Dogecoin is still gaining traction among retail investors despite not rallying as hard as some other altcoins in the crypto market. These retail investors have been placing large buy orders on the open market which has managed to drown out the sell pressure of the last few days.

Dogecoin Buy Orders Outpace Sell Orders

In an interesting twist of events, Dogecoin buyers are becoming the dominant players in the meme coin. This turn in dominance is proven by the order book data across top exchanges which show a very large buy wall compared to that of sellers.

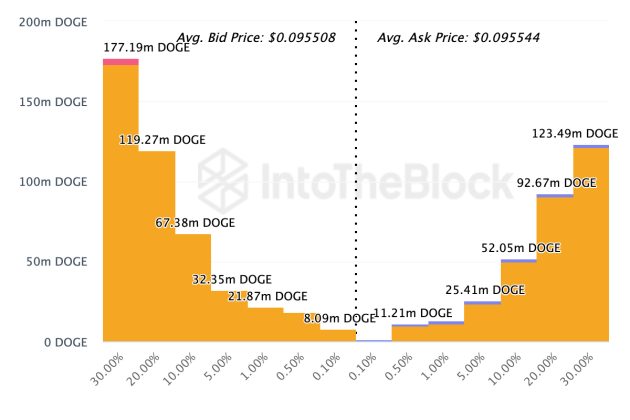

IntoTheBlock shows on its Exchange-Onchain Market Depth page that the Dogecoin bidders are way more than the askers. The figures for this are currently sellers with orders amounting to 318.8 million DOGE at an average asking price of $0.095544.

In contrast, the buy orders surmount the sellers with 444.28 million DOGE in open buy orders at an average price of $09.95508. This means there is demand for Dogecoin up to the tune of 125.48 million DOGE in the open market currently.

This is a significant increase from the previous day’s figures where buyers outpaced sellers by just 61 million DOGE. This goes to show that demand for Dogecoin is still very high and a single catalyst could set it off towards new 2023 highs.

DOGE Whales Coming Out To Play

Retail investors are not the only ones looking to take advantage of a potential price recovery for Dogecoin. IntoTheBlock’s large transaction data also points to large DOGE whales starting to rouse from their slumber and joining the party.

Between Sunday, December 10, and Monday, December 11, there was an uptick in the number of large transactions being carried out on the network. These large transactions are those carrying at least $100,000 and above. In this timeframe, the total number of large transactions sent was from 1,460 to 1,780, translating to a 20% increase in large transactions. This increase in large transactions saw the large transaction volume go from $1.35 billion to $1.62 billion.

This rise in retail buy bids in addition to the rising volume of large transactions paints a very bullish picture for the Dogecoin price. If historical performance holders, then DOGE could be seeing a delayed rally which could see its price finally cross $0.15.

For now, the meme coin is still facing hefty resistance at $0.1 where there have been large sell-offs and multiple rejections. However, if DOGE is able to surmount this level and turn it into support, the bulls will regain total control.