Bloomberg Intelligence senior macro strategist Mike McGlone thinks the time of large Bitcoin (BTC) pumps is over.

McGlone tells his 59,400 followers on the social media platform X that Bitcoin’s volatility has more room to decline than most traditional assets, which could reduce the top crypto asset’s relative risk.

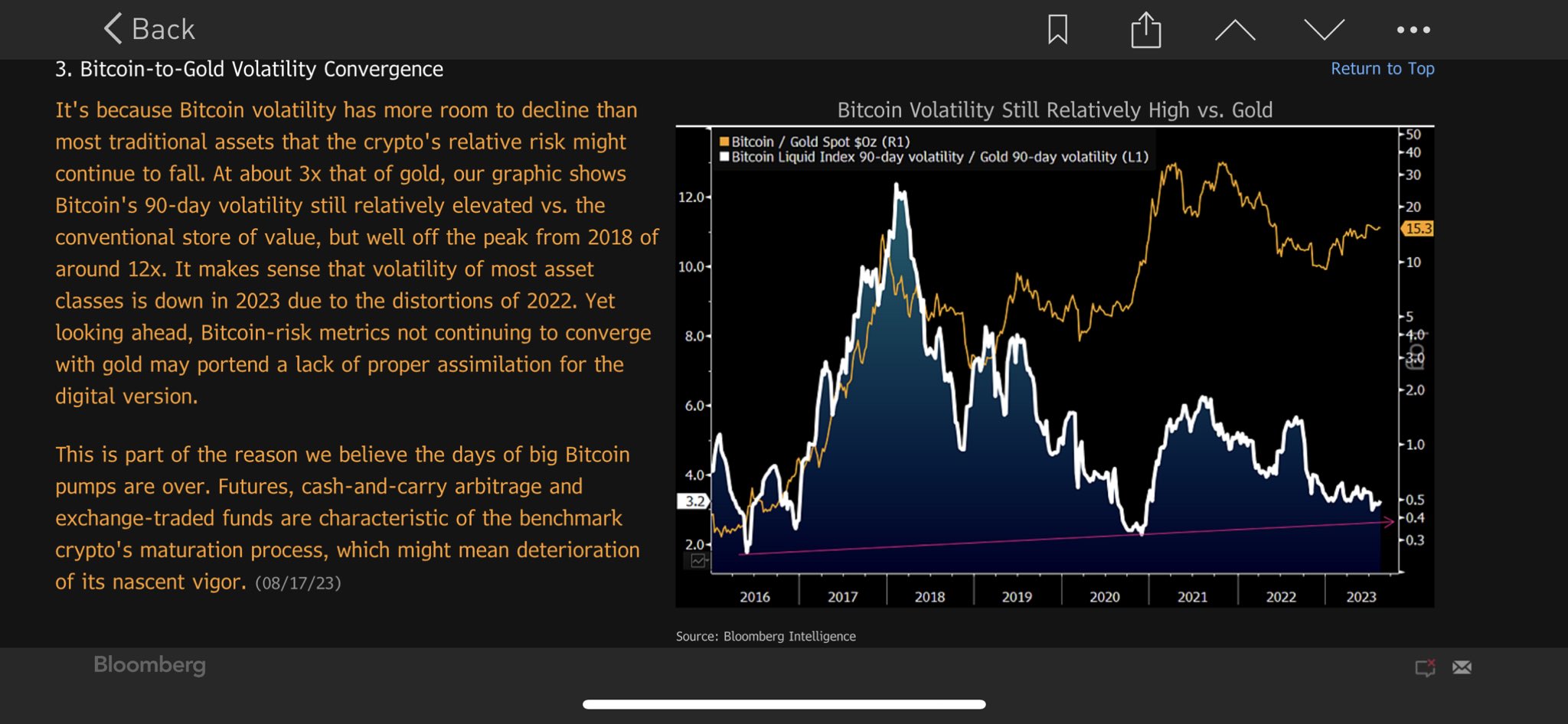

“At about 3x that of gold, my graphic shows Bitcoin’s 90-day volatility still relatively elevated vs. the conventional store of value, but well off the peak from 2018 of around 12x.”

The analyst argues that Bitcoin is going through a maturation process and a “deterioration of its nascent vigor.” He also warns that BTC could be facing an elongated retracement period.

“About 10% guaranteed return in two years may change everything – the last time the US Treasury two-year note yielded about 5% was before the financial crisis and birth of Bitcoin, which may portend the headwinds facing most risk assets. My analysis focused on 100-week moving averages shows mostly downward biases, notably vs. the steepest Treasury yield competition in almost two decades.”

Bitcoin is trading at $26,109 at time of writing. The top crypto asset by market cap is down 0.11% in the past 24 hours and more than 11% in the past seven days.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Days of ‘Big Bitcoin Pumps’ Are Over, According to Bloomberg Macro Strategist – Here’s Why appeared first on The Daily Hodl.