Cryptocurrency investors are in a tizzy after dormant funds from the December Orbit Chain heist were spotted tumbling through Tornado Cash, a notorious blockchain anonymizer. The hack, which pilfered a staggering $48 million (now ballooned to $121 million due to market fluctuations), had gone quiet for months, leading many to believe the ill-gotten gains were gathering dust in a digital vault.

Elusive Hacker Strikes Again

Then, like a digital phantom, the hacker resurfaced, transferring nearly $50 million worth of stolen Ether to a new wallet before churning it through Tornado Cash, a service notorious for its ability to obfuscate the trail of cryptocurrency transactions. This laundering maneuver makes it extremely difficult, if not impossible, to track the stolen funds and return them to their rightful owners.

ONGOING: $100M Orbit Chain Exploiter sends $32M to Tornado Cash after 5 months silence

In the past hour, the Orbit Chain Exploiter moved 8671 ETH ($32M) to a new address and is currently in the process of depositing it to Tornado Cash.

They stole over $100M in ETH and DAI… pic.twitter.com/Bq7BRdXqmc

— Arkham (@ArkhamIntel) June 8, 2024

Orbit Chain Hack: Motive Unclear

The motive behind the hacker’s sudden activity remains a mystery. Some speculate it might be a response to Orbit Chain’s recent revival of certain bridging services, which allow users to transfer crypto assets between different blockchains. This could indicate the hacker is preparing to cash out, or it might simply be an attempt to further confuse investigators.Orbit Chain themselves haven’t exactly been forthcoming with information. Despite reassurances that they’re working with authorities, the cause of the hack remains shrouded in secrecy. The protocol also hasn’t addressed user concerns about potential reimbursement, leaving many investors feeling lost in the digital ether.

This incident emphasizes the inherent vulnerabilities of DeFi platforms. Although they present an alluring picture of decentralized finance, investors may be at risk due to a lack of regulatory monitoring.

The hunt for the missing millions, now obscured by a digital smokescreen, has become significantly more complex.

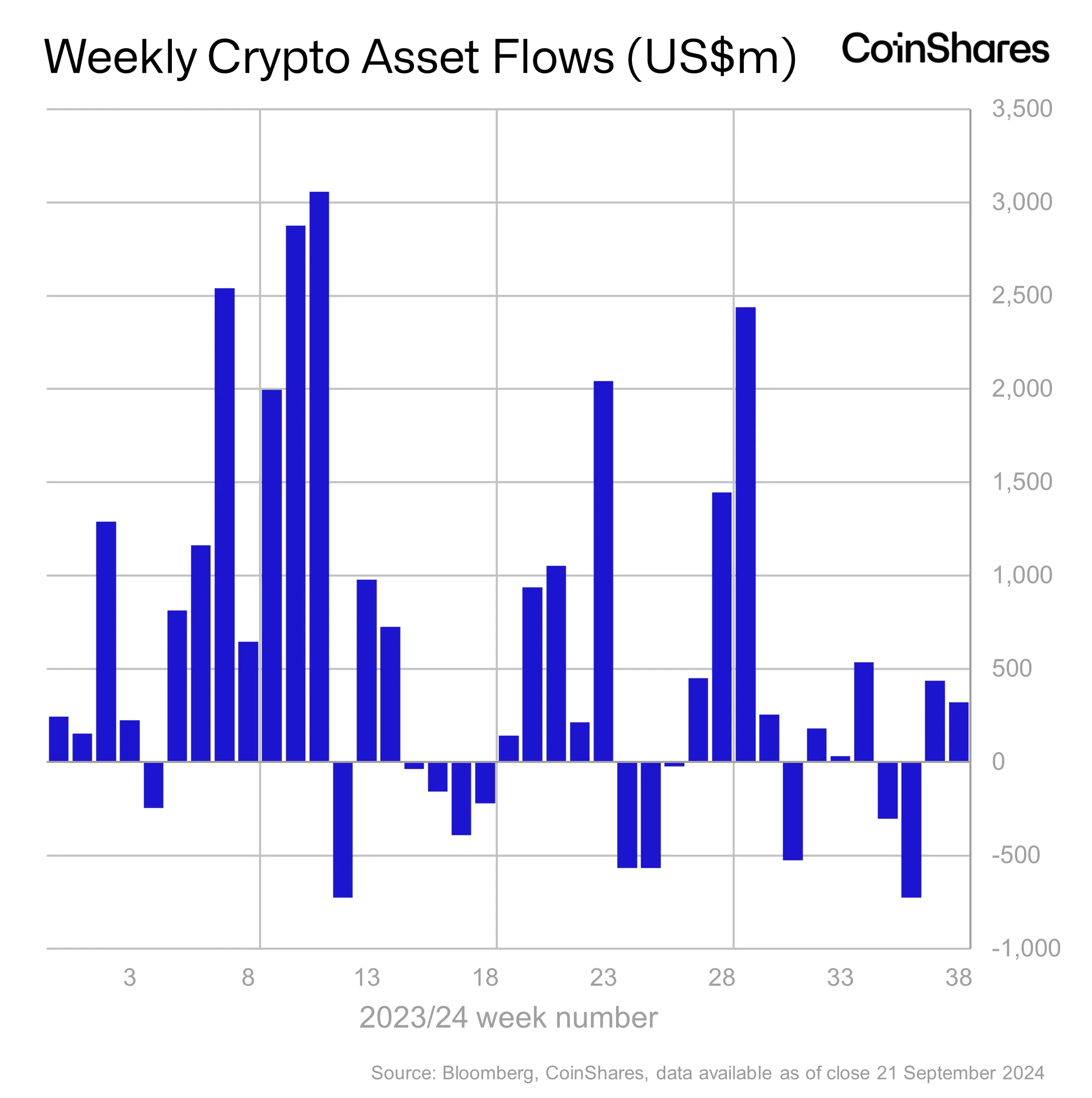

Crypto Crime On The RiseAmidst a concerning trend of increasing cryptocurrency theft, recent data shows that hackers managed to steal $540 million in digital assets during the first quarter of 2024. This marks a 42% rise compared to the same period last year. The Decentralized Finance (DeFi) industry, valued at over $100 billion in total value locked (TVL), is particularly vulnerable due to its decentralized exchanges.

A web3 bug bounty platform found that DeFi was the primary target for exploits in Q1, indicating significant security gaps compared to Centralized Finance (CeFi) platforms.

Related Reading: Bitcoin Miner Core Scientific Says No To CoreWeave $1 Billion Buyout Offer

Hacks were responsible for the majority of these losses, making up 96%, while fraud accounted for only 4%. Ethereum and BNB Chain were the most targeted blockchains, with Ethereum experiencing over 30 individual attacks.

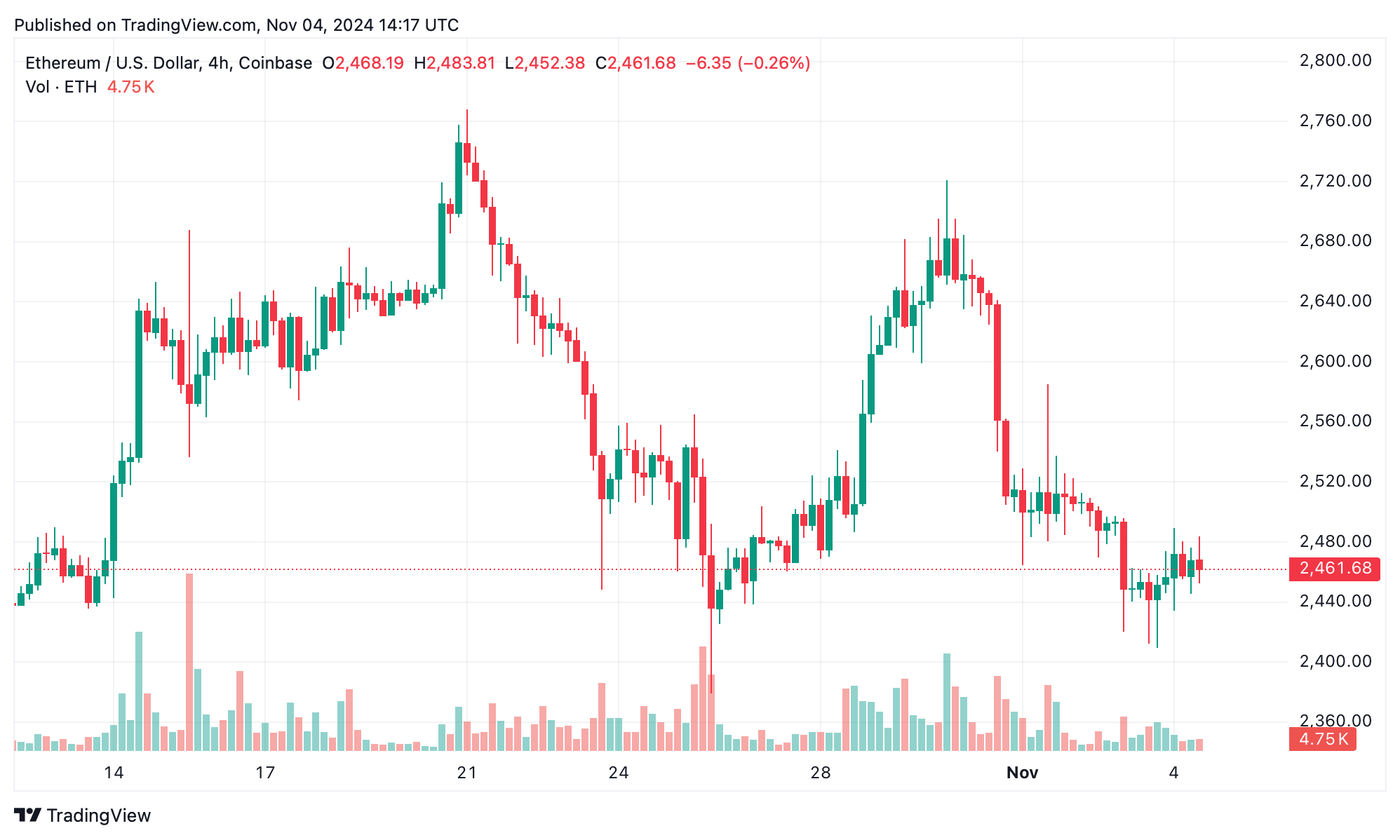

Featured image from Pexels, chart from TradingView