KuCoin’s research arm published a report revealing that the crypto market saw over $1 billion in investments in May. Despite this impressive figure, it is actually a slight decrease from the month that came before that.

Also Read: Predicting the Next Crypto Bull Run

On June 13, KuCoin Research announced that 156 investments were publicly disclosed in May, with $1.02 billion in capital flowing into the market. This amount shows a 10.61% increase compared to May 2023 but a 6.4% decline compared to April.

Crypto market sees a lot of developments in May

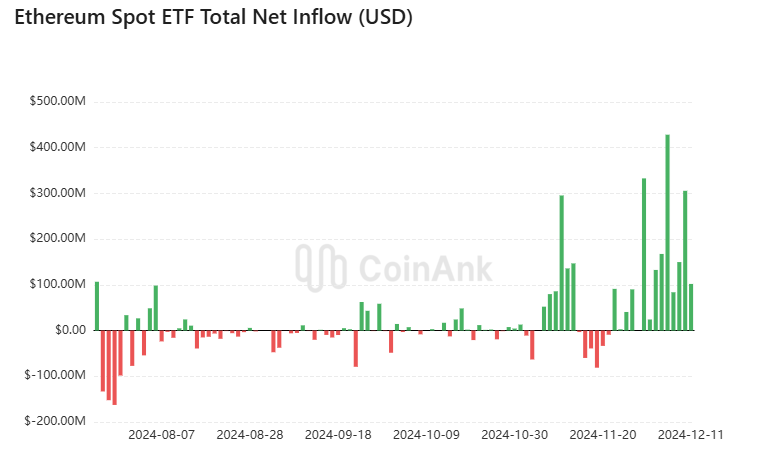

The crypto market experienced notable developments in May, per the report. The SEC’s surprise approval of a Spot Ethereum ETF boosted market confidence. The U.S. stock market’s strong performance and the rise in meme stocks also contributed to the rebound in crypto assets. Cryptocurrency ETFs saw increased capital inflows, particularly in the U.S. market.

Stablecoins had a mixed month. The issuance of fiat-collateralized stablecoins stagnated. USDC and FDUSD saw notable declines, while USDe reached a new high. SosoValue data shows that the total issuance of six traditional stablecoins decreased by $840 million in May. According to Glassnode, USDT and PYUSD are on an upward trend, while USDC, DAI, and TUSD have declined.

Notably, PYUSD increased from $327 million on April 30 to $398 million on May 31, a monthly increase of 21.7%. On May 29, PYUSD announced that it would be officially issued on Solana, targeting the retail payment scenario. This unique positioning may bring new changes to Solana’s developers, users, and ecosystem, said KuCoin.

After sitting around $2.3 billion for a month, the issuance of USDe surged, reaching $2.978 billion by the end of May. Although it did not break the $3 billion mark, it surpassed FDUSD to become the fourth-largest stablecoin.

Layer-2 projects barely budge

Public chains and Layer-2 ecosystems showed significant differences. Despite rising Ethereum prices, its Layer-2 ecosystem did not see a corresponding increase in activity. Base and Linea maintained a net inflow trend, performing well. High-performance public chains and low-cost on-chain fees no longer attract as many players.

Also Read: Canada makes amendments to crypto investment rules

In the BTC sector, BRC20 remained weak, while Runes dominated the trading volume of major BTC assets. DOG saw a huge increase in overall market value, surpassing $800 million by the end of May. Large projects tightened their sybil hunt screenings. LayerZero Labs introduced Self-Report Sybil Activity, encouraging users to report sybil activity for rewards. According to the report, in crypto gaming and earning models, Tap to Earn and related mini-games showed strong market appeal within the TON ecosystem.

Cryptopolitan reporting by Jai Hamid