In a recent move reflecting the ongoing foreign exchange crisis, Egyptian banks are intensifying restrictions on using credit cards for international transactions. This measure aims to conserve the country’s foreign currency reserves, a crucial step in the current economic landscape.

Egyptian banks tighten international card spending limits

Al Baraka Bank Egypt has recently adjusted its international credit card usage policies. The bank has established a new limit of EGP 7,750 for POS and e-commerce international purchases. Similarly, EG-Bank has set its international purchasing limit at EGP 3,000 for credit card transactions. These changes are part of a broader strategy by Egyptian banks to effectively manage the outflow of foreign currency.

This step follows a pattern of increasing restrictions imposed by Egyptian financial institutions. Since 2022, banks have been actively limiting credit card foreign currency spending. This is a response to the urgent need to halt the depletion of foreign currency resources, exacerbated by the disparity between the official and parallel market rates for the USD. Currently, the USD trades at EGP 30.9 in the official market and EGP 58.7 in the parallel market.

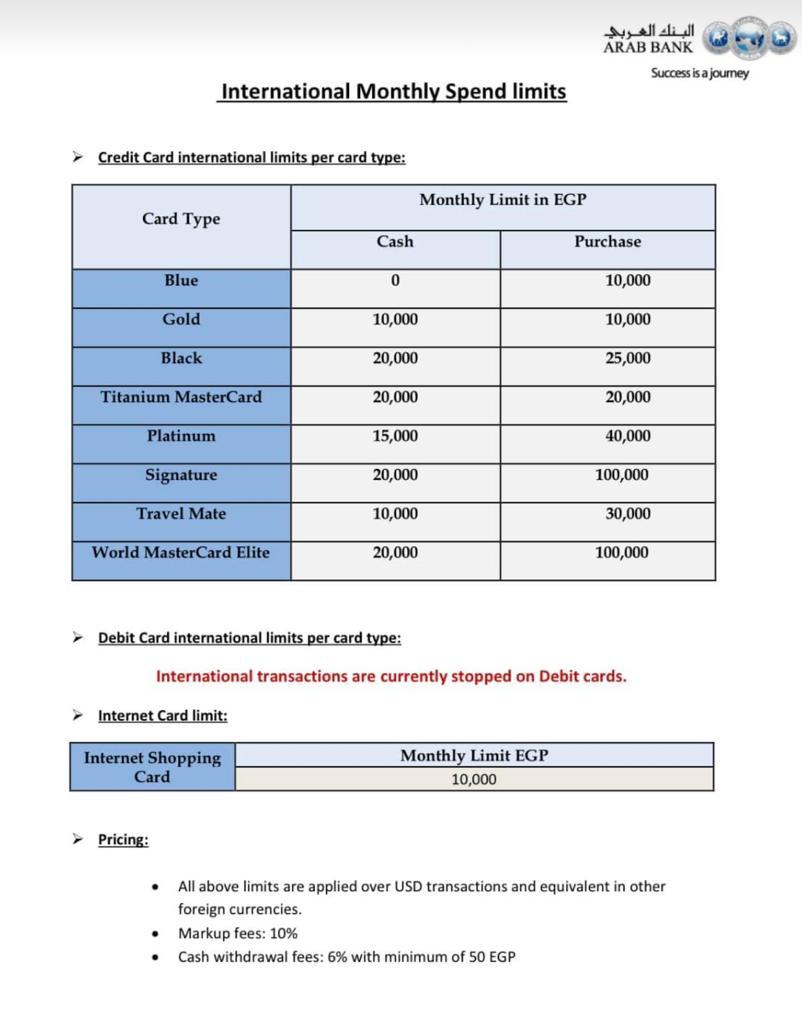

Commercial International Bank and Abu Dhabi Islamic Bank, among others to impose limits

Last week, the Commercial International Bank (CIB), Egypt’s largest private bank, and Abu Dhabi Islamic Bank Egypt joined the trend by reducing their credit cards’ foreign currency withdrawal limits. This move aligns with the Central Bank of Egypt’s instructions on 17 October to regulate credit card transactions in foreign currencies, amidst growing concerns over potential misuse.

In December, several banks, including the National Bank of Egypt (NBE), Banque Misr, and the CIB, took a significant step by suspending international transactions for newly issued credit cards for up to six months from the date of issuance. This decision was preceded by an earlier action on 9 October when local banks suspended hard currency cash withdrawals and purchases for debit card users.

Banks offering high-yield savings products to attract domestic liquidity

To counteract these restrictive measures and safeguard the savings of Egyptians, banks are introducing high-yield financial products. In January, NBE, Banque Misr, and the Arab African International Bank launched new savings accounts offering up to 23 percent yields. Additionally, on 4 January, NBE and Banque Misr announced the introduction of new Certificates of Deposit (CDs) with annual yields of 23.5 percent and 27 percent, respectively.

These offerings are a strategic move by banks to attract significant liquidity, which is anticipated to enter the market in January as previous CDs by NBE and Banque Misr reach maturity. This approach bolsters domestic financial stability by encouraging savings and investments within the country rather than seeking opportunities abroad.