In a recent interview with Fox News, renowned economist Harry Dent issued a dire prediction for the global economy, forecasting 2024 to be the year of the most significant financial crash in living memory. Citing a combination of overvalued markets, excessive stimulus spending, and artificial inflation of asset prices, Dent’s analysis paints a grim picture of the near future. With his reputation for contrarian yet often accurate forecasts, Dent’s warnings carry weight in financial circles.

Harry Dent Anticipates Severe Financial Turmoil in 2024

Harry Dent, known for his unconventional yet insightful market analyses, told Fox News that the current economic situation is “100% artificial,” driven by unprecedented levels of money printing and deficit spending amounting to $27 trillion over 15 years. This artificial inflation of the economy, according to Dent, sets the stage for a dangerous and inevitable downturn.

Amidst this backdrop, the U.S. economy in late 2023 displays a juxtaposition of growth and uncertainty. Yet, looming concerns persist, as unemployment rates may rise due to the Federal Reserve’s persistent interest rate hikes. This economic landscape sets a complex stage for 2024, with expert forecasts ranging from continued expansion to potential recession.

The yield curve spread between 10-year and 3-month Treasury rates suggests a 61% chance of a recession within the next year. The core of Dent’s argument revolves around what he terms the “everything bubble,” a phenomenon he asserts began in late 2021, post-COVID-19 pandemic.

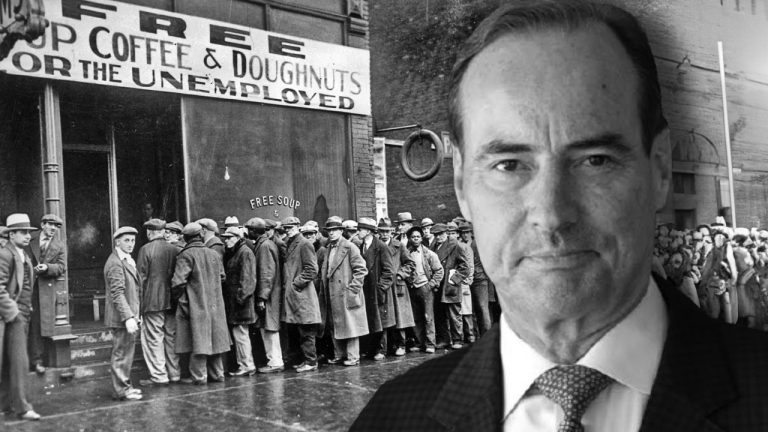

Unlike previous market bubbles, which were typically confined to certain sectors, Dent believes this bubble encompasses nearly all asset classes, making its potential burst far more devastating. Dent’s analysis points to the real estate and stock markets as prime examples of this overvaluation. He warns against complacency, advising that the impending crash will not be a mere correction but a catastrophic fall mirroring the Great Depression levels.

He predicts an 86% crash in the S&P and a 92% crash in the Nasdaq, with even greater losses in the crypto economy. “This is going to hurt the rich a lot more than the average person. The average person is going to lose their job for six months to two years. The average rich person is going to lose 50% to 80% of their lifetime accumulated net worth,” Dent told the news outlet.

Dent added:

They’re going to see the biggest comedown to reality. And then the next stage of the boom is the millennial boom, which will not be as long as the baby boom, but it’ll go into 2037 before we slow down again. That boom will be less rich-get-richer, it will be more the middle class catching up again.

Challenging the optimistic outlook of many investors and analysts, Dent criticizes the recent market rally, including the Dow Jones Industrial Average’s record highs. He views these as temporary and misleading, encouraging investors to “get out of the way” of the impending financial storm.

The Federal Reserve’s recent hints at ending its campaign against inflation and the possibility of rate cuts, according to Dent, will not prevent the looming crisis. He argues that the central bank’s efforts are too little too late, predicting a shift from disinflation to deflation, a scenario not seen since the 1930s.

Dent continued:

If I’m right, it is going to be the biggest crash of our lifetime, most of it happening in 2024.

A significant concern raised by Dent is the potential for a protracted economic slowdown following the burst of the “everything bubble.” He cautions that this could last for 12 to 14 years, exacerbating the wealth gap in America. Dent concludes with a somewhat optimistic note for the long term, predicting a recovery led by the millennial generation.

The economist forecasts a new boom period, less characterized by the rich getting richer, but more by the middle class regaining ground. This new phase, according to Dent, could extend until around 2037, offering a glimmer of hope after a period of intense economic turmoil.

What do you think about Harry Dent’s prediction concerning 2024? Share your thoughts and opinions about this subject in the comments section below.