Coinspeaker

Ethena Labs Leverages Bitcoin to Enhance USDe Stability

This strategic decision not only diversified the collateral base of USDe but also tapped into Bitcoin’s robust market value and widespread trust within the crypto community.

Excited to announce that Ethena has onboarded BTC as a backing asset to USDe

This is a crucial unlock which will enable USDe to scale significantly from the current $2bn supply pic.twitter.com/FOZRWBrVZV

— Ethena Labs (@ethena_labs) April 4, 2024

Ethena’s strategy involves generating yields by shorting futures of cryptocurrencies such as Ether (ETH) and now BTC, which has proved both profitable and controversial. By pocketing funding rates from these shorts, Ethena has boasted an APY of 37% for its users. The integration of Bitcoin, with its larger open interest of $25 billion compared to ETH’s, is seen as a strategic move to enhance USDe’s scalability and liquidity, potentially increasing the synthetic dollar’s issuance capacity by more than 2.5 times.

The Methodology Behind the Move

Ethena’s cash-and-carry trade operations involve users depositing cryptocurrencies, including Ethereum and Bitcoin, which are then used to mint USDe. This USDe can be staked directly on Ethena’s platform or supplied to other DeFi platforms to earn additional yield. To know more about the innovative process of yield generation, check out our previous publication on Ethena.

The inclusion of Bitcoin in its strategy allows Ethena to mitigate the volatility inherent in cryptocurrency markets. By holding BTC and shorting BTC perpetual futures contracts simultaneously, Ethena aims to balance any losses from BTC’s price fluctuations with gains from short positions, ensuring USDe’s value remains stable.

Market Reaction and Future Prospects

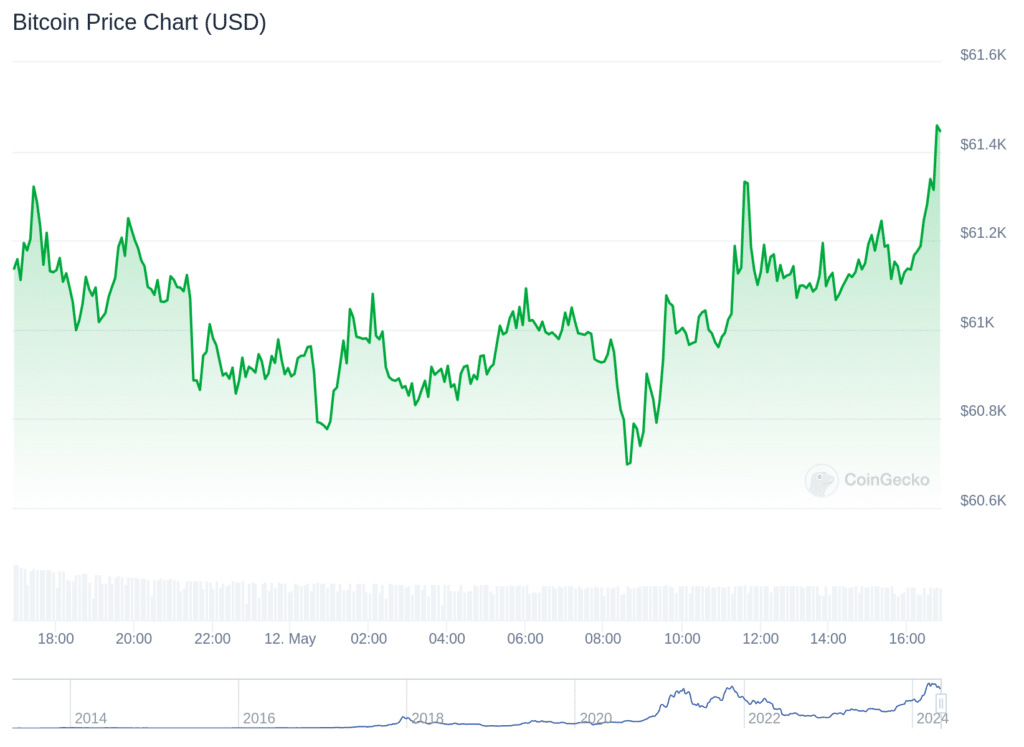

Despite some initial market volatility reflected in an 8% drop in ENA token following the announcement, the broader sentiment towards Ethena’s strategic pivot has been optimistic. Market analysts highlight the potential for this move to bolster USDe’s position as a safer alternative to conventional stablecoins and scale its market presence significantly.

Ethena’s innovative approach, which now includes Bitcoin as collateral, distinguished its synthetic dollar product from conventional stablecoins by reducing reliance on the traditional banking system. With a $2 billion market cap, USDe ranks among the top five US dollar-denominated products, trailing only behind giants like USDT, USDC, DAI, and FDUSD.

Ethena (ENA) Price Analysis

Photo: TradingView

The ENA/USDT price is consolidating around the $1.00 mark, with Fibonacci retracement levels drawn, indicating potential support/resistance areas. As for the last visible candlestick, the price is slightly below the $1.00 level. The RSI is hovering around 40.79, which suggests that the asset is neither overbought nor oversold. The DMI shows the ADX (yellow line) above 20, indicating a moderate strength, with -DI (red line) potentially crossing above +DI (blue line), suggesting that the downtrend can be stronger than the uptrend in the near term. However, the consolidation around the $1.00 level suggests a balance between buyers and sellers, indicating indecision in the market. Overall, the price momentum is weak with a slight bearish bias of the last data point on the chart.

Looking Ahead

As Ethena Labs continues to refine its strategies and expand its collateral options, the integration of Bitcoin is seen as a pivotal step towards achieving a more resilient and scalable synthetic dollar. This move not only enhances the safety and stability of USDe for token holders but also sets a precedent for integrating crypto assets in maintaining the peg and integrity of synthetic financial products. The crypto community eagerly watches how this strategic decision unfolds in the broader context of DeFi’s growth and maturity.