Turmoil is swirling through the altcoin world as the value of this sector of cryptocurrency faces substantial losses.

Amid growing uncertainties and legal hurdles, altcoins, an umbrella term for all cryptocurrencies excluding Bitcoin and Ether, are encountering a rough patch with the prices of numerous tokens taking a significant hit.

Mounting altcoin crisis

Legal proceedings instituted by US regulators against prominent exchanges such as Coinbase and Binance have put the altcoin market under significant pressure.

Consequently, more than 50 cryptocurrencies, collectively valued over $100 billion and representing approximately ten percent of the market, are now under scrutiny by the SEC.

Prominent players like Solana, Polygon, and Cardano have witnessed a decline in their value ranging between 23% and 32%, according to CCData. The potential implications of these legal classifications have stirred alarm among crypto stakeholders.

Vetle Lunde, a senior analyst at K33 Research, stressed that all U.S. crypto exchanges could feel the ripple effect of this issue, possibly leading to the forced closure of several altcoin pairs.

Altcoins bracing for impact

As the dust settles, the crypto market is eager to see whether United States courts will endorse the SEC’s classifications. Meanwhile, the tremors are already palpable.

Notably, Robinhood Markets have announced their decision to delist Solana, Cardano, and Polygon from their platform. With the potential for other exchanges to follow this lead, altcoin operations could become significantly more costly.

The ripple effect of the SEC’s classification is expected to dampen investment enthusiasm for blockchain networks, underpinning tokens like Solana and Cardano.

Both chains are well-recognized for their role in developing decentralized finance and other applications. This regulatory development could pose serious challenges to their ability to raise funding from the U.S., a situation that is likely to impact developer and user onboarding.

The Cardano and Solana Foundations have expressed their disagreements with the SEC’s classification of their tokens as securities under U.S. law. They look forward to collaborating with regulators for more clarity on this issue. Polygon Labs, however, has refrained from commenting.

Crypto giants stay steady

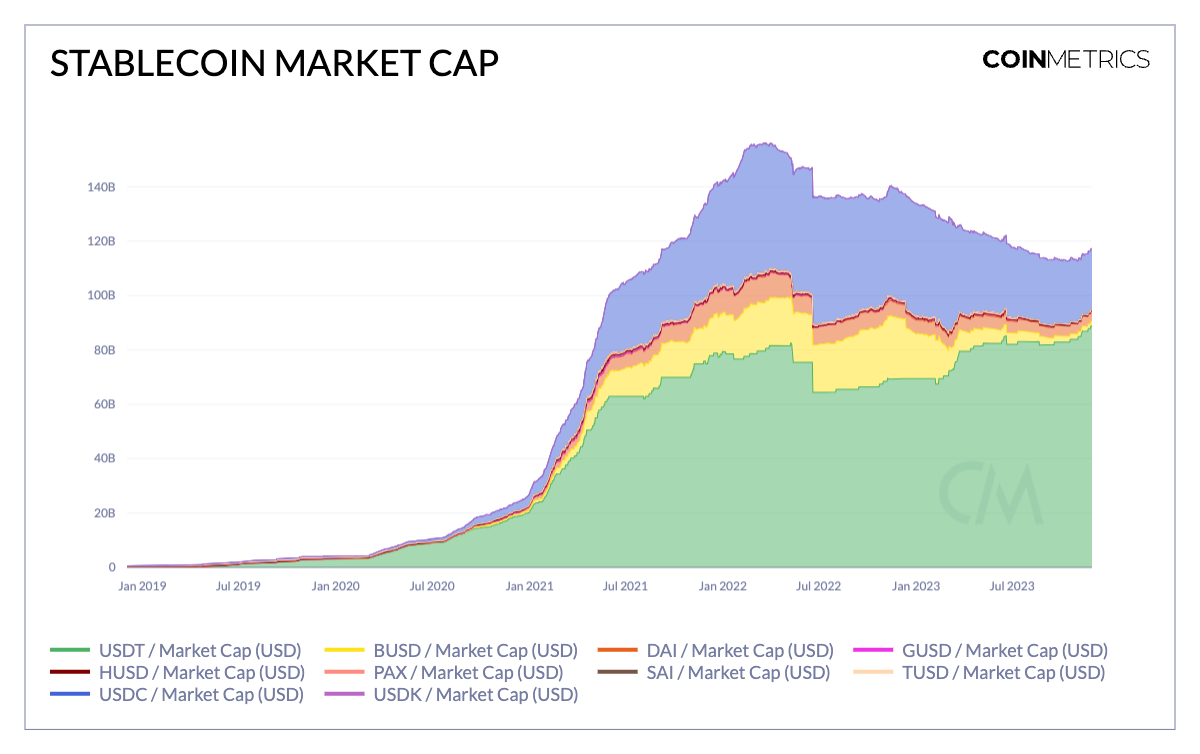

While altcoins tremble, Bitcoin and Ether, alongside stablecoins such as Tether and USC Coin, seem to be holding their ground amidst the turmoil. The SEC’s lawsuit hasn’t named these crypto giants, indicating they may be exempt from the brewing crisis.

However, investor nerves are still on edge, reflected by Bitcoin and Ether’s respective 4.5% and 8% decline since the filing of the first SEC lawsuit. Bitcoin, considered a relatively secure haven among crypto assets, continues to enjoy a slight increase in its market share, rising from 45% to 47.6%.

Even as altcoins struggle to maintain stability, some market observers suggest the current downturn may be opening the door to value seekers. Despite the troubling times, altcoins have seen some net inflows, contrasting with Bitcoin and Ether, according to Coinshares data.

Investors seem willing to grant these younger, developing assets the benefit of the doubt. As CoinShares analyst James Butterfield noted, investors are clinging to the hope that these investments will eventually bear fruit, reflecting a silver lining amidst the altcoin storm.