The next two weeks could be decisive for the crypto industry as it faces significant legislative developments in the US Congress. These developments may potentially reshape the regulatory landscape for digital assets in the United States.

3 Major Crypto Legislations Are Up For Vote

The community is closely monitoring the Senate’s upcoming vote on the repeal of Staff Accounting Bulletin No. 121 (SAB 121). Initially issued by the Securities and Exchange Commission, SAB 121 requires financial institutions to list on their balance sheets the digital assets they hold in custody for clients.

This practice diverges from traditional custodial asset handling, which does not consider custodied assets as part of a company’s own balance sheet. Critics argue that this could unjustly inflate a bank’s assets and liabilities, leading to increased capital reserve requirements and potentially stifling the growth of crypto custody services.

Last week, the House of Representatives saw a bipartisan effort to repeal this regulation, with 21 Democrats joining Republicans. “Last week 21 Democrats took a tough vote and joined Republicans in repealing the SEC’s SAB 121. This is an issue that is important for both banks/crypto and a personal priority for SEC Chair Gensler,” said Ron Hammond, Director of Government Relations at the Blockchain Association via X.

The Senate, led by Senator Cynthia Lummis, is expected to follow suit this week. However, President Biden has indicated plans to veto the repeal, necessitating a challenging two-thirds majority in Congress to override the veto.

“Given the razor thin majorities in both Chambers, we’ve seen a few Congressional Review Acts (CRAs) get to the President’s desk on a bipartisan basis, but have failed at that stage. This requires a 2/3 congressional vote to overturn. Biden plans to veto so tough hill to climb,” Hammond remarked.

Another key legislative item on the agenda is a bill introduced by Representatives Larry Bucshon and Lisa Blunt Rochester. Scheduled for a vote this week, this bipartisan initiative requires the Department of Commerce to serve as the principal adviser to the President on blockchain issues. The bill also proposes the creation of an advisory group within the Commerce Department to further integrate blockchain technology into federal governance and policy-making.

Another highly anticipated legislative push is the upcoming vote on the FIT 21 bill, set around May 23-24. Authored by Patrick McHenry, chair of the House Financial Services Committee, this bill represents the first comprehensive attempt to establish a regulatory framework for cryptocurrencies at a federal level.

“FIT 21 is Patrick McHenry’s legacy and the first time Congress will vote on a regulatory framework for crypto. This is a moment that has been in the making for nearly a decade,” Hammond highlighted. The bill has garnered significant attention, and its amendments will be crucial in shaping its final form, appealing to both Democratic and Republican legislators.

Political And Regulatory Context

These legislative efforts occur against a backdrop of heightened regulatory scrutiny by the SEC under Chair Gary Gensler and broader concerns expressed by the Biden administration regarding the alleged risks associated with crypto assets.

The administration argues that SAB 121 is vital for protecting investors and maintaining stability in the financial system. Conversely, many in Congress and the industry believe that the SEC’s current approach hampers innovation and fails to provide clear compliance guidelines.

Moreover, the intersection of crypto policy and election year dynamics cannot be understated. With former President Donald Trump’s recent endorsements of cryptocurrency and its bipartisan potential, crypto policy is emerging as a significant campaign issue.

“Trump inserting himself in crypto has little political risk, but major benefit given the bipartisan campaign wins crypto has been picking up in the primaries,” noted Hammond. This positions crypto as a unique issue that could influence voter demographics, particularly among younger voters who have shown consistent interest in digital asset technologies.

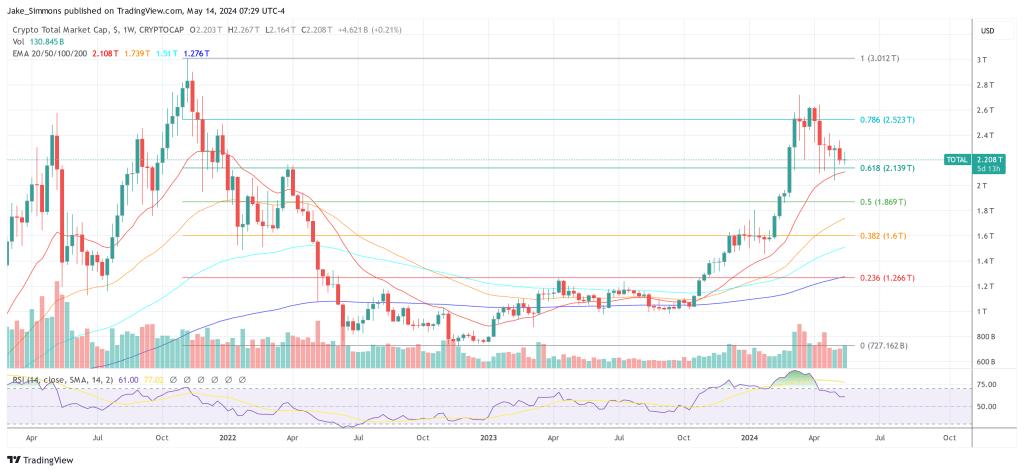

At press time, the total crypto market capitalization stood at $2.208 trillion, still 37% away from its all-time high of November 2021.