A CryptoQuant analyst believes a significant pullback for Bitcoin could be inevitable based on the net taker volume indicator data.

Bitcoin Net Taker Volume Has Plunged Into Negative Zone Recently

As CryptoQuant Netherlands community manager Maartunn explained in a post on X, the BTC net taker volume has recently turned red. The “net taker volume” refers to a metric that keeps track of the difference between the taker buy and taker sell volumes of Bitcoin on the futures market.

When the value of this metric is positive, it means that the taker buy volume exceeds the taker sell volume right now. Such a trend implies a bullish mentality is dominant among the investors currently.

On the other hand, negative values suggest the majority shares a bearish sentiment, as the selling pressure in the sector appears to be higher at the moment.

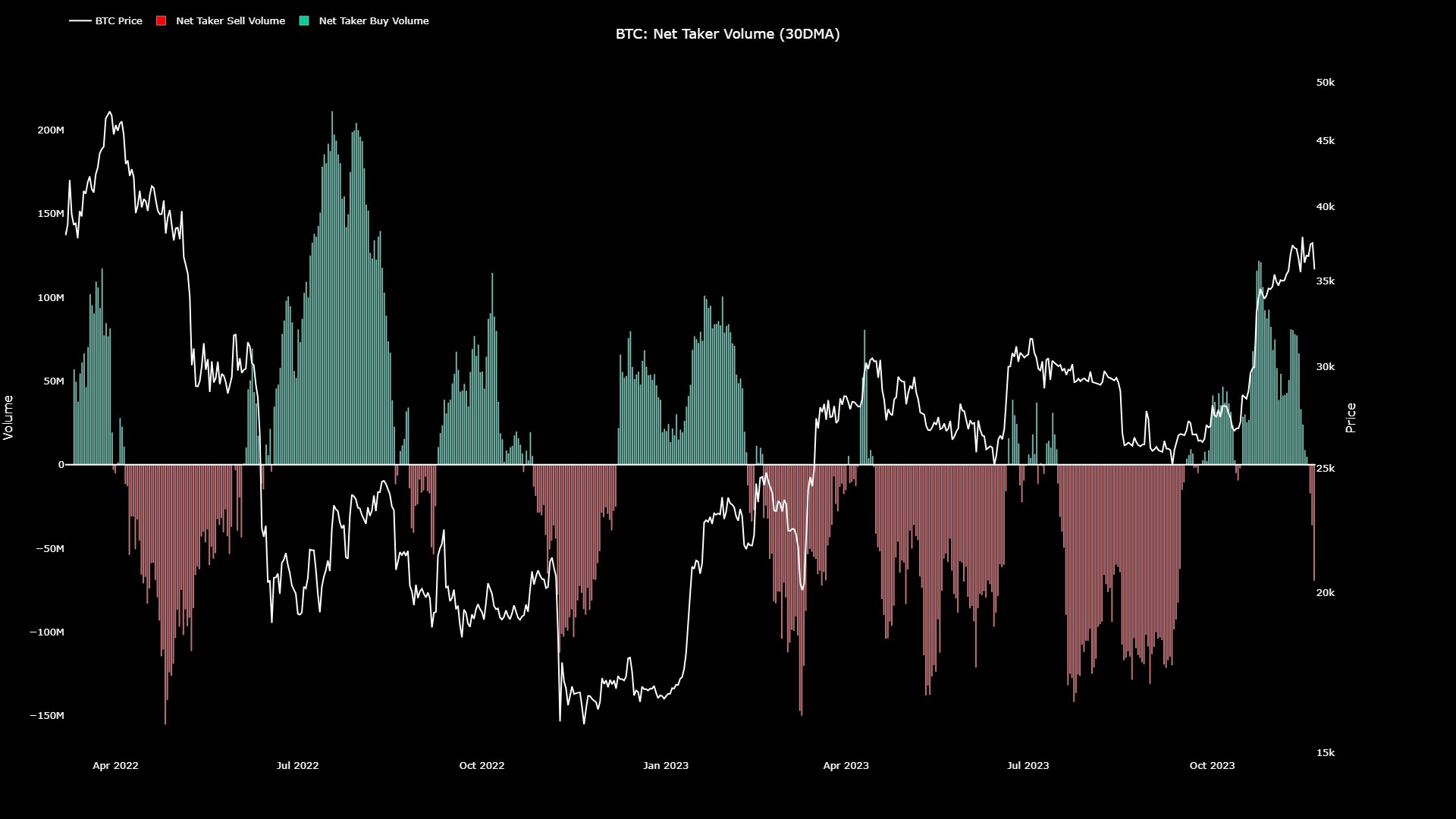

Now, here is a chart that shows the trend in the 30-day moving average (MA) Bitcoin net taker volume over the past couple of years:

As displayed in the above graph, the 30-day MA Bitcoin net taker volume was highly positive when the latest rally first occurred. This naturally suggests that a high amount of buying pressure was present in the sector.

The chart shows that such indicator values also accompanied many other surges in the cryptocurrency during the past couple of years. Still, as soon as the metric dropped, the price hit a local top.

Recently, the earlier significantly positive 30-day MA net taker volumes started disappearing, and now, the indicator has taken on a negative shade. This could be bad news for Bitcoin, as previous periods where taker sellers assumed command led to the asset observing notable bearish momentum.

Some exceptions have been to this, like the net taker volume briefly turned negative when this rally kicked off. However, these instances have had the market leaning towards the other side to a very minimal degree, which isn’t the case this time.

The indicator has only just turned negative, so it certainly doesn’t have the duration on its side yet, but the level it has plunged to is quite sizeable. “A significant pullback is inevitably on the horizon,” warns Maartunn.

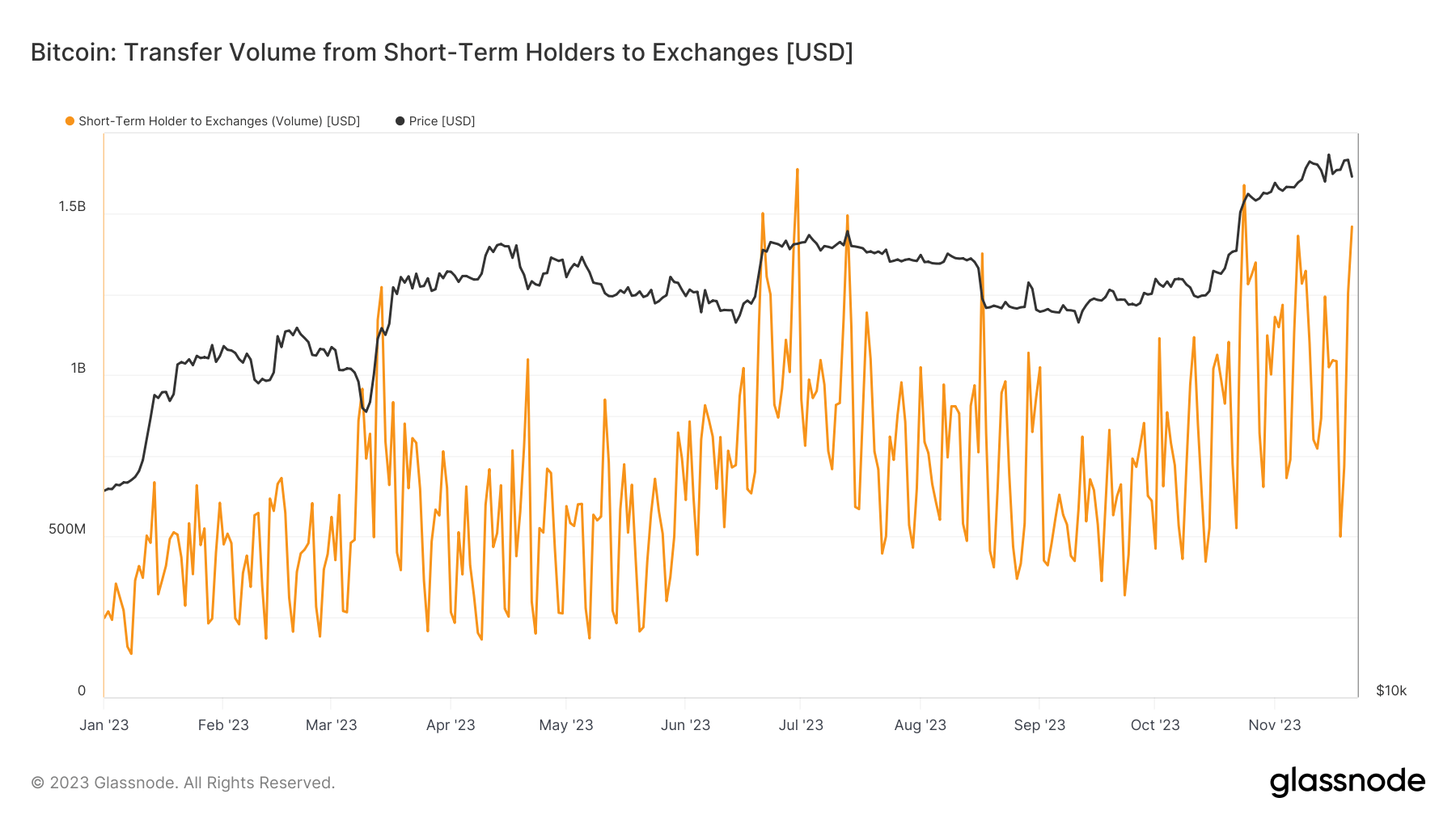

In some other news, the Bitcoin short-term holders (investors holding since less than 155 days ago) transferred a large volume towards exchanges yesterday, as analyst James V. Straten has pointed out.

Investors usually transfer to these platforms for selling purposes so that these deposits could have been a sign of a selloff in the market. The short-term holders transferred $1.5 billion to exchanges yesterday, making it the fifth biggest selloff of the year.

BTC Price

At the time of writing, Bitcoin is trading at around $36,600, up 1% in the past week.