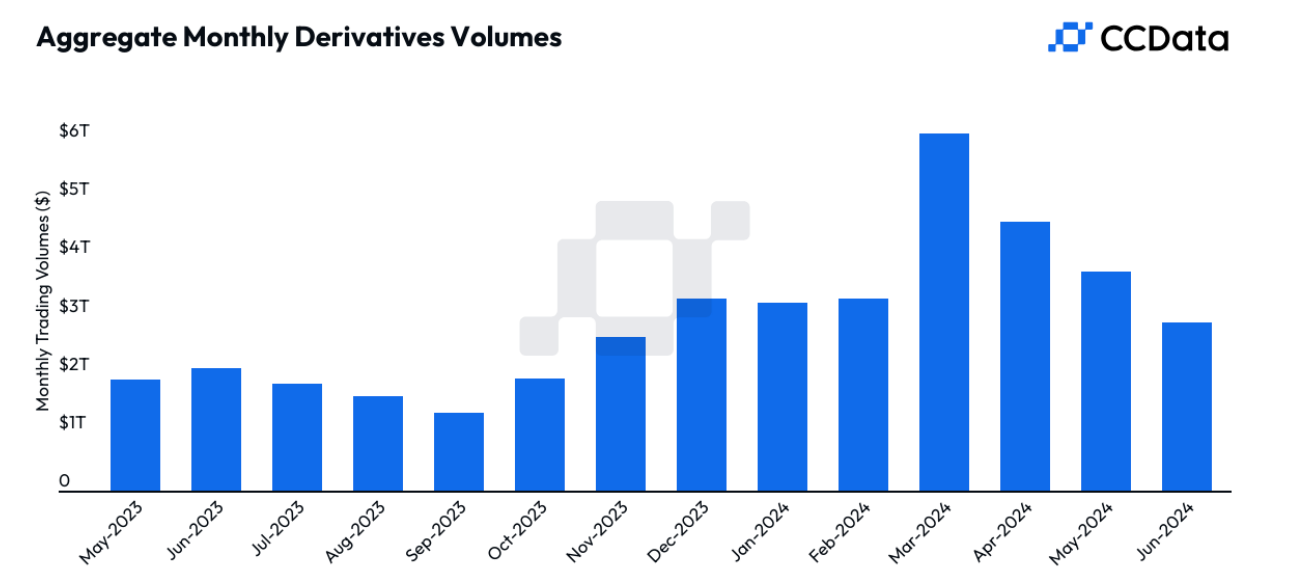

Crypto trading volumes on centralized exchanges are plummeting. June saw a big drop in both spot and derivatives trading volumes, per a report from CCData.

This decline has been steady since March 2024, when digital asset volumes hit an all-time high of $9.05 trillion. By June, the volume fell by 21.8% to $4.22 trillion.

Bitcoin and Ethereum stayed mostly stagnant, dragging the overall trading volume down with them. June was the third consecutive month of declining trading volumes on centralized exchanges.

The combined spot and derivatives trading volume fell by 21.8%, reaching $4.22 trillion. Open interest on derivatives exchanges also saw a decrease in June.

It dropped by 9.67% to $47.11 billion, following a wave of liquidations. This has continued into July. Coinbase had a dramatic drop in its open interest, plummeting by 52.1% to $18.2 million.

Binance, though maintaining the largest position among centralized exchanges, still saw its open interest decrease by 9.93% to $19.4 billion.

CME’s institutional volumes didn’t escape this decline either. After a strong performance in May, June’s total futures trading volume on CME fell by 11.5% to $103 billion.

BTC options trading volume dropped by 28.2% to $1.50 billion, and ETH options trading volume faced an even steeper decline of 58.0%, falling to $408 million.

The approval of spot Ethereum ETFs in May spurred a huge trading activity, which cooled off in June. The exchange market share is also changing.

Compared to December, Bybit, Bitget, and HTX saw the largest increases in market share, rising by 2.01%, 1.74%, and 1.43%, respectively.

From the second half of 2023 to the first half of 2024, Bybit, Bitget, and Gate.io showed the biggest gains, increasing their market share by 4.07%, 3.47%, and 2.71%, respectively.

On the other side, Binance’s market share dropped from 40.4% in July 2023 to 31.2% in June 2024, a decrease of 9.16%. But average funding rates across the four analyzed exchanges stabilized slightly, recovering from the previous month’s negative rates.

A negative funding rate is typically a bearish signal, where short position holders pay long position holders. However, as Bitcoin recovered and got back above $60,000, the bulls came back.