Despite Ethereum 2.0 staking becoming increasingly popular among holders, long-term stakers have faced an average loss of around 31%. Furthermore, over the past ten weeks, the realized value of Ethereum (ETH) has decreased as the average price of Ether supply was valued at the day; each coin was last transacted on-chain. Despite this negative pressure, Ethereum stakers and long-term holders remain confident in their investment; many are anticipating a recovery in the altcoin’s price.

Ethereum Shanghai upgrade and ETH token unlock event spark surge in stakers

As the Ethereum Shanghai upgrade and ETH token unlock event approach, stakers have been flooding the ETH2 deposit contract with the altcoin. According to data from crypto intelligence tracker Nansen, a total of 17.52 million Ethereum tokens have now been deposited in the contract so far.

According to data from crypto intelligence tracker Santiment, Ethereum 2.0 stakers are experiencing a drop in realized prices over the last ten weeks, with average losses of 31%. Despite this, the volume of ETH staked on the network is increasing steadily. This comes after Ethereum recently recorded an important milestone surpassing 1.9 billion transactions. In addition, the second-largest cryptocurrency by market capitalization has remained above the $1,553 level since its dip from $1,600 on March 3.

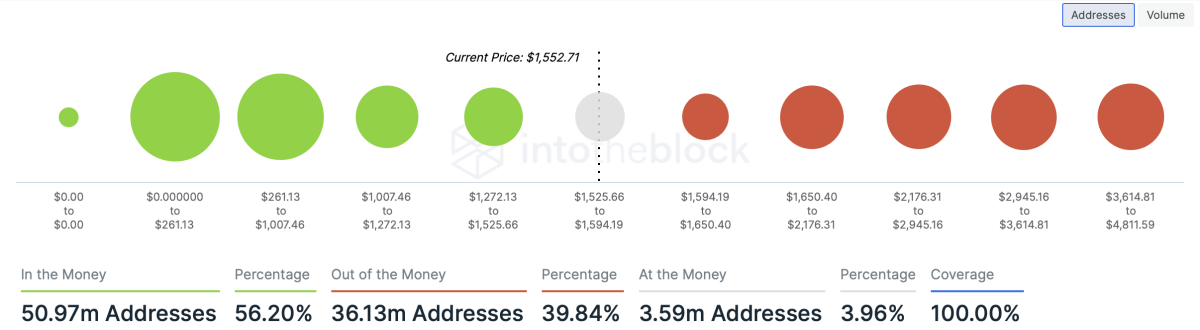

Data from IntoTheBlock shows that $1,525 is a crucial level of support for Ethereum; 5.93 million wallet addresses have accumulated ETH within the price range of $1,272.13 – $1,525. If this level of support holds, Ethereum has the potential to move higher in price.