Despite enduring the crypto winter, a notable number of asset managers, hedge funds, and investors are anticipating substantial growth in the digital assets sector over the next five years, according to a crypto report by Coalition Greenwich. The crypto report, conducted through interviews with 60 professionals, including portfolio managers, traders, analysts, researchers, and managing directors in the United States, the United Kingdom, and the European Union, provides insights into the industry’s outlook and strategies.

Coalition Greenwich crypto report reveals key statistics

The research, led by senior analyst David Easthope, reveals that 48% of the surveyed firms currently have crypto assets under management (AUM). Even more strikingly, nearly 80% of the respondents expect significant industry-wide growth in digital AUM over the next five years, with 41% anticipating a “very strong” compound annual growth rate (CAGR) exceeding 11%. In addition, a quarter of the interviewed firms already have dedicated digital asset strategies in place, and this figure is expected to rise to 33% within the next two years.

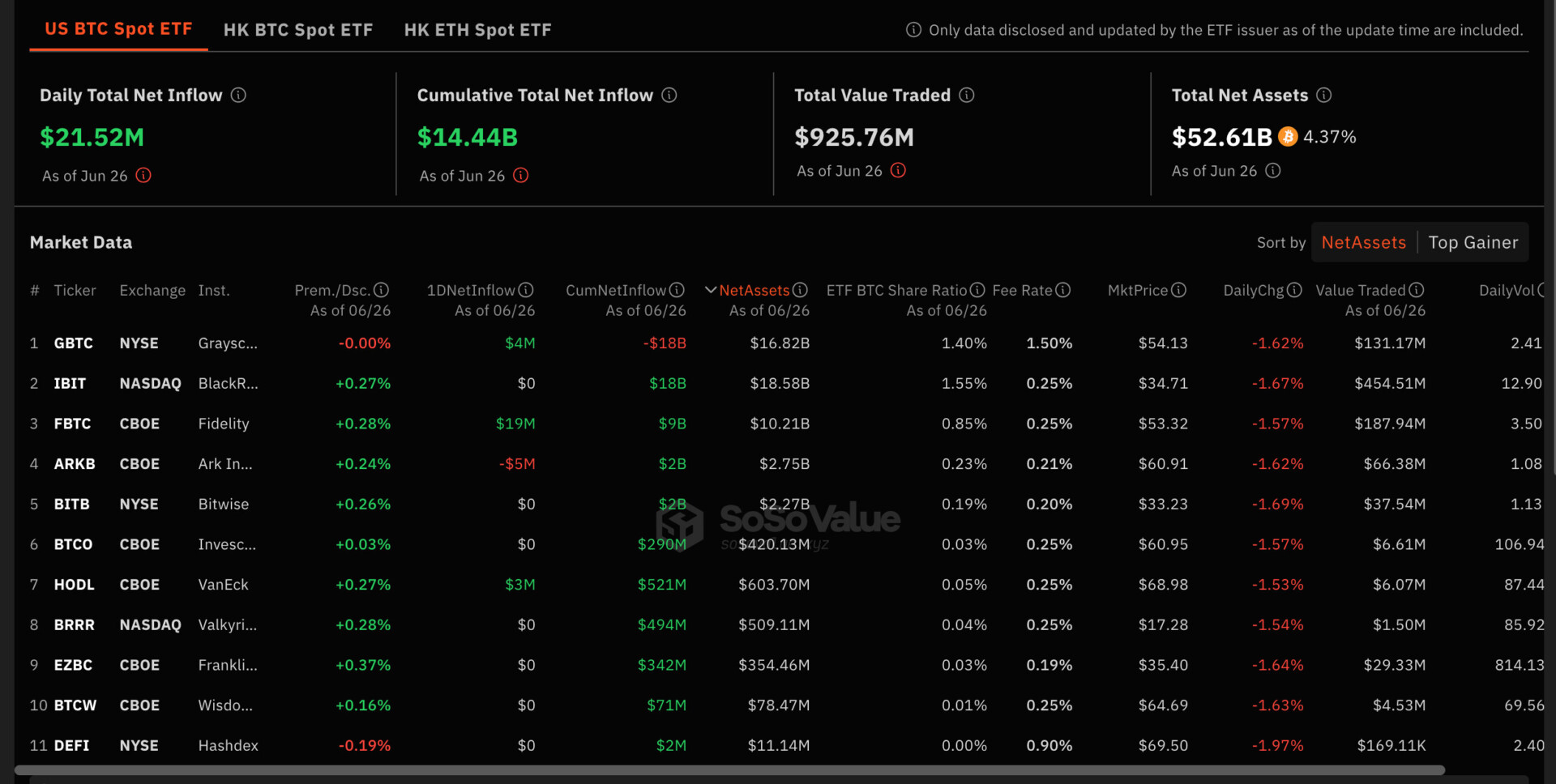

This signals a growing commitment to integrating cryptocurrencies and digital assets into their portfolios. The crypto report also highlights a trend towards assembling teams of seasoned professionals to manage digital assets. Currently, 24% of the firms have senior roles dedicated to digital assets, underlining the increasing importance of this asset class. Many firms are exploring various digital assets for direct management, including exchange-traded funds (ETFs), digital asset securities, stablecoins, cryptocurrencies, DeFi tokens, and crypto futures.

Others are planning to provide support or trading services for these assets, reflecting a diversified approach to digital asset investment. Despite the current regulatory challenges, survey participants remain optimistic about opportunities in the U.S. market. While the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have undertaken enforcement actions against crypto firms, the report suggests that there is a belief that these agencies will become more favorable to the sector in the future.

Market challenges and preparation for future growth

The crypto report notes that constructive discussions are occurring behind the scenes among regulated institutions, fostering a positive outlook for the industry. One particular area of interest for fund managers is the concept of tokenizing financial assets and real-world assets (RWAs). Tokenization involves issuing blockchain-backed tokens representing various assets, such as cash-like instruments, commodities, securities, or real estate. Prominent figures like BlackRock CEO Larry Fink have described tokenization as the future of markets. Bernstein, a global asset management firm, estimated tokenization to be a $5 trillion opportunity.

Tokenization offers benefits such as real-time settlements and transparency through distributed ledgers. The crypto report reveals that 67% of market participants are particularly interested in the efficiency gains facilitated by this technology. Investment banks are also exploring digital bonds. Several major financial institutions, including UBS, Deutsche Bank, JPMorgan, Goldman Sachs, HSBC, BNP Paribas, and RBC Capital Markets, are actively involved in projects related to crypto-native bond issuance. However, despite the growing enthusiasm, asset managers face challenges related to data analysis tools for the expanding crypto sector.

Banks, in particular, may need to integrate on-chain data with their conventional off-chain accounting and administrative functions, especially if they engage with DeFi protocols. Yet, the infrastructure for such integration is still in its early stages. Similarly, funds rely on various sources, including centralized exchanges, derivatives exchanges, decentralized exchanges, and dealers for market and pricing data. Aggregating this data is often considered beyond the capabilities of many traditional managers. In response to this data challenge, approximately 85% of survey participants indicated their intent to seek external vendors for market data rather than building their internal systems.

This shift is expected to lead to a surge in data-providing services within the next 12 months, as the crypto sector continues to evolve. The crypto report from Coalition Greenwich underscores a growing wave of optimism in the asset management industry regarding the future of digital assets and cryptocurrencies. Despite regulatory hurdles and market uncertainties, a significant number of firms are actively incorporating these assets into their strategies, preparing for a future where blockchain technology, tokenization, and data analysis play increasingly vital roles. The industry’s evolution is a testament to the enduring appeal and potential of the crypto sector.