Coinspeaker

Crypto Derivatives Market Share Declines despite Record Trading Volume in March

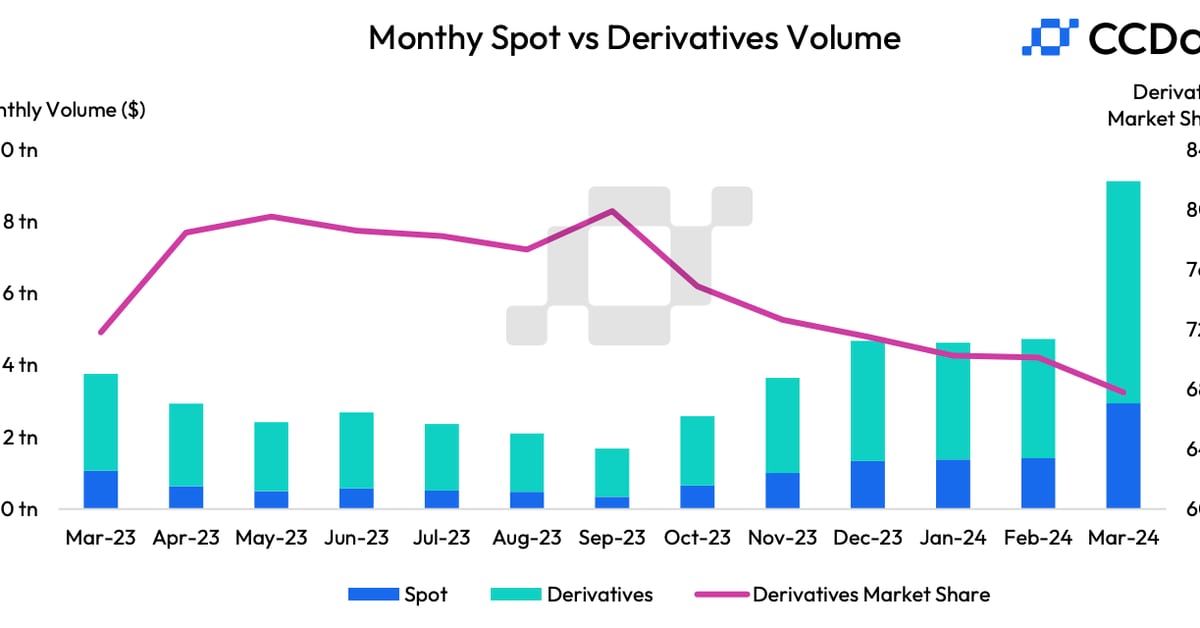

Data records from digital assets provider CCData suggest that trading volume in crypto futures and options on centralized exchanges surged explosively last month, gaining 86.5% to reach a record high of $6.18 trillion. That figure represents three times the total market capitalization of all cryptocurrencies combined.

Despite the impressive surge, however, the dwindling dominance of derivatives in the crypto market continues to raise concerns. In the same month, crypto derivatives market share slipped to 67.8%, its lowest level in about 14 months.

Why Crypto Derivatives Market Share Is on Decline

There is an apparent contradiction around the market share. However, the reason may be tied to the spot market. From CCData’s monthly report, it could be seen that spot trading activity surged significantly on centralized exchanges. Interestingly, the surge happened simultaneously as Bitcoin was riding to new all-time highs. So, as the excitement around Bitcoin grew, retail participants returned to the market, causing traders to flock to the spot market, where cryptocurrencies are exchanged for immediate delivery. Per CCData, spot trading volume saw a remarkable 108% increase, totaling $2.94 trillion.

Moreover, derivatives have a reputation for creating artificial demand and supply in the market. They are usually an avenue for speculative activity, especially during major market tops. Therefore, the sustained decline in their market could be a sign of market maturity and a shift toward tangible ownership. More so, crypto bulls have something to cheer about as the spot trading volumes could also be an indicator of a continued price rally.

In all of this dynamic, it is worth noting that Bitcoin (BTC), played a major role. In March, BTC surged by 16.6% to attain a new ATH of $73,000. That is according to CoinMarketCap data. Overall, the first quarter of 2024 brought about an impressive 68% price increase for Bitcoin.

So, while the crypto ecosystem continues to evolve, traders and investors will likely keep a close eye on these ever-changing dynamics, hoping to latch onto opportunities as presented by the market forces. It remains to be seen whether derivatives will regain their dominance or spot trading will keep up the momentum. One thing is certain, though, the crypto market forever remains a no-man’s land. Therefore, participants must be highly aware to adapt their strategies accordingly.

Crypto Derivatives Market Share Declines despite Record Trading Volume in March