In a notable development in the cryptocurrency market, DYDX, a prominent decentralized exchange, has unlocked 33.3 million DYDX tokens, valued at approximately $98 million.

The event, closely monitored by FOMOonchain, represents a significant 12.34% of the total circulating supply of DYDX tokens. The unlock has garnered attention due to its potential impact on the market and the value of DYDX tokens.

Details of the DYDX Token unlock

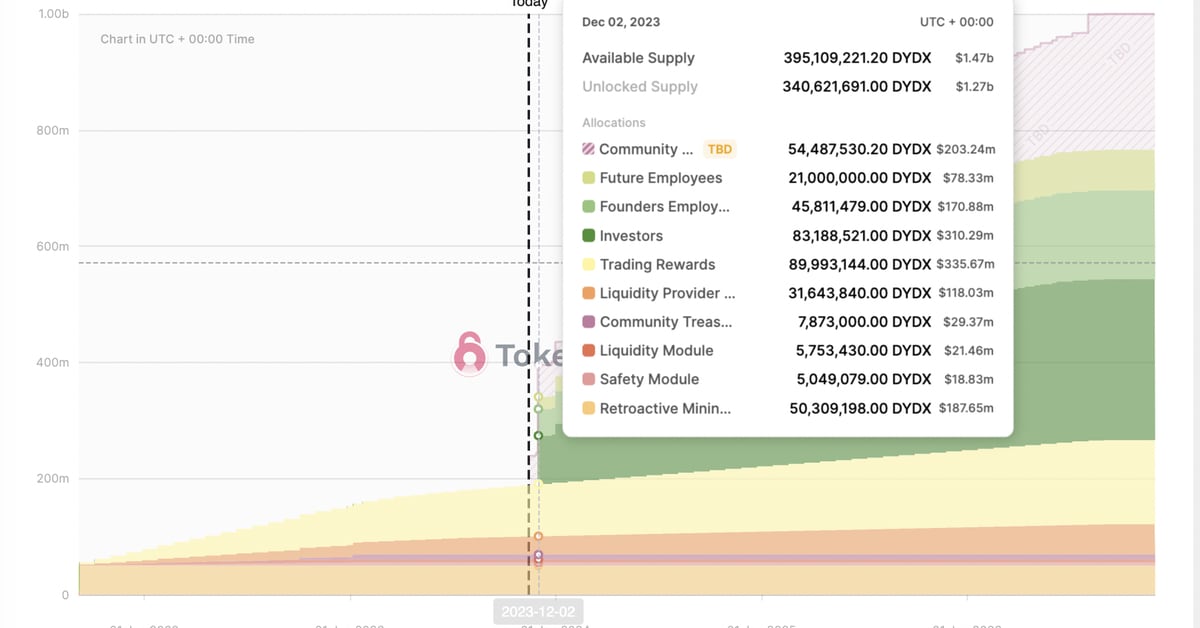

The unlocking of 33.3 million DYDX tokens is a substantial event for both the platform and its token holders. Valued at around $98 million, the release of tokens into the market could have various implications for the token’s price and liquidity. The amount unlocked constitutes a significant portion of the circulating supply, making it a noteworthy occurrence in the cryptocurrency trading community.

The decision to unlock these tokens is part of DYDX’s planned token distribution strategy, which is often outlined in the project’s whitepaper or tokenomics. Such unlocks are typically scheduled events and are closely watched by investors and traders for their potential impact on the market. The release of a large number of tokens can lead to increased trading activity and possibly affect the token’s price, depending on how the market absorbs the additional supply.

Market implications and investor sentiment

The recent unlocking of 33.3 million DYDX tokens, a significant portion of the circulating supply, has elicited mixed reactions within the cryptocurrency market. For some investors, this event is seen as a positive development, presenting opportunities for increased liquidity and potential entry points for buying. The infusion of a substantial number of tokens into the market is often viewed as a chance to capitalize on potential shifts in token dynamics and market trends.

However, other investors and market analysts express concern over the potential impact of this large-scale token release on DYDX’s price. The sudden increase in available supply can lead to volatility and uncertainty regarding the token’s value. Such events test the market’s capacity to absorb new assets without destabilizing existing price structures, making it a critical moment for both long-term holders and prospective buyers of DYDX tokens.

Market analysts and investors will be closely monitoring the price of DYDX tokens following the unlock to gauge the market’s reaction. How the market absorbs the additional supply could provide insights into the overall sentiment towards DYDX and its prospects. It is not uncommon for token prices to experience volatility following such significant unlock events, as the market adjusts to the new level of supply.

Conclusion

The unlocking of 33.3 million DYDX tokens marks a pivotal moment for the decentralized exchange and its stakeholders. As the market responds to the influx of tokens, it will be crucial for investors and traders to stay informed and make calculated decisions. The event highlights the dynamic nature of tokenomics in the cryptocurrency world and the importance of understanding the implications of token distribution strategies. As DYDX navigates the significant phase, the cryptocurrency community will be keenly observing the outcomes and their long-term impact on the platform’s valuation and market presence.