Bitcoin and low-cap, high-risk memecoins led the crypto market in the third quarter leading venture capitalists to overlook mid-tier projects.

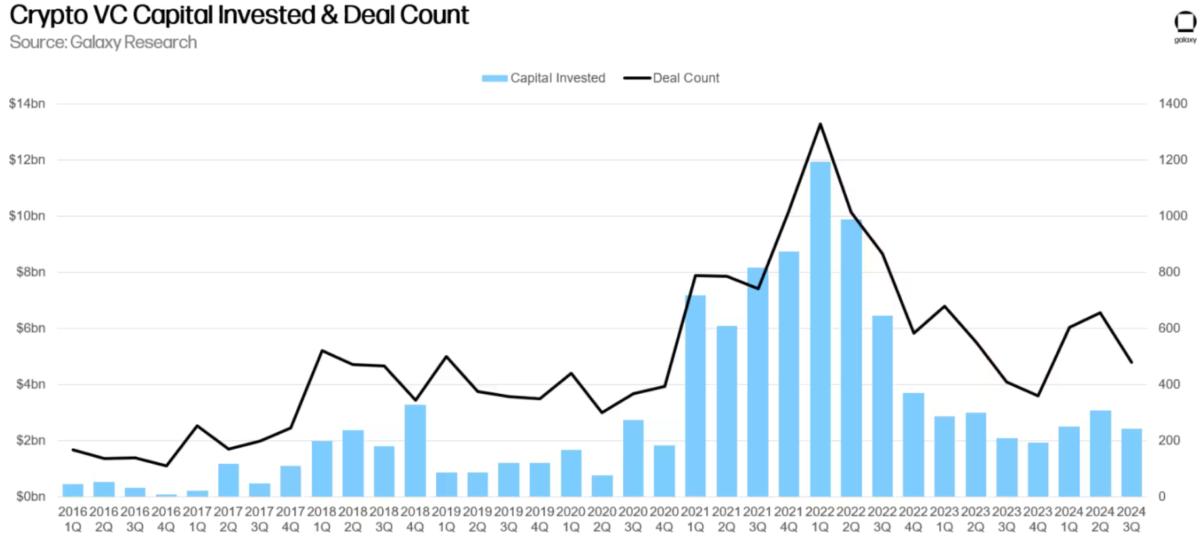

Crypto venture capital funding fell 20% to $2.4 billion over the third quarter, driven by a “barbell market” where Bitcoin and high-risk memecoins led, leaving mid-tier projects seeking funding overlooked, says Galaxy Digital.

The funding fall was accompanied by a 17% decrease in deals, with 478 made during Q3, the crypto investment firm’s head of research Alex Thorn and research analyst Gabe Parker explained in an Oct. 15 report.

The $2.4 billion in funding throughout Q3 is a 21.5% increase from the nearly $2 billion in venture capital that flowed into crypto in the third quarter of 2023.