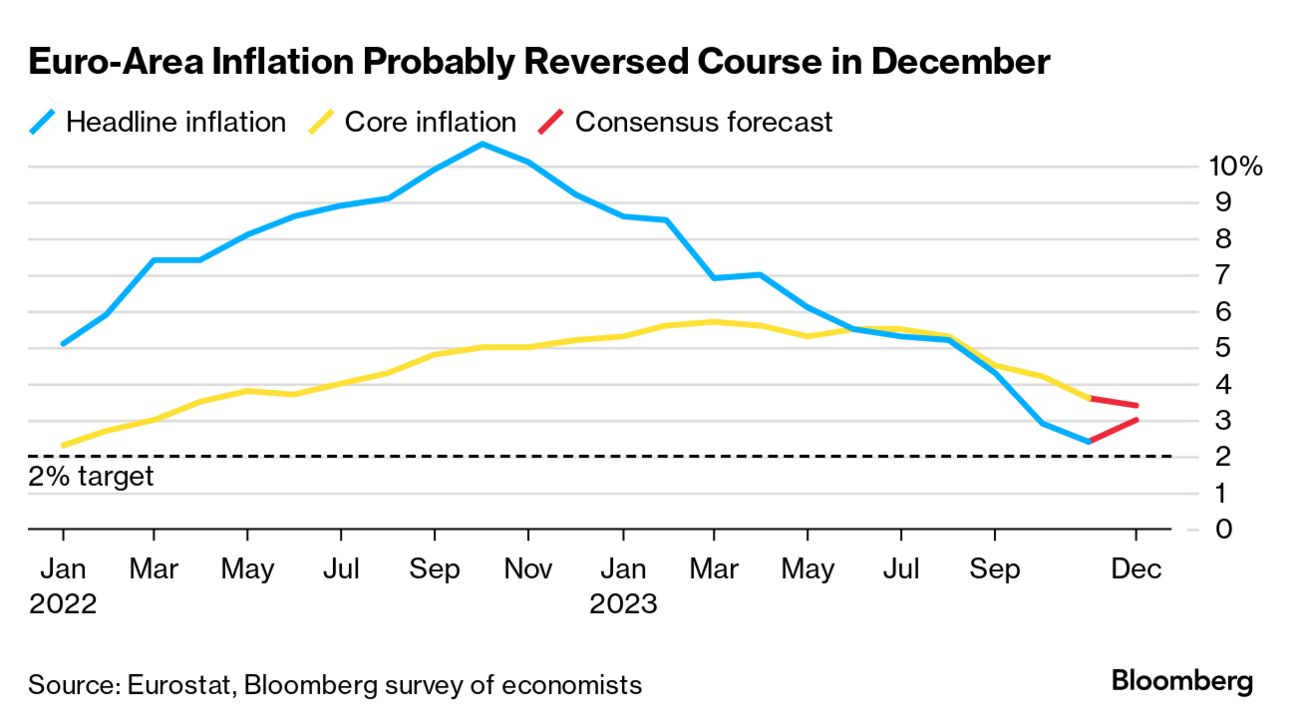

The European Central Bank (ECB) has revealed that its artificial intelligence (AI) model indicates a potentially faster decline in inflation within the euro area than the bank’s official projections. The statement was made by Philip Lane, the ECB’s chief economist, during a recent presentation. This marks the first time the ECB has publicly commented on forecasts generated by its newly implemented machine-learning model.

AI model contradicts official projections

The ECB’s AI model, developed by economists Michele Lenza, Inès Moutachaker, and Joan Paredes, incorporates approximately 60 variables to capture nuances that traditional algorithms might overlook. According to Lane, the AI-generated forecasts foresee inflation by June falling significantly below the bank’s official macroeconomic projections. This is notable as it brings the forecast closer to the ECB’s target of 2%, although Lane emphasized the substantial uncertainty surrounding these predictions.

The ECB’s official projection for inflation in the second quarter of the year stands at 2.7%, higher than the 2.3% anticipated by economists polled by Reuters. Interestingly, the AI model’s projections align more closely with the expectations of market analysts, just below the 2.3% mark. This discrepancy has the potential to impact investor sentiments, as some might interpret it as a signal for the ECB to consider interest rate cuts sooner rather than later.

Caution advised amidst uncertainty

Despite the AI model’s divergence from official projections, Lane cautioned against hasty conclusions. He highlighted the “wide distribution” of potential outcomes presented by the model, indicating a range of possibilities that call for a prudent approach. The chief economist emphasized the need to rely on actual data and refrain from making significant decisions based solely on the central point of the distribution.

“The models do say: ‘There are many possibilities here; wait for the data to tell you because you wouldn’t want to put all your bets on the center of this distribution’,” Lane stated during the presentation.

Shipping disruption’s limited impact on inflation

In addition to the AI model’s revelations, Lane addressed concerns regarding the recent disruption of shipping in the Red Sea. Despite the potential for supply chain disruptions and increased shipping costs, Lane reassured us that, as of now, the situation has not materially impacted Europe’s inflation outlook. He attributed this to the limited weight of shipping costs in the overall price index.

Investors anticipating a shift in the ECB’s stance based on AI-generated forecasts may find encouragement, especially if they foresee a potential adjustment in interest rates. However, the cautionary approach advocated by Lane underlines the need for careful consideration of the broader range of possibilities presented by the AI model.