Ethena Labs believes that financial instruments tied to the U.S. dollar offer a new frontier for markets outside the United States.

Financial instruments tied to the United States dollar offer a new frontier for markets outside the country. That’s the bet of Ethena Labs, a startup getting $14 million in funding for an Ethereum-based synthetic dollar.

Ethena’s team disclosed the funding on Feb. 16, backed by venture capital firm Dragonfly, among other investors. An earlier round of investment in 2023 landed the startup $6 million from Binance Labs, Gemini, Bybit, Mirana Ventures, OKX Ventures and Deribit to bootstrap decentralized finance solutions built on the Ethereum network.

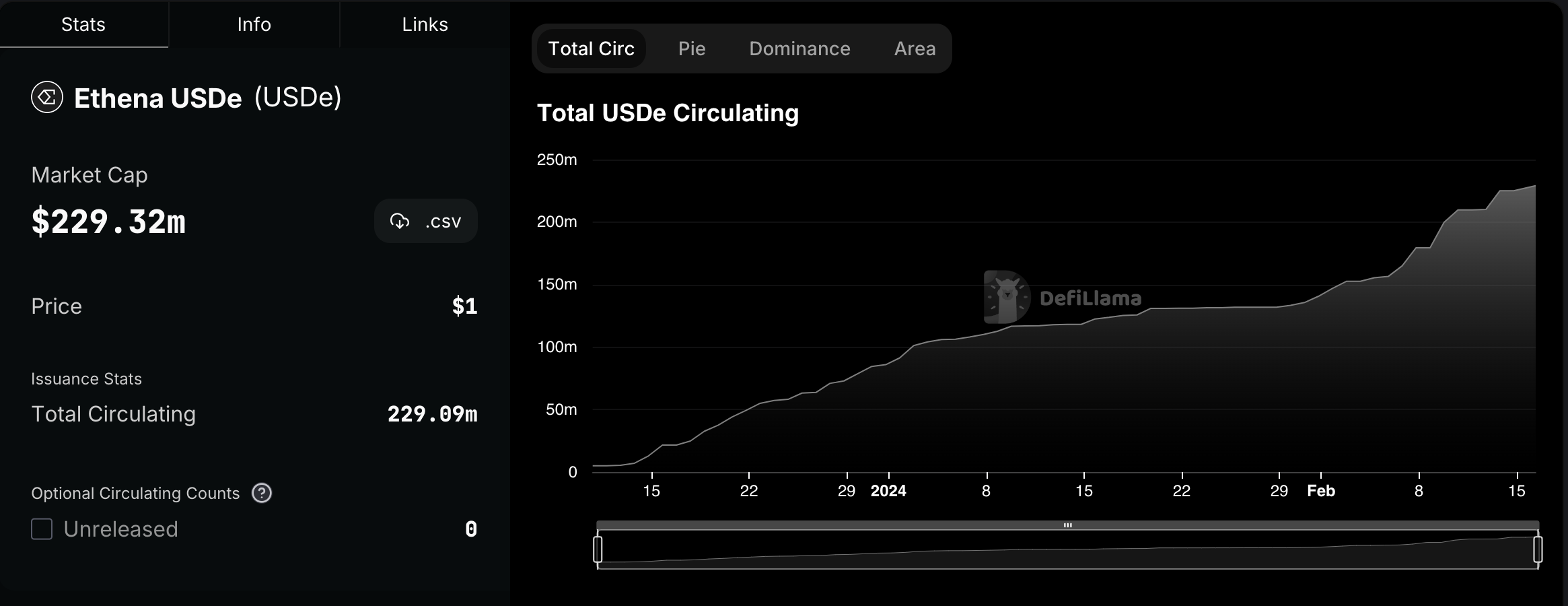

The capital will support the USDe, a synthetic dollar backed by delta-hedging strategies using staked Ether (ETH) as collateral. The product has amassed $200 million in total value locked since its launch in December, according to data from DefiLlama.