Demand for Bitcoin options has been balanced between bulls and bears, meaning whales remain unconviced.

Bitcoin (BTC) experienced a 23% gain in the five days ending Feb. 28, but BTC options traders are reluctant to adopt a bullish stance. This is partly due to the fact that the last time Bitcoin incurred a 5% weekly loss was more than five weeks ago, leading to a demand for downside protection.

Concerns arise among investors about the potential decline in the heavy inflow into spot Bitcoin exchange-traded funds (ETF), which could trigger a price correction. This suggests that these traders are either unconvinced by the current bull run or perceive no need for leverage in the face of macroeconomic uncertainty.

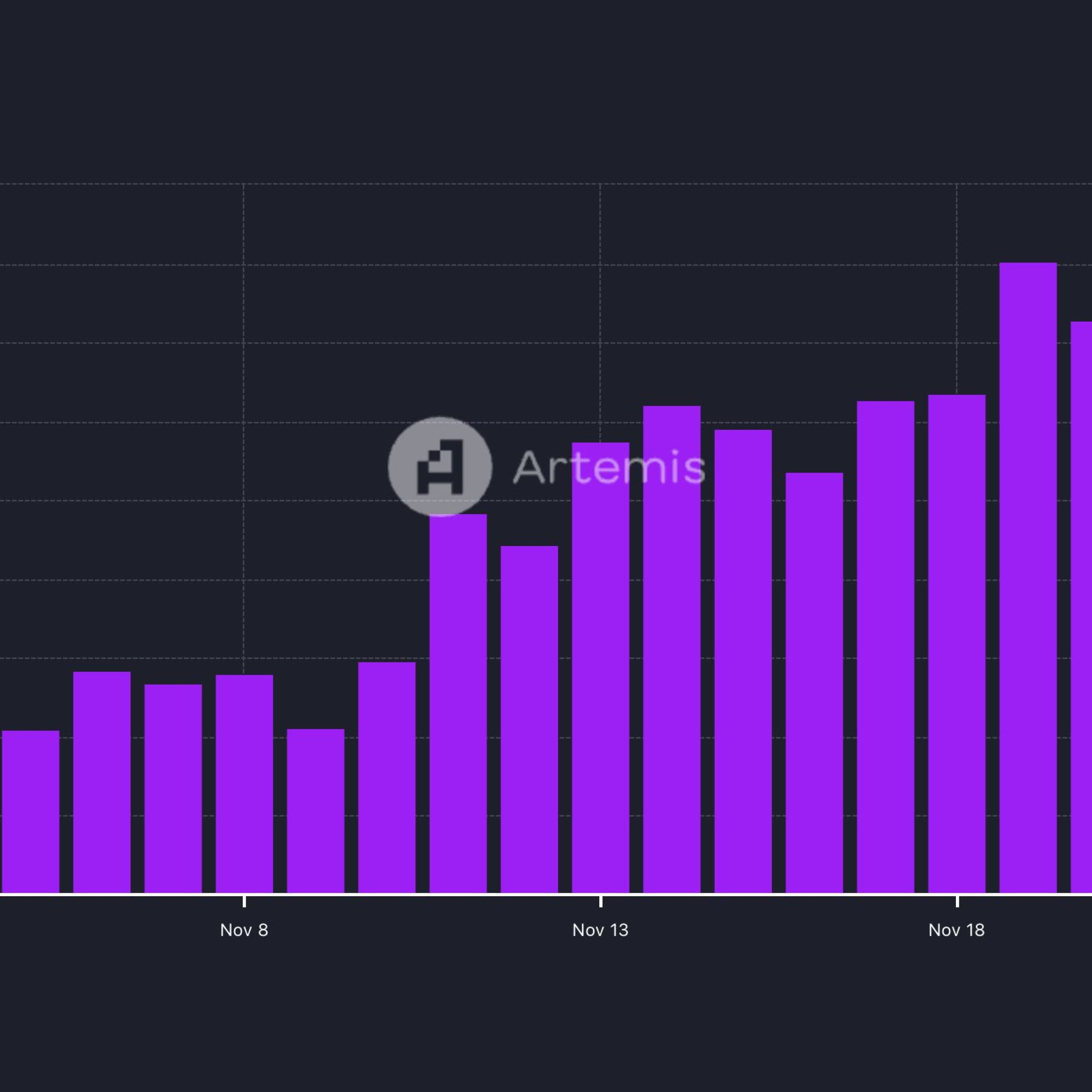

On Feb. 28 alone, U.S. Bitcoin ETFs saw a net inflow of $673 million, accumulating a total of $7.4 billion in net deposits since their launch on Jan. 11. Bloomberg's senior ETF analyst, James Seyffart, reported this information, highlighting that only 150 ETFs have ever surpassed the $10 billion mark in assets under management. Notably, BlackRock's iShares Bitcoin ETF already boasts over $9 billion in assets, according to Nate Geraci, co-founder of the ETF Institute.