The cryptocurrency market is abuzz as Bitcoin, the world’s leading digital currency, surpasses the $52,000 mark, fueling speculation about a potential pre-halving rally. This surge in price has captivated investors and analysts alike, drawing attention to historical trends associated with the impending reduction in mining rewards.

Bitcoin Analyst pre-halving rally and market dynamics.

Jag Kooner, the Head of Derivatives at Bitfinex, has weighed in on the current market movement, suggesting that it aligns with patterns indicative of a pre-halving rally. According to Kooner, such rallies typically commence approximately eight weeks before the halving event and have historically resulted in significant price increases for Bitcoin.

Kooner emphasized the potential for this rally to propel prices beyond previous cycle highs, citing the recent resurgence of Bitcoin’s trillion-dollar market cap and consistent inflows into spot Bitcoin ETFs as key contributing factors. Additionally, he noted a decrease in selling pressure stemming from Grayscale’s GBTC conversion, further bolstering Bitcoin’s price trajectory.

However, Kooner issued a cautionary note against solely relying on historical patterns, emphasizing that while they offer valuable insights, they do not guarantee repetition. He pointed to the rising interest in alternative cryptocurrencies (altcoins) as a unique aspect of the current market dynamics, suggesting a diversification of investor sentiment.

Market dynamics and future outlook

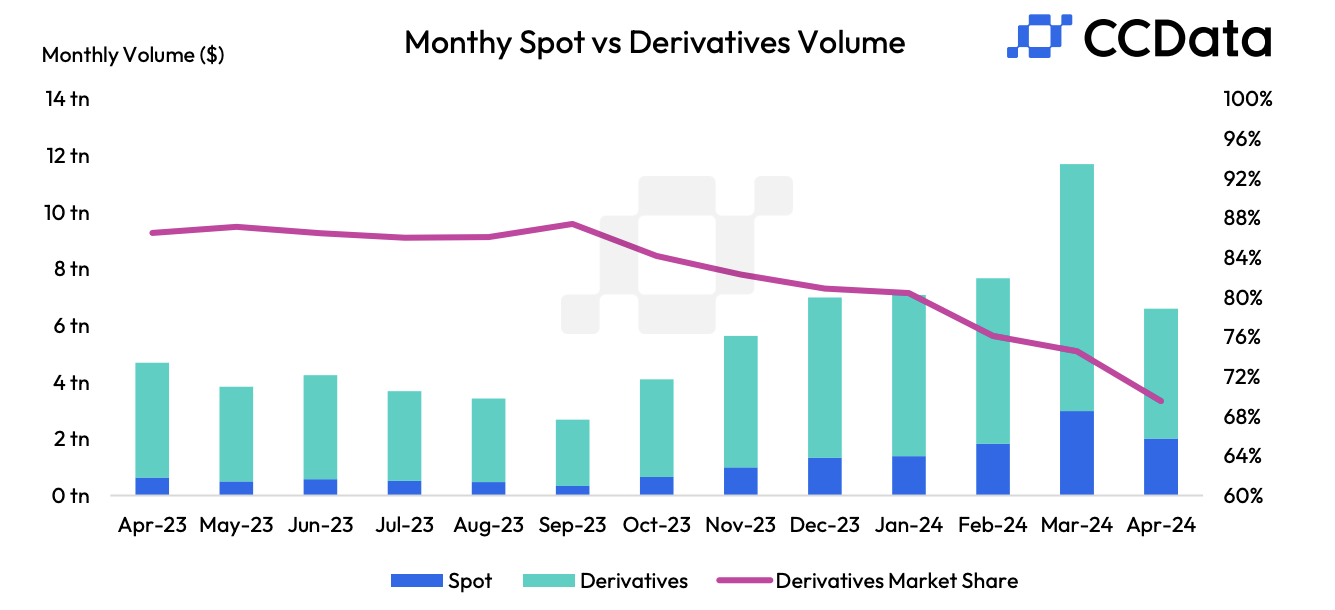

The cryptocurrency market has recently reached a significant milestone, with its total value surpassing $2 trillion. This achievement underscores the growing mainstream acceptance and adoption of digital assets, further solidifying their position as a legitimate asset class.

Looking ahead, the next Bitcoin halving is anticipated to occur in April, resulting in a 50% reduction in the miner reward per block. This event, occurring approximately every four years, is designed to regulate the supply of new Bitcoins, potentially impacting their value due to increased scarcity.

As Bitcoin continues to assert its dominance in the cryptocurrency market, the recent surge in price above $52,000 has sparked speculation about a pre-halving rally. Analysts, including Jag Kooner of Bitfinex, have highlighted historical patterns indicating such a trend, citing factors such as Bitcoin’s trillion-dollar market cap, inflows into spot Bitcoin ETFs, and diminishing selling pressure from Grayscale’s GBTC conversion.

The future of cryptocurrency markets

However, while historical patterns provide valuable insights, they do not guarantee future outcomes, as cautioned by Kooner. The evolving landscape of the cryptocurrency market, characterized by rising interest in altcoins and the milestone of surpassing $2 trillion in total market value, adds complexity to the current market dynamics.

As investors brace for the upcoming Bitcoin halving in April, anticipation mounts regarding its potential impact on Bitcoin’s value and the broader cryptocurrency market. With uncertainty looming, stakeholders remain vigilant, closely monitoring market trends and developments to navigate the ever-evolving landscape of digital assets.

While the recent surge in Bitcoin’s price signals optimism among investors, the crypto market continues to operate within a volatile and dynamic environment, underscored by both historical precedents and emerging trends.