Last week, cryptocurrency investment products raked in an impressive figure at $2 billion. This brings the total inflows over the last five weeks to an impressive $4.3 billion. Bitcoin led the pack with inflows of $1.97 billion.

Also read: Wintermute CEO says Ethereum’s real challenge is its ideological contradictions

Ethereum was next in line, seeing its largest inflow week since March with a total of $69 million. CoinShares reported that trading volumes in Exchange-Traded Products (ETPs) surged to $12.8 billion for the week, marking a 55% increase from the previous week.

Bitcoin steals the show

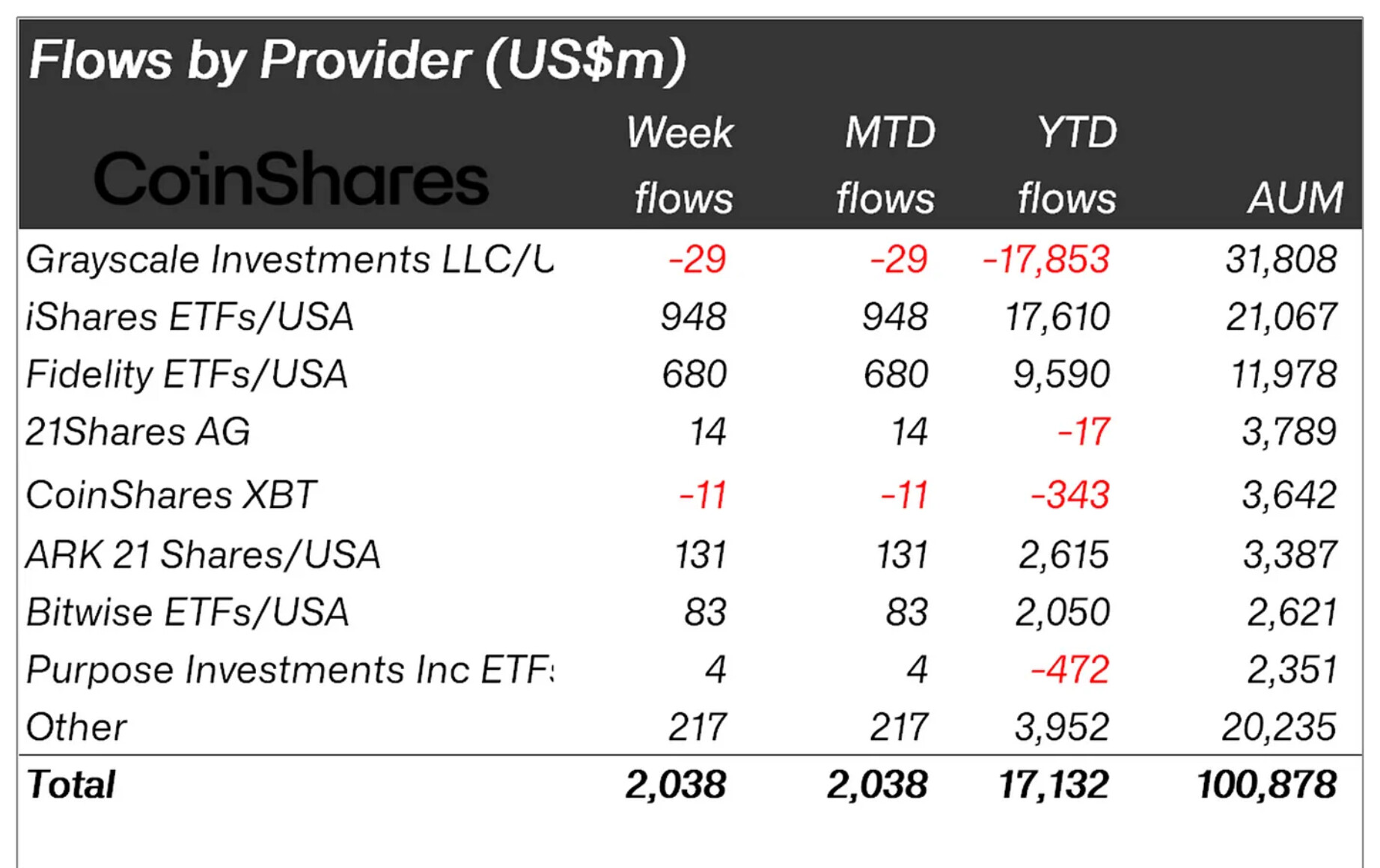

Almost all spot ETF providers observed net inflows, with a noticeable outflow slowdown from incumbents. This change in sentiment is believed to be a direct response to weaker-than-expected macroeconomic data in the US, which has accelerated expectations for interest rate cuts.

The United States dominated the inflow scene, with $1.98 billion pouring in last week. Remarkably, the first day of the week saw the third-largest daily inflow on record. The iShares Bitcoin ETF now surpasses the incumbent Grayscale, boasting $21 billion in assets under management (AuM).

Bitcoin remained the primary focus, securing $1.97 billion in weekly inflows. Meanwhile, short-Bitcoin products saw outflows for the third consecutive week, totaling $5.3 million. This indicates a strong bullish sentiment among investors.

Ethereum enjoyed its best week of inflows since March, totaling $69 million. This surge is likely a reaction to the unexpected SEC decision to allow Ether spot ETFs. The altcoin sector saw minor activity, with Fantom and XRP standing out. Fantom attracted inflows of $1.4 million, and XRP brought in $1.2 million.

Bitcoin displays resilience

Bitcoin has shown remarkable resilience against bearish market pressures. Recent data reveals that Bitcoin’s price increased by 0.3% in 24 hours, settling at $69,388 with low volatility. According to Ruslan Lienkha, chief of markets at YouHodler, Bitcoin is in an incredibly favorable market position.

Also read: Arthur Hayes says it’s time to go long on Bitcoin

“It can overcome the resistance level in the zone of $71k-$73k and renew all-time highs in the coming weeks,” he stated in an email to Cryptopolitan. He attributed this optimism to the expected interest rate cuts in the US after the ECB, which will likely stimulate even more capital inflow into risk assets.

Lienkha noted, “Although the crypto market is high-risk by definition, we notice that investors are moving towards meme coins, increasing the risk.” He added that the overall market outlook remains positive unless unexpected negative macroeconomic data acts as a black swan. For instance, if inflation were to rise again following the ECB’s rate cut, it could disrupt the market.

The rise in trading activity is not limited to Bitcoin and Ethereum. There’s also an elevated trading interest in meme stocks such as GameStop and other low-rated penny stocks, indicating a growing risk appetite among investors.

Cryptopolitan reporting by Jai Hamid