CryptoQuant has measured the next market mood based on a key optimism indicator. Bitcoin holders are at the peak level of optimism and now have to choose between waiting for an extended bull market or taking profits and reducing risk. Holders are now in the profit-sentiment threshold, which may set the pace for the next move of the entire crypto market.

Bitcoin holders that are in the money are near peak levels, after the successful 2024 bull market. BTC still holds above $62,000 even after the recent downward pressure and has recovered well in the past week. At this stage in the market, more than 95% of all long-term buyers for BTC are in profit, barring the latest purchases at an all-time high. Even short-term buyers from the last 12 months are easily in the green.

CryptoQuant suggests that the choice to hold is peak market optimism, only rarely seen during previous bull markets.

The CryptoQuant analysis also shows the BTC market may be overheated. The current price level also shows BTC dominance near its higher range, at 53.6% of the entire crypto market capitalization.

CryptoQuant Notes Whales Absent from Exchanges

Some of the large-scale traders that usually fuel selling are absent from the market, shows additional CryptoQuant research. Whale wallets with 1,000 to 10K BTC are not depositing their funds to exchanges, instead choosing to hold.

This investor behavior may indicate that the key traders are overwhelmingly optimistic and await a better time to sell, instead of realizing profits.

BTC Sentiment Changes Within Days

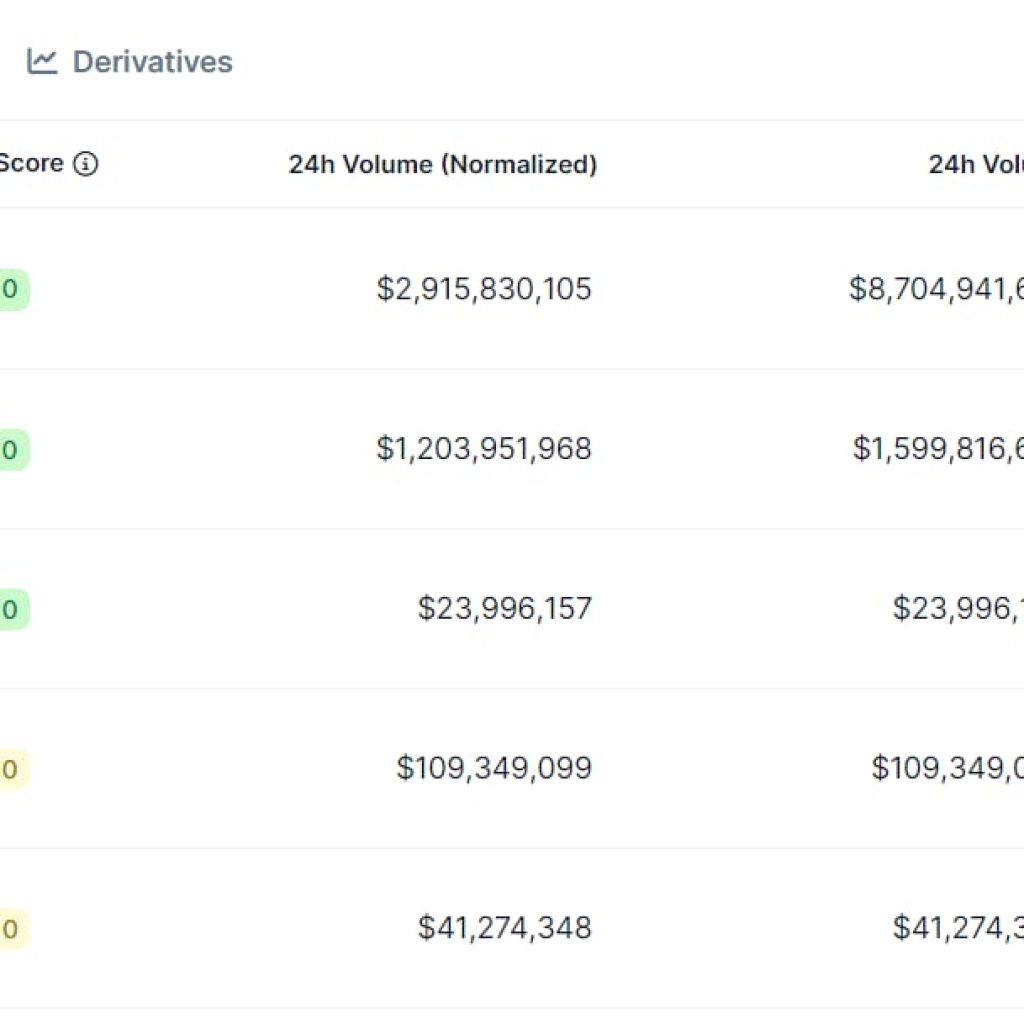

The latest few upswings of BTC also happen on relatively low volumes. BTC trading is now established at a baseline between $15B and $30B per day, with a rare hike to $50B.

In the short term, BTC trading is still optimistic, with sentiment in the zone of “greed”. Trader behavior also shifted quickly after the recent correction, where sentiment briefly dipped to “fear”.

Even during corrections, BTC remains resilient and so far liquidations are relatively low, leading to fast consolidation and recovery. Other sentiment metrics see the same situation where bullish and bearish moods are at a balance, waiting for news to tip the scales.

Even a few days can make a difference, with more bullish attitudes before the latest move to $62,000.

BTC sentiment in the short term changes fast, and even the smallest signs are taken into account. Bitfinex trading is one of the factors that reveals the preferences of BTC whales. The slight price premium on Bitfinex is considered a signal for a potential price bounce.

BTC sentiment is still based on centralized trading. Despite the appearance of DeFi on the Bitcoin chain, the novelty factor is not enough to boost demand. BTC also commands the altcoin markets, as any downturn in BTC immediately affects other assets.

Miners Show Signs of Accumulation, Keep Scarce New Coins

Miners are showing signs of confidence in Bitcoin’s future and are trying to retain coins after the latest Halving. Miner statistics shows the lowest selling since the bear market lows, when BTC traded at $16,000-$18,000.

At the current price range, BTC mining is slightly profitable. Not selling to cover costs means miners can acquire and hold even more scarce new BTC with no trading or transfer history.

With more heists, new BTC is becoming valuable, wince its origin can be proven. Using BTC in mainstream investments like ETF or funds also means new coins show premium demand. Network fundamentals are also much stronger and may indicate an extension of the bull market.

Miners also decreased their activity in the past day, slowing down mining by 7.5%. The slowdown arrives ahead of the next difficulty calculation event, and may mean the next two weeks will have easier block production. This is yet another sign miners are attempting to get more of the 3.25 BTC block reward. Currently, miners also have increased revenues from fees, due to increased network usage.

Bitcoin fees range at a usual rate of 2.88M per day, with anomalies raising daily fees to as much as 75M per day.