Coinspeaker

Crypto Trader Accused of $110M Theft Faces US Criminal Trial

A jailed crypto trader, Avraham Eisenberg, faces a criminal trial this week over reshaping Decentralized Finance’s (DeFi) terrain. Accused of manipulating Mango Markets, a DeFi platform, to acquire $110 million, Eisenberg argues his actions merely exploited a coding loophole – challenging DeFi’s core tenet, “code is law”.

The jury selection for this high-stakes trial starts today, April 8th, 2024, at a federal court in New York. This court has seen major crypto cases, including the recent 25-year sentencing of FTX co-founder Sam Bankman-Fried. Another ongoing case involves Terraform Labs and Do Kwon for the 2022 collapse of TerraUSD, which wiped out $40 billion in investor funds.

Alleged Crypto Trader Inflates Contract by 1,300%

Prosecutors revealed the manipulation tactics of the crypto trader. They assert Eisenberg used two anonymous accounts to drastically inflate Mango Markets’ futures contracts value by 1,300% within a brief 20-minute span. This allowed him to acquire an immense $110 million in cryptocurrencies through “borrowing”, with an alleged lack of intent to repay the sum.

Eisenberg, however, maintains his innocence. He claims his actions followed the platform’s rules. DeFi transactions typically operate under smart contracts: self-executing programs outlining the platform’s rules. DeFi advocates contend this autonomy separates it from traditional finance, promoting transparency and trust.

This case, however, raises a critical question: Does the lack of explicit regulations within a DeFi protocol automatically make an activity legal? Prosecutors contend that established laws prohibiting market manipulation and fraud still apply, no matter how the platform is being used.

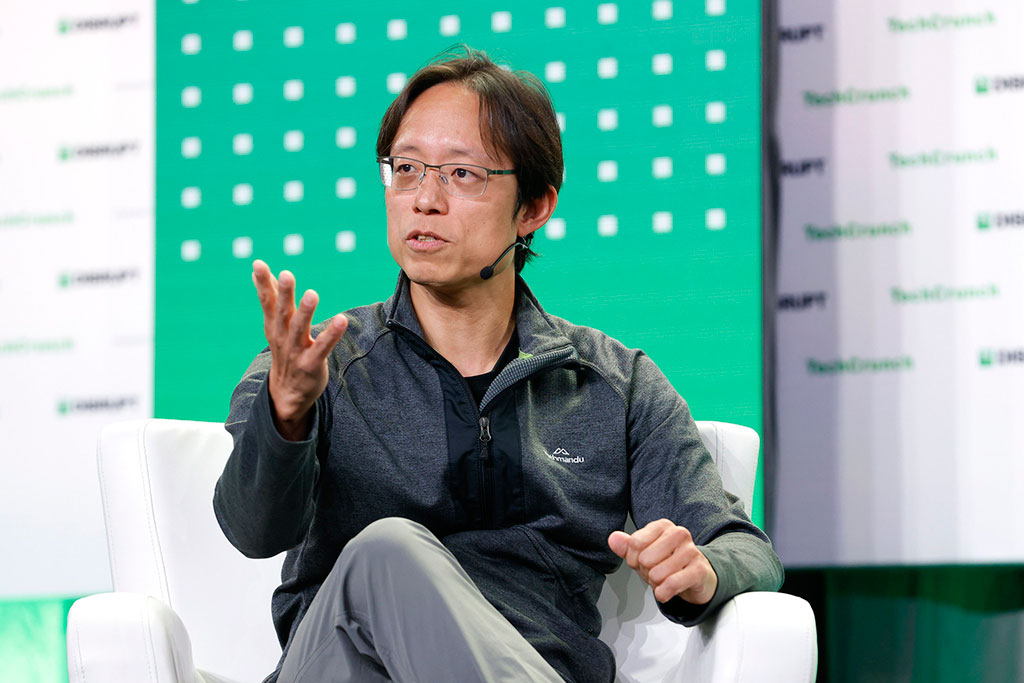

“It touches on the big argument within crypto – is code law? […] If the code allows somebody to do that, does the actual law? Obviously, the government took a different approach that code is not law. Just because there is an opportunity to exploit it does not mean that it’s legal,” said Chris Janczewski, head of global investigations at TRM Labs.

$67 Million Return Deal

Adding another layer of intrigue, Eisenberg reportedly attempted to settle the matter with Mango DAO, the community governing body behind the platform. This deal, which involved returning $67 million of the funds in exchange for dropped legal claims, is now being contested by Mango Labs LLC and regulators.

The legal battle extends beyond the courtroom. The SEC, CFTC, and Mango Labs LLC have all filed civil suits against Eisenberg, further complicating the situation. It’s a battle for the very soul of DeFi – a fight that will determine if this innovative financial system can truly thrive within the boundaries of the law.

Crypto Trader Accused of $110M Theft Faces US Criminal Trial