The European Central Bank (ECB) can’t find common ground on interest rate cuts, creating confusion. Officials have mostly aligned on a 2% inflation goal, but now, opinions diverge on how to proceed as they near that target.

Friction among ECB policymakers was obvious last week in Washington during discussions about the global economy. Topics ranged from interest rates and inflation outlooks to the ECB’s communication approach, and quantitative tightening.

What is behind the ECB discord?

With the next Governing Council meeting set for December, the debate is heating up. In the coming days, officials will analyze October inflation data and preliminary third-quarter GDP figures, which are expected to reveal Germany in recession. Again.

With market expectations split between a quarter-point and half-point rate cut in December, pressure mounts for clarity amid all this ambiguity. And the U.S. presidential election on November 5 only adds to the unease.

ECB President Christine Lagarde kicked off the debate, assuring everyone they are “on the right track of disinflation,” but emphasizing caution. She warned against making premature decisions, stating, “Direction of travel is clear, pace to be determined.”

But ECB members, each with distinct views, made themselves heard. Bundesbank President Joachim Nagel cautioned against quick cuts. Austria’s Robert Holzmann backed a quarter-point move in December, and Lithuania’s Gediminas Simkus saw no need for a 50 basis point cut.

Vice President Luis de Guindos and Executive Board member Isabel Schnabel also weighed in. They made it clear that disagreement extended across inflation outlooks, economic risks, and interest rate strategies. Central bank chiefs from Portugal, Germany, and Spain each offered unique perspectives.

The Portuguese central bank chief Mario Centeno argued the ECB should stay flexible, suggesting larger cuts if necessary due to sluggish investment, weak inflation history, and a soft labor market.

This approach might keep the eurozone from economic stagnation. “For an economy with 0.9% inflation over 10 years, we need the option of bigger steps,” said Centeno.

Balancing inflation targets and market signaling

ECB Chief Economist Philip Lane defended the inflation trajectory, saying disinflation is progressing and economic recovery is merely delayed. Still, concerns linger.

Belgian central bank head Pierre Wunsch played down recent drops in inflation to 1.7%—the lowest in three years—but refrained from endorsing cuts in December. Spain’s central bank chief, Jose Luis Escriva, added, “Risks to growth are clearly to the downside. But it’s not as clear that inflation’s path leans that way.”

The debate doesn’t just stop at rates. Members differ on how the ECB should communicate its future stance. Currently, the ECB pledges to keep its restrictive stance “as long as needed.” But this language, last debated in September, may be revised as early as December.

France’s Francois Villeroy de Galhau called for a shift to “soft signaling,” suggesting a gradual pivot to forward-looking forecasts instead of relying on monthly data. This approach would give markets more breathing room for interpretation and ECB officials more flexibility.

Another friction point? Quantitative tightening.

The ECB has been slowly letting bonds mature without reinvestment and plans to cease all reinvestments by year-end. The problem is if it keeps rolling off bonds while cutting rates, the central bank might send mixed signals.

Some officials argue that QT’s policy impact is minimal and serves as a safeguard for future economic crises. Meanwhile, those watching bond markets closely urge compensatory rate cuts to offset any tightening effect.

The neutral rate debate also resurfaced, with varying views on what level won’t push or slow growth. Centeno pegged it “at 2% or slightly below,” while Finland’s Olli Rehn referenced research estimating a range between 2.2% and 2.8%.

Market bets and IMF projections

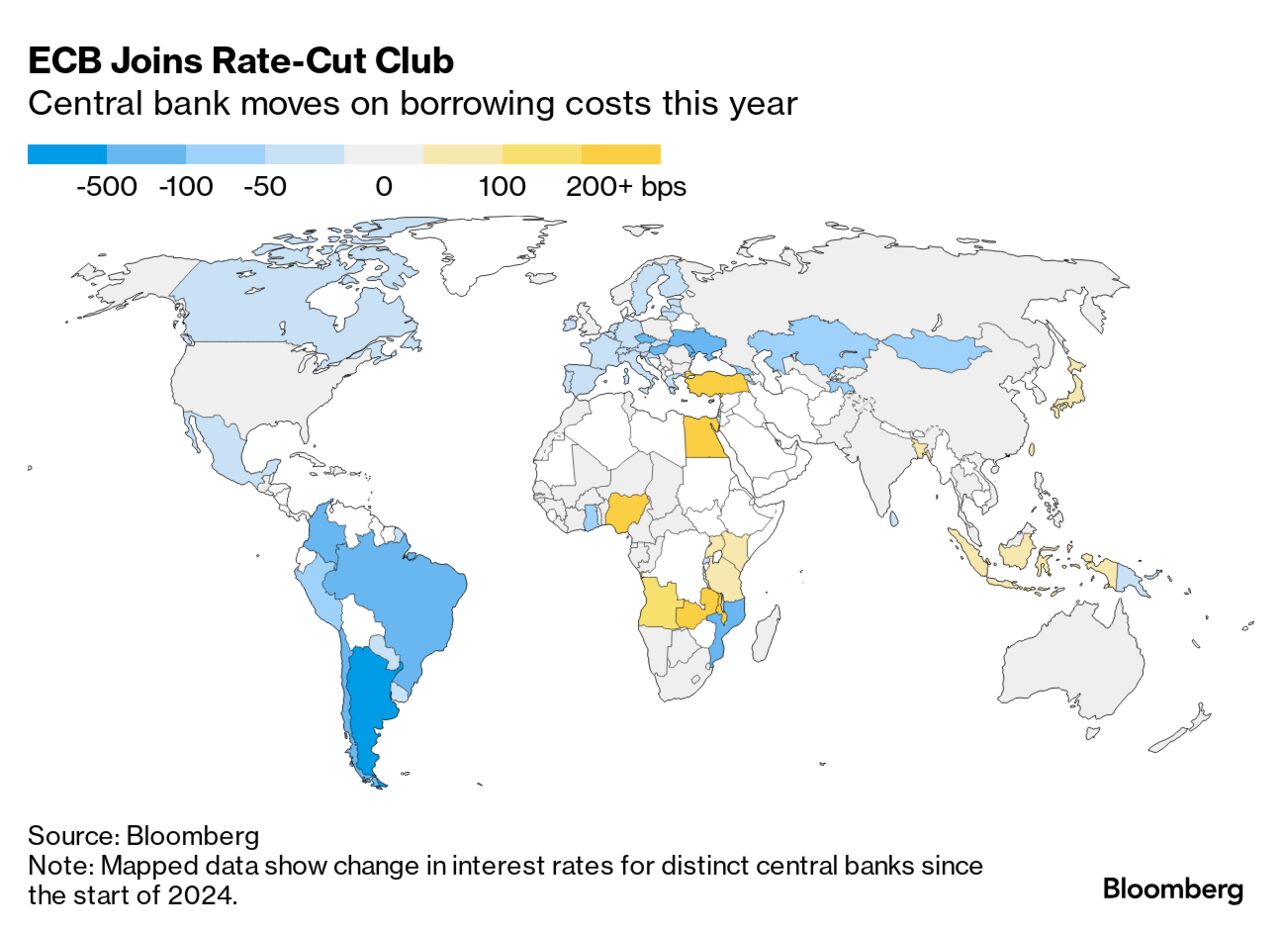

While ECB leaders argue, markets are already betting. Financial markets price in 32 basis points of cuts for December, with 58 basis points by January, indicating nearly a 30% chance of a half-point cut.

This reflects optimism that inflation will stabilize, as France’s Villeroy de Galhau hinted at the possibility of meeting the 2% goal as soon as early 2025. Governing Council member Holzmann backed this expectation, seeing the rapid decline in inflation as a sign that the ECB could cut rates sooner than anticipated.

Adding to the pressure, inflation dropped below 2% in September for the first time since 2021, thanks largely to falling energy costs. But there are concerns ahead, with service prices and wage growth still elevated.

Lagarde, though optimistic, reminded everyone to “be attentive to everything.” Domestic inflation and core services, which stayed around 3.9%, require close monitoring, especially as economic dynamics continue to shift.

Meanwhile, the IMF has made some low growth estimates for the Eurozone, with hits to Germany’s and Italy’s industries. “We’re all confident that 2025 is the year when we hit our target sustainably. But energy, domestic inflation, services… we’re not out of the woods,” said Lagarde.