Coinspeaker

ETH ETFs See $27M Inflows Despite Grayscale $2B Cumulative Outflows

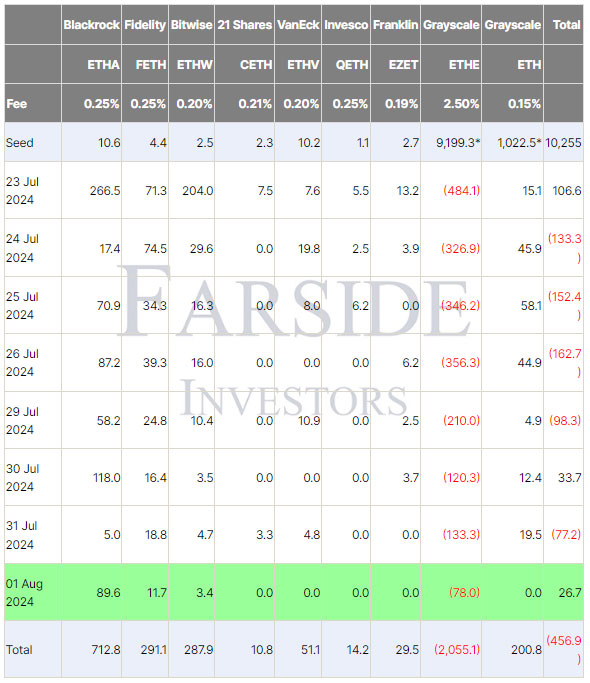

The daily net inflows into US spot Ether Exchange-Traded Funds (ETFs) have again turned positive, despite Grayscale Ethereum Trust (ETHE) outflows having exceeded the $2 billion mark. On August 1, 2024, Ether ETFs’ net inflow was at $26.7 million, mainly triggered by the large $89.6 million investment in BlackRock’s iShares Ethereum Trust (ETHA), according to Faride Investors data.

Photo: Farside Investors

In contrast, Grayscale’s Ethereum Trust saw $78 million in outflows on the same day, totaling over $2 billion since converting to a spot ETF. The conversion marked a shift for ETHE, which provided institutional investors Ether exposure as a trust before becoming a spot ETF on July 23, 2024.

Grayscale Ethereum Trust Outflows Continue

Before its conversion, ETHE managed $9 billion in Ether. As of August 1, outflows have topped 22% of the initial fund value. Mads Eberhardt, a senior analyst at Steno Research, anticipates that the substantial outflows from Grayscale’s ETHE will likely diminish by the end of the week. Eberhardt suggests that slowing outflows could act as a bullish signal for Ether prices.

“When it does, it’s up only from there,” Eberhardt wrote in a July 30 post on X (formerly known as Twitter). This optimism reflects the belief that reduced selling pressure could stabilize and potentially increase Ether’s price.

Earlier, on July 23, Will Cai, head of indexes at Kaiko, commented that ETH prices would be “sensitive” to inflows into the new spot products. This sensitivity is evident as ETH is currently trading at $3,158, an 8% decline since the ETF launches, according to TradingView data.

The fluctuations in ETH prices highlight the market’s responsiveness to changes in ETF flows. Investors and analysts are closely monitoring these dynamics, considering both the positive inflows into new ETFs and the ongoing outflows from Grayscale’s fund.

Ether ETFs Market Contrasts

While the positive inflows into new Ether ETFs show growing investor interest and confidence, the substantial outflows from Grayscale’s fund reflect some caution. However, analysts like Eberhardt remain optimistic that the tide will turn once the outflows subside, potentially leading to a price recovery for ETH.

As the market adjusts to these shifts, the future of Ether ETFs and their impact on ETH prices will be an area of keen interest. Investors will be watching closely to see if the positive inflows continue and if the outflows from Grayscale’s fund stabilize, setting the stage for a potential rebound in Ether prices.

Overall, the story of Ethereum ETFs is one of contrasts, with significant movements in both directions. The coming weeks will be crucial in determining whether the bullish outlook holds true and how the market adapts to these evolving conditions.

ETH ETFs See $27M Inflows Despite Grayscale $2B Cumulative Outflows