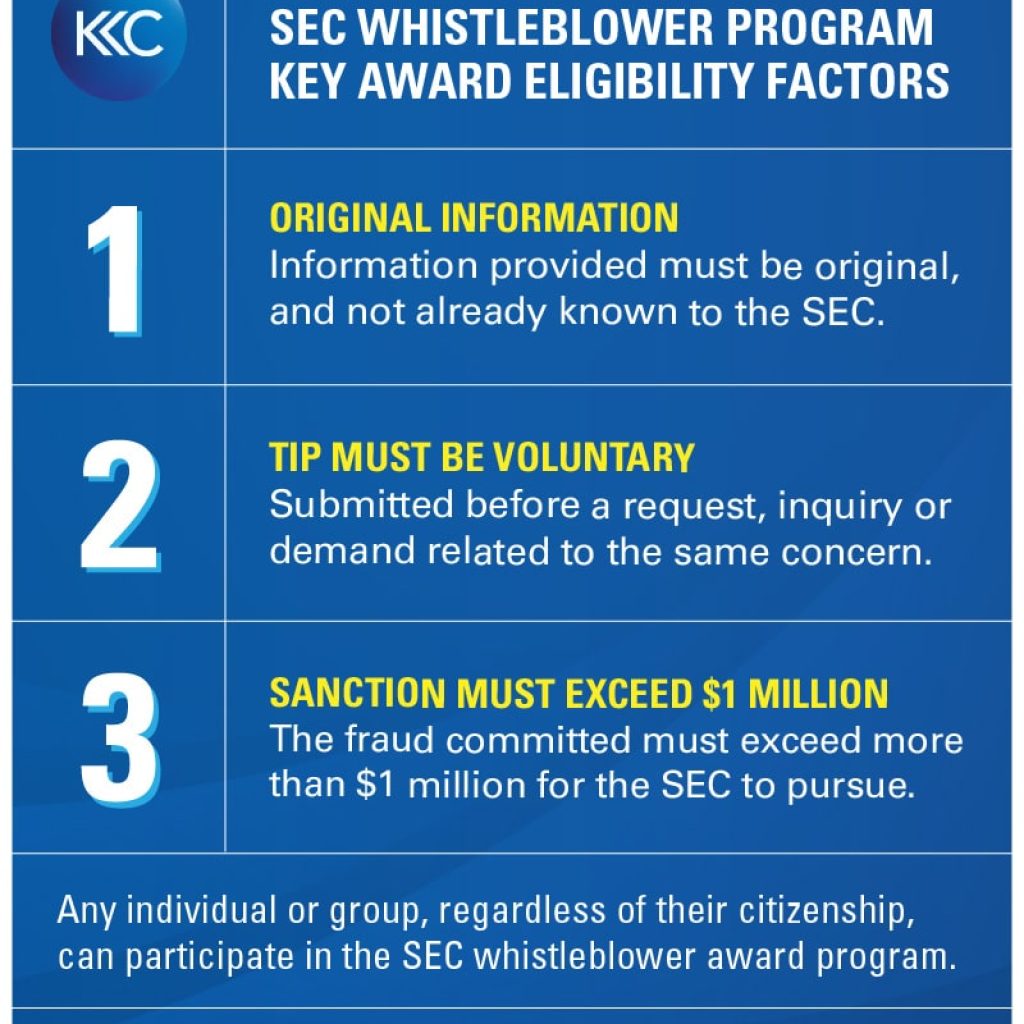

Even the staunchest SEC critics would struggle to argue against the merits of their whistleblower program. It can be seen as a gold standard, designed to encourage insiders to report violations of securities laws by offering monetary rewards and protection from retaliation. If crypto is to survive and thrive in the long term, it needs to clean up its act, and a whistleblower program akin to the SEC’s — but tailored to the specific needs of crypto — is the best way to achieve this.

We need to work with the SEC and regulators in crypto’s most important jurisdictions — including Hong Kong, the United Arab Emirates, the European Union, and other emerging crypto hubs — to develop a global standard for whistleblowing in the crypto industry. By putting in place whistleblower protection and incentive mechanisms across borders, the program can effectively mitigate some of the risks that arise from information asymmetry that exists between users and those who operate their crypto platforms.