Recently, a market analyst, Conor Ryder, CFA, examined the liquidity of the cryptocurrency markets. The liquidity issue was brought to light by market depth, spreads, slippage, and volume.

According to the analyst, crypto markets are most volatile during periods of low liquidity. Prices have less support both to the downside and to the upside, which may explain BTC’s rapid +17% increase since the beginning of the month.

An in-depth look at crypto liquidity levels

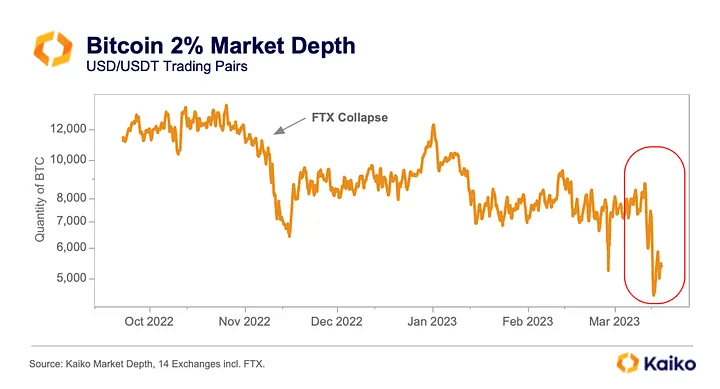

As the banking industry reels from several high-profile failures, liquidity has become a hot topic in traditional financial markets. This has trickled down to cryptocurrencies, which were already suffering from a lack of liquidity in the wake of FTX.

Under market depth, the analyst discovered that BTC pairs are at their lowest level of liquidity in ten months, even lower than just after the collapse of FTX.

Ryder observes that the crypto market has not filled the void left by the collapses of FTX and Alameda. However, the recent problems in the banking industry have only exacerbated bitcoin’s liquidity issues. The liquid flow gap following the implosion of FTX is one of the factors contributing to the current lack of liquidity in the markets.

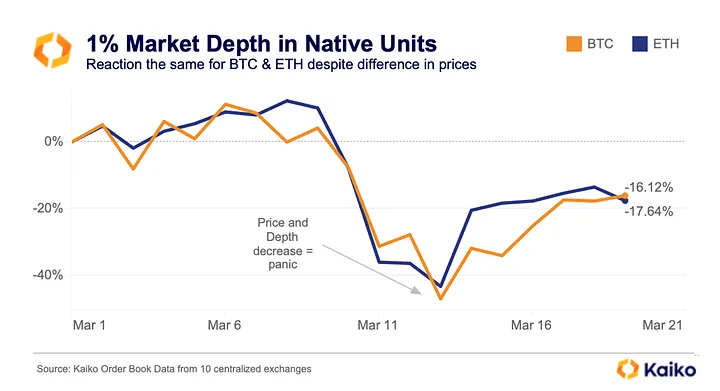

According to the analyst, neither BTC nor ETH have improved in depth, indicating that the current market boom was solely a price-driven increase in market liquidity, which is a less sustainable method. Interestingly, market makers did not differentiate between BTC and ETH despite the general rotation into BTC over the past week.

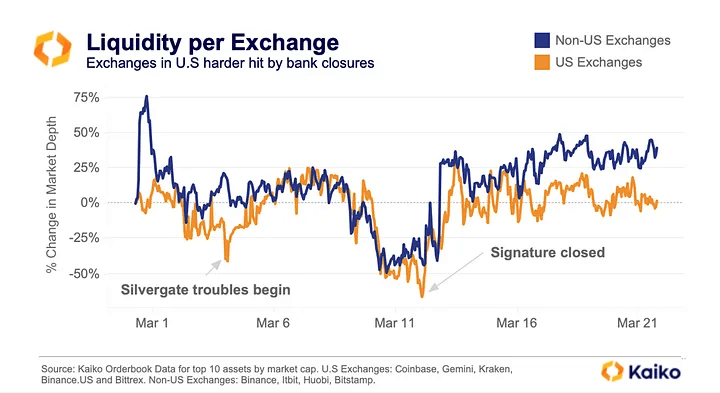

Moreover, the closure of SEN and the wind-down of Signet, two of the only USD payment rails for cryptocurrencies, has caused U.S. exchanges to be hit harder from a liquidity perspective as market makers in the region face unprecedented operational challenges.

Liquidity flow in crypto exchanges

The analyst highlights the disparity in the reaction between U.S. and non-U.S. exchanges, with non-U.S. exchanges reacting more severely to recent liquid flow issues. The good news is that liquidity appears to have returned to levels seen in early March, although the loss of easy fiat on-ramps may have a longer-term effect.

Moore also discovered that spreads have recently tightened, which discourages market makers from adding liquidity. During the banking issues, USD pair spreads appeared more volatile than USDT pair spreads. The rate increased from 0.02% to 0.04% after the closure of Silvergate.

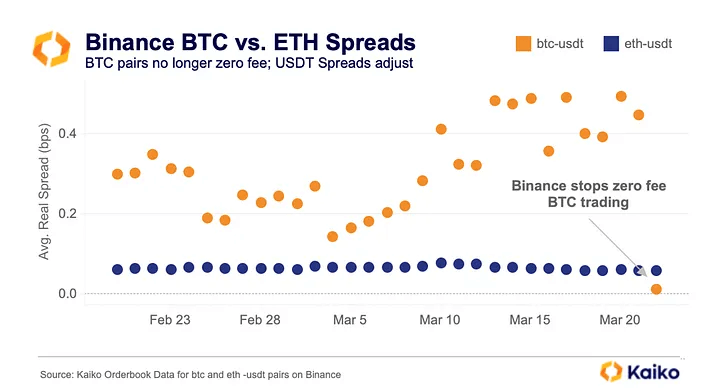

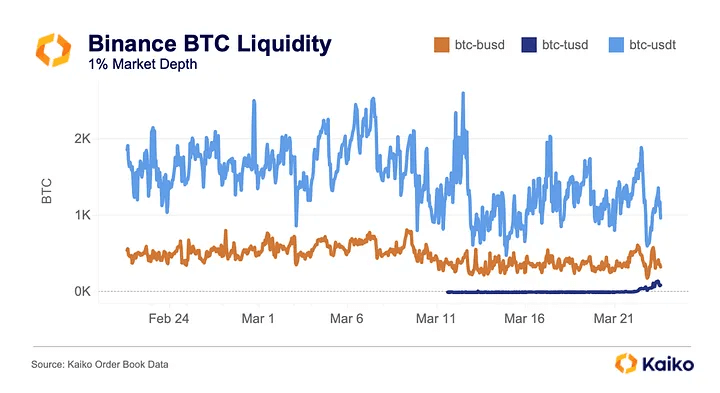

In addition, Binance recently announced the end of the zero-fee program for all BTC trading pairs, with the exception of BTC/TUSD. Before removing the zero-fee program, Binance’s zero-fee pairs, led by BTC-USDT, gained a significant market share.

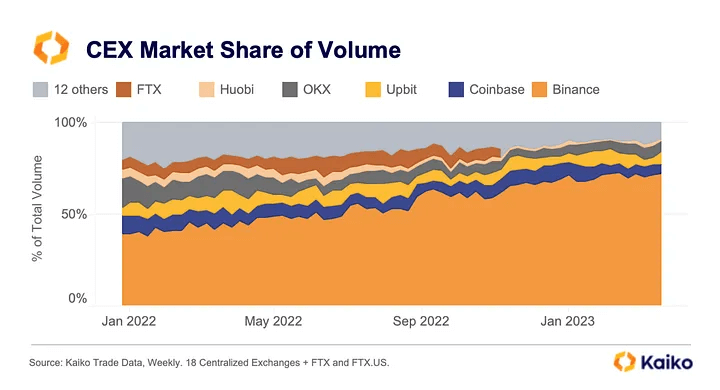

According to the analyst, the significance of this event on market liquidity cannot be underreported; Binance is the most liquid exchange, and the BTC-USDT pair is the most liquid pair in the crypto market. Since July, the zero-fee program has allowed Binance to increase its market share by over 20%, with over 61% of trading volume coming from zero-fee pairs.

As a result of the reintroduction of a taker fee, the volatility of BTC spreads on Binance, which had previously been volatile due to the absence of a fee, has decreased, bringing BTC spreads below ETH spreads.

With the reintroduction of the taker fee, investors are unwilling to pay a higher spread, which makes it less profitable for market makers to offer liquidity on that pair. This has resulted in a 70% drop in overnight liquidity for the BTC/USDT pair on Binance as market makers seek out more profitable markets on other exchanges and pairs.

Examining the current market volumes

Compared to the multi-year lows established at the end of 2022, crypto volumes have increased significantly in recent times. When volumes are broken down by exchange, it’s Binance versus everyone else. Notably, Coinbase has failed to gain market share in terms of volume despite concerns over USD pairs and the launch of its own Layer 2 platform, Base.

Based on the volume share per exchange, the analyst concludes that very little volume flows into U.S. exchanges and, consequently, USD pairs. The proportion of stablecoin volumes relative to USD volumes supports this conclusion, with stablecoin volumes increasing from 77% to 95% in less than a year.

Due to the phasing out of USD pairs, market liquidity has decreased due to the absence of suitable payment methods comparable to SEN or Signet. According to the analyst, the current high volatility in cryptocurrency markets is primarily due to low liquidity.